Mazda 2008 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2008 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

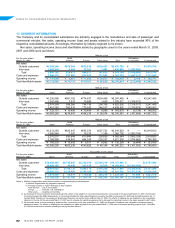

4) As discussed earlier in the depreciation of tangible fixed assets section, commencing in the year ended March 31, 2008, the Domestic Companies changed the depreciation

method in relation to the change in the Japanese Income Tax Code. The effects of this change on Japan Segment for the year ended March 31, 2008 were to increase operating

expense by ¥910 million ($9,100 thousand) and to decrease operating income by the same amount.

5) As discussed earlier in the accounting for residual value for fixed assets section, commencing in the year ended March 31, 2008, in relation to the changes in the Japanese

Income Tax Code, for the tangible fixed assets that were acquired on or before March 31, 2007 and for which accumulated depreciation has reached 95% of the acquisition

cost, the Domestic Companies recognize depreciation for the difference between the 5% residual value and the nominal value (i.e., 1 yen) on a straight-line basis over 5 years,

starting in the year following the year in which accumulated depreciation has reached 95% of the acquisition cost (or the year ending March 31, 2008, whichever comes later).

The effects of adopting this accounting for residual value of fixed assets on the consolidated statement of income for the year ended March 31, 2008, were to increase operating

expense by ¥3,951 million ($39,510 thousand) and to decrease operating income by same amount.

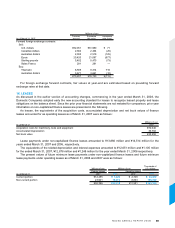

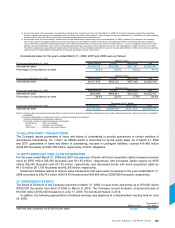

International sales for the years ended March 31, 2008, 2007 and 2006 were as follows:

Millions of yen

For the year ended March 31, 2008 North America Europe Other areas Total

International sales ¥1,015,315 ¥888,555 ¥691,787 ¥2,595,657

Percentage of consolidated net sales 29.2% 25.6% 19.9% 74.7%

Millions of yen

For the year ended March 31, 2007 North America Europe Other areas Total

International sales ¥1,017,874 ¥789,135 ¥553,149 ¥2,360,158

Millions of yen

For the year ended March 31, 2006 North America Europe Other areas Total

International sales ¥843,988 ¥668,941 ¥519,232 ¥2,032,161

Percentage of consolidated net sales 28.9% 22.9% 17.8% 69.6%

Thousands of U.S. dollars

For the year ended March 31, 2008 North America Europe Other areas Total

International sales $10,153,150 $8,885,550 $6,917,870 $25,956,570

Notes: 1) Overseas sales include exports by Mazda Motor Corporation and its domestic consolidated subsidiaries as well as sales (other than exports to Japan) by overseas consolidated

subsidiaries.

2) Method of segmentation and principal countries or regions belonging to each segment

a) Method: Segmentation by geographic adjacency

b) Principal countries or regions belonging to each segment

North America ........... U.S.A. and Canada

Europe ......................Germany, U.K. and Russia

Other areas ............... Australia, China and Colombia

18. RELATED PARTY TRANSACTIONS

The Company issued guarantees of loans and letters of undertaking to provide guarantees to certain creditors of

AutoAlliance International, Inc. (“AAI”), an affiliate which is accounted for by the equity basis. As of March 31, 2008

and 2007, guarantees of loans and letters of undertaking, included in contingent liabilities, covered ¥16,480 million

($164,800 thousand) and ¥22,789 million, respectively, of AAI’s obligations.

19. SUPPLEMENTARY CASH FLOW INFORMATION

For the years ended March 31, 2008 and 2007, the exercise of bonds with stock acquisition rights increased common

stock by ¥555 million ($5,550 thousand) and ¥1,153 million, respectively, and increased capital surplus by ¥555

million ($5,550 thousand) and ¥1,153 million, respectively, and decreased bonds with stock acquisition rights by

¥1,110 million ($11,100 thousand) and ¥2,306 million, respectively.

Assets and liabilities related to finance lease transactions that were newly recognized in the year ended March 31,

2008 amounted to ¥38,743 million ($387,430 thousand) and ¥39,906 million ($399,060 thousand), respectively.

20. SUBSEQUENT EVENTS

The Board of Directors of the Company resolved on March 31, 2008, to issue notes and bonds up to ¥70,000 million

($700,000 thousand) from April of 2008 to March of 2009. The Company issued domestic unsecured bonds of

¥10,000 million ($100,000 thousand) on June 17, 2008. The bonds will mature in 2013.

In addition, the following appropriation of retained earnings was approved at a shareholders’ meeting held on June

25, 2008:

Thousands of

Millions of yen U.S. dollars

Year-end cash dividends: ¥3.00 ($0.03) per share ¥4,228 $42,280