Mazda 2009 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2009 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

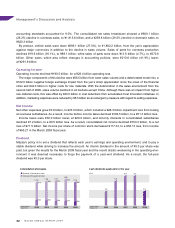

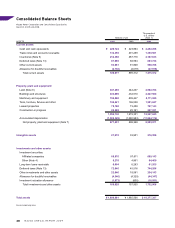

Financial Position

Total assets as of March 31, 2009, stood at ¥1,801.0 billion, which was ¥184.6 billion lower than at the previous

year-end as a result of reductions in inventories and trade receivables. Cash and cash equivalents (“cash”)

decreased ¥3.2 billion, to ¥220.7 billion. Inventories were reduced by ¥73.3 billion, to ¥214.4 billion. Net

property, plant and equipment decreased ¥21.0 billion, to ¥877.4 billion.

The total short- and long-term interest-bearing debt grew ¥248.4 billion, to ¥753.4 billion. Net interest-bearing

debt, which deducts the ¥220.7 billion in cash as of the fiscal year-end, increased ¥251.5 billion, to ¥532.6

billion, thereby resulting in a 78 percentage point rise in the net debt-to-equity ratio, to 129%.

Equity as of the fiscal year-end decreased ¥139.4 billion from the previous year-end, to ¥414.7 billion. Equity

per share decreased ¥76.84 (19.6%), to ¥314.98, from ¥391.82 at the end of the previous year. Equity—calcu-

lated as net assets less minority interests and stock acquisition rights—stood at ¥413.1 billion, for a 4.9

percentage point decline in the equity ratio, to 22.9%.

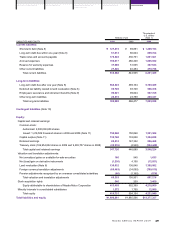

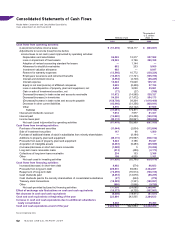

Cash Flows

Cash and cash equivalents (“cash”) as of March 31, 2009, totaled ¥220.7 billion, which was ¥3.2 billion less than

at the previous fiscal year-end. Although financing activities generated ¥137.0 billion in net cash, operating

activities and investing activities used cash in the amount of ¥67.4 billion and ¥61.8 billion, respectively.

(Cash Flow from Operating Activities)

Operating activities during the year used net cash in the amount of ¥67.4 billion. Loss before income taxes was

¥51.3 billion, while depreciation and amortization was ¥75.2 billion. However, accompanying reduced production

and other factors, decrease in trade notes and accounts payable was ¥158.7 billion, and income taxes paid was

¥30.3 billion.

(Cash Flow from Investing Activities)

Investing activities used net cash in the amount of ¥61.8 billion, the main component of which was ¥49.0 billion

of capital expenditures for the acquisition of plant and equipment.

(Cash Flow from Financing Activities)

Financing activities generated net cash of ¥137.0 billion. The Company procured funds through long-term

borrowing while repaying interest-bearing debt and acquiring treasury stock.

1,767.8 1,788.7

1,907.8 1,985.6

275.8

407.2 479.9 554.2

1,801.0

414.7

Total assets (Billions of yen)

Equity (Billions of yen)

)'', )''- )''. )''/ )''0

(As of March 31)

KfkXcXjj\kj&<hl`kp

528.1

455.4 474.7 505.0

313.5

246.8 232.2

281.1

753.4

532.6

Financial debt (Billions of yen)

Net financial debt (Billions of yen)

)'', )''- )''. )''/ )''0

(As of March 31)

=`eXeZ`Xc[\Yk&E\k]`eXeZ`Xc[\Yk

Management’s Discussion and Analysis

44