Mazda 2009 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2009 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

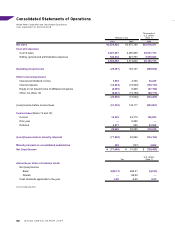

accounting standards accounted for 9.0%. The consolidated net sales breakdown showed a ¥680.1 billion

(26.2%) decline in overseas sales, to ¥1,915.6 billion, and a ¥259.8 billion (29.5%) decline in domestic sales, to

¥620.3 billion.

By product, vehicle sales were down ¥696.1 billion (27.0%), to ¥1,882.2 billion, from the yen’s appreciation

against major currencies in addition to the decline in sales volume. Sales of parts for overseas production

declined ¥19.6 billion (18.1%), to ¥89.1 billion, while sales of parts were down ¥13.6 billion (4.7%), to ¥272.8

billion. Other sales, which also reflect changes in accounting policies, were ¥210.6 billion (41.9%) lower,

at ¥291.9 billion.

Operating Income

Operating income declined ¥190.5 billion, for a ¥28.4 billion operating loss.

The major components of this decline were ¥86.5 billion from lower sales volume and a deteriorated model mix, a

¥102.0 billion negative foreign exchange impact from the yen’s sharp appreciation since the onset of the financial

crisis and ¥44.0 billion in higher costs for raw materials. With the deterioration in the sales environment from the

second half of 2008, sales volume declined in all markets except China. Although there was an impact from higher

raw material costs, this was offset by ¥44.0 billion in cost reductions from accelerated Cost Innovation initiatives. In

addition, marketing expenses were reduced by ¥6.5 billion as an emergency measure with regard to selling expenses.

Net Income

Net other expenses grew ¥3.9 billion, to ¥23.0 billion, which included a ¥28.3 billion impairment loss from tooling

at overseas subsidiaries. As a result, income before income taxes declined ¥194.5 billion, to a ¥51.3 billion loss.

Income taxes were ¥30.0 billion lower, at ¥20.6 billion, and minority interests in consolidated subsidiaries

declined ¥1.2 billion, to a ¥0.5 billion loss. As a result, consolidated net income declined ¥163.3 billion, to a net

loss of ¥71.5 billion. Net income per share of common stock decreased ¥117.34, to a ¥52.13 loss, from income

of ¥65.21 in the March 2008 fiscal year.

Dividend

Mazda’s policy is to set a dividend that reflects each year’s earnings and operating environment, and to pay a

stable dividend while striving to increase the amount. An interim dividend in the amount of ¥3.0 per share was

paid, but given the results for the March 2009 fiscal year and the recent drastic weakening in the operating envi-

ronment it was deemed necessary to forgo the payment of a year-end dividend. As a result, the full-year

dividend was ¥3.0 per share.

1,104 1,149 1,177 1,240

810 913 983

859

294 264 257

1,116

896

220

290

Domestic (Thousands of units)

Overseas (Thousands of units)

)'', )''- )''. )''/ )''0

(Years ended

March 31)

:fejfc`[Xk\[n_fc\jXc\j

3.0

6.0 6.0

3.0

5.0

)'', )''- )''. )''/ )''0

(Years ended

March 31)

(Yen)

:Xj_[`m`[\e[jXggc`ZXYc\kfk_\p\Xi

Management’s Discussion and Analysis

42