Mazda 2009 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2009 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

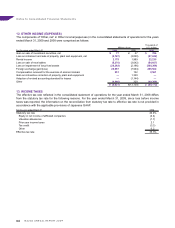

12. OTHER INCOME (EXPENSES)

The components of “Other, net” in Other income/(expenses) in the consolidated statements of operations for the years

ended March 31, 2009 and 2008 were comprised as follows:

Thousands of

Millions of yen U.S. dollars

For the years ended March 31 2009 2008 2009

Gain on sale of investment securities, net ¥ 77 ¥ 27 $ 786

Loss on retirement and sale of property, plant and equipment, net (2,707) (3,030) (27,622)

Rental income 2,179 1,989 22,235

Loss on sale of receivables (5,376) (3,042) (54,857)

Loss on impairment of long-lived assets (28,262) (2,196) (288,388)

Foreign exchange gain/(loss) 29,057 (7,544) 296,500

Compensation received for the exercise of eminent domain 251 122 2,561

Gain on retroactive correction of property, plant and equipment — 1,330 —

Adoption of revised accounting standard for leases — (1,144) —

Other (4,840) 329 (49,388)

¥ (9,621) ¥(13,159) $ (98,173)

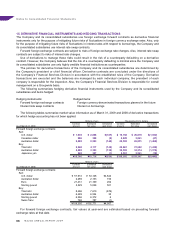

13. INCOME TAXES

The effective tax rate reflected in the consolidated statement of operations for the year ended March 31, 2008 differs

from the statutory tax rate for the following reasons. For the year ended March 31, 2009, since loss before income

taxes was reported, the information on the reconciliation from statutory tax rate to effective tax rate is not provided in

accordance with the applicable provisions of Japanese GAAP.

For the year ended March 31 2008

Statutory tax rate 40.4%

Equity in net income of affiliated companies (2.4)

Valuation allowances (1.7)

Prior year income taxes 2.1

Tax credit (3.3)

Other 0.2

Effective tax rate 35.3%

Notes to Consolidated Financial Statements

64