Mazda 2009 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2009 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Review of OperationsMessages from Management Mazda’s Environmental and

Safety Technology

Corporate Information Financial Section

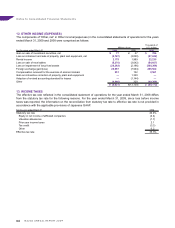

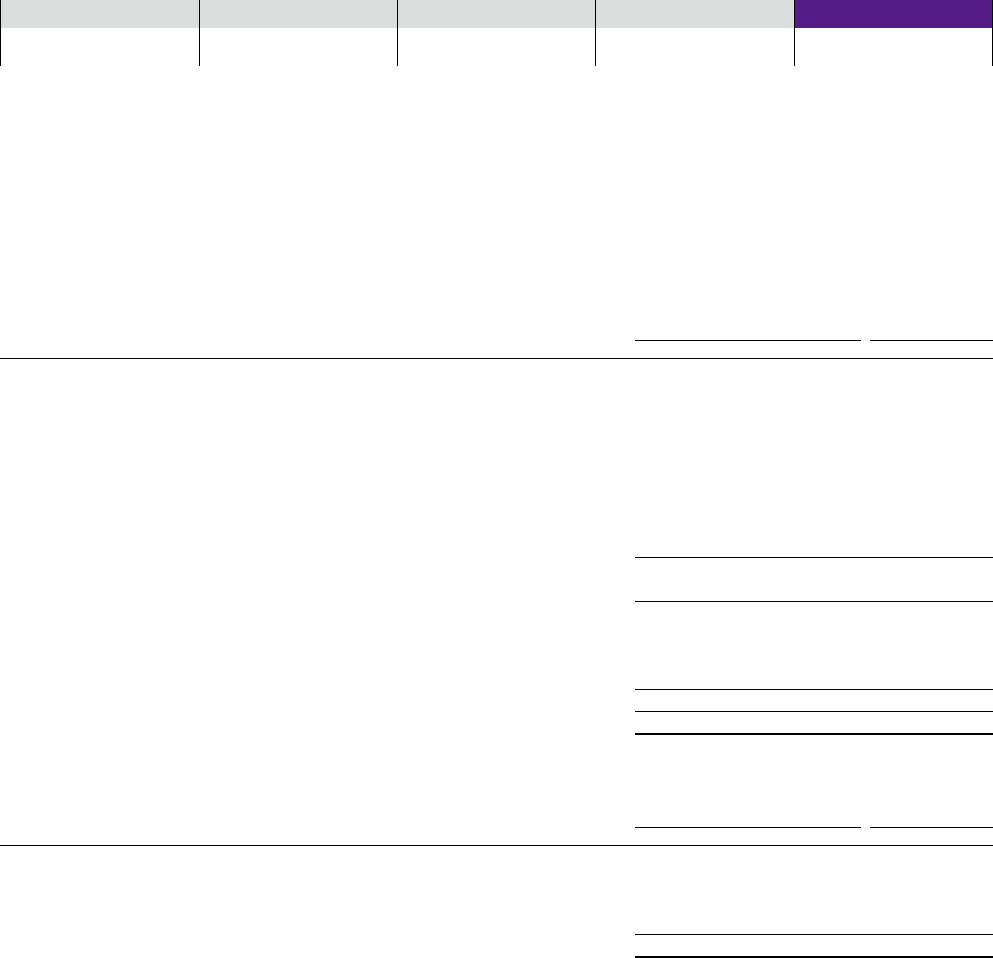

Deferred tax assets and liabilities reflect the estimated tax effects of loss carryforwards and accumulated

temporary differences between assets and liabilities for financial accounting purposes and those for tax purposes. The

significant components of deferred tax assets and liabilities as of March 31, 2009 and 2008 were as follows:

Thousands of

Millions of yen U.S. dollars

As of March 31 2009 2008 2009

Deferred tax assets:

Allowance for doubtful receivables ¥ 2,219 ¥ 1,655 $ 22,643

Employees’ severance and retirement benefits 34,989 40,043 357,031

Loss on impairment of long-lived assets 12,982 6,691 132,469

Accrued bonuses and other reserves 25,723 37,875 262,480

Inventory valuation 10,089 4,281 102,949

Valuation loss on investment securities, etc. 1,202 1,206 12,265

Net operating loss carryforwards 47,615 12,736 485,867

Other 63,065 70,568 643,520

Total gross deferred tax assets 197,884 175,055 2,019,224

Less valuation allowance (45,888) (21,014) (468,244)

Total deferred tax assets 151,996 154,041 1,550,980

Deferred tax liabilities:

Reserves under Special Taxation Measures Law (6,662) (7,193) (67,980)

Other (5,769) (10,254) (58,867)

Total deferred tax liabilities (12,431) (17,447) (126,847)

Net deferred tax assets ¥139,565 ¥136,594 $1,424,133

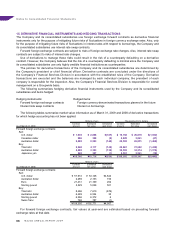

The net deferred tax assets are included in the following accounts in the consolidated balance sheets:

Thousands of

Millions of yen U.S. dollars

As of March 31 2009 2008 2009

Current assets—Deferred taxes ¥ 67,985 ¥ 92,594 $ 693,724

Investments and other assets—Deferred taxes 72,940 45,516 744,286

Current liabilities—Other (261) (5) (2,663)

Other long-term liabilities (1,099) (1,511) (11,214)

Net deferred tax assets ¥139,565 ¥136,594 $1,424,133

14. PRIOR YEAR INCOME TAXES

Prior year income taxes recorded in the year ended March 31, 2008 are primarily for the taxes that the Company was

subject to following a tax audit by the Hiroshima Regional Taxation Bureau. As a result of the tax audit, the Company

had reassessed and corrected certain prior year income tax filings to pay additional income taxes and penalties in

accordance with the reassessment in January 2008. These additional income taxes and penalties, which amounted to

a total of ¥6,290 million, were recognized as prior year income taxes in the consolidated statement of operations for

the year ended March 31, 2008.

65