Mazda 2009 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2009 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

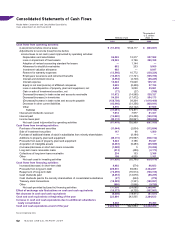

Free cash flow—the sum of cash flows from operating and investing activities—was negative in the amount of

¥129.2 billion for the year.

Fund procurement during the year consisted of ¥211.9 billion in long-term borrowing and a bond issue in

June 2008 with a total amount of ¥10.0 billion.

Significant Contracts, etc.

Mazda formed a global partnership with the Ford Motor Company in 1979, and since then both companies have

further developed and strengthened their cooperative relationship. An agreement was concluded in 1996 to

further bolster that relationship through Ford’s acquisition of 33.4% of Mazda’s total shares outstanding. On

November 19, 2008, Ford sold a portion of its shareholding, reducing its stake in Mazda to 13.8%. However, this

does not represent any change in the strategic relationship between the two companies, as Ford remains

Mazda’s largest shareholder and the two companies continue to operate joint businesses and use common plat-

forms and powertrains.

March 2010 Fiscal Year Outlook

Our forecasts for the March 2010 fiscal year are shown below. Although improvements continue to be made in

areas including vehicle cost and fixed expense reductions, the effects of lower sales volume and a deteriorated

model mix from lower demand and the yen’s appreciation against major currencies are seen as outpacing these

improvements. Our exchange rate assumptions for the year are ¥95/U.S. dollar and ¥125/euro.

● Global sales volume: 1.10 million units (a 12.8% decrease from the March 2009 fiscal year)

● Net sales: ¥2,030.0 billion (a 19.9% decrease from the March 2009 fiscal year)

● Operating income (loss): ¥(50.0) billion

● Net income (loss): ¥(50.0) billion

An operating loss is forecast for the first half of the March 2010 fiscal year on continued weak demand and

some remaining effect from inventory level adjustments, but we are however projecting a turnaround to an oper-

ating profit for the second half due to a full contribution to earnings from the new Mazda3 and further progress in

cost reductions. We are also aiming for positive free cash flow over the full year.

15.1

24.8

27.8

22.9

22.3

)'', )''- )''. )''/ )''0

* The amounts of equity used in the calculation of equity ratio exclude minority interests

(and, from the March 2007 fiscal year, stock acquisition rights).

(%)

(As of March 31)

<hl`kpiXk`f!

35.9 33.6 21.0 10.2

133.7

114.6 116.4

103.0

67.4

129.2

)'', )''- )''. )''/ )''0

(Years ended

March 31)

Free cash flow (Billions of yen)

Cash flow from operating activities (Billions of yen)

:Xj_]cfnj

45

Review of OperationsMessages from Management Mazda’s Environmental and

Safety Technology

Corporate Information Financial Section