Mazda 2009 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2009 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

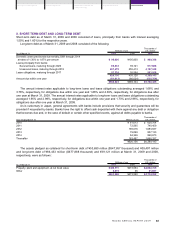

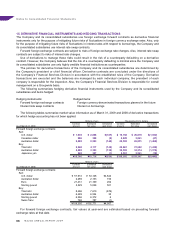

Available-for-sale securities that had available market values as of March 31, 2008 were as follows:

Millions of yen

Acquisition Carrying Unrealized

costs values gains

Stocks ¥558 ¥1,441 ¥883

Other 362 362 —

¥920 ¥1,803 ¥883

Available-for-sale securities with no available fair values as of March 31, 2008 were as follows:

Millions

of yen

Carrying values

Non-listed equity securities ¥ 3,196

Certificates of deposit 103,000

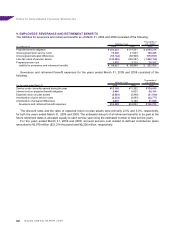

5. INVENTORIES

Inventories as of March 31, 2009 and 2008 were as follows:

Thousands of

Millions of yen U.S. dollars

As of March 31 2009 2008 2009

Finished products ¥171,412 ¥242,224 $1,749,102

Work in process 29,648 32,637 302,531

Raw materials and supplies 13,328 12,855 136,000

¥214,388 ¥287,716 $2,187,633

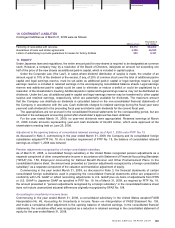

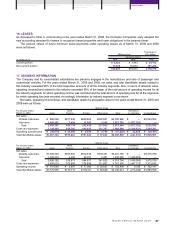

6. LAND REVALUATION

As of March 31, 2001, in accordance with the Law to Partially Revise the Land Revaluation Law (Law No.19, enacted

on March 31, 2001), land owned by the Company for business use was revalued. The unrealized gains on the

revaluation are included in equity as “Land revaluation,” net of deferred taxes. The deferred taxes on the unrealized

gains are included in liabilities as “Deferred tax liability related to land revaluation.”

The fair value of land was determined based on official notice prices that are assessed and published by the

Commissioner of the National Tax Administration, as stipulated in Article 2-4 of the Ordinance Implementing the Law

Concerning Land Revaluation (Article 119 of 1998 Cabinet Order, promulgated on March 31, 1998). Reasonable

adjustments, including those for the timing of assessment, are made to the official notice prices.

The amounts of decrease in the aggregate fair value of the revalued land as of March 31, 2009 and 2008 from

that at the time of revaluation, as stipulated in Article 10 of the Land Revaluation Law, were ¥83,322 million ($850,224

thousand) and ¥82,650 million, respectively.

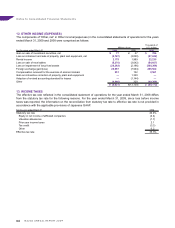

7. IMPAIRMENT OF LONG-LIVED ASSETS

For the purpose of reviewing for impairment, assets are generally grouped by company; however, idle assets and

assets for rent are individually reviewed for impairment.

For the year ended March 31, 2009, the Domestic Companies recognized an impairment loss of ¥2,218 million

($22,633 thousand) on idle assets. Also, an impairment loss of ¥2,366 million ($24,143 thousand) was recognized

on goodwill, including the write-down of goodwill by a consolidated foreign subsidiary in Belgium. In addition, a

consolidated foreign subsidiary in the United States reduced the carrying value of its leased properties held for use in

production, resulting in an impairment loss of ¥23,678 million ($241,612 thousand) in the consolidated statement of

operations. As a result, the total impairment loss that was recognized in the consolidated statement of operations for

the year ended March 31, 2009 amounted to ¥28,262 million ($288,388 thousand).

In the consolidated statement of operations for the year ended March 31, 2008, a total impairment loss of ¥2,196

million was recognized, which primarily consisted of impairment on idle assets by the Domestic Companies.

Notes to Consolidated Financial Statements

60