Mazda 2008 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2008 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Accounting for Share-based Payment

Commencing in the year ended March 31, 2007, the Domestic Companies adopted ASBJ Statement No. 8,

Accounting Standard for Share-based Payment, issued by the ASBJ on December 27, 2005 and the ASBJ Guidance

No. 11 (revised 2006), Guidance on Accounting Standard for Share-based Payment, last revised by the ASBJ on May

31, 2006.

The effects of adopting the new standard for the year ended March 31, 2007 were to decrease operating income

and income before taxes by ¥67 million. The effects of adopting the new standards on the segment information are

discussed in the applicable section of the notes to the consolidated financial statements.

Accounting Standard for Presentation of Equity in the Balance Sheet

Effective from the year ended March 31, 2007, the Domestic Companies adopted the new accounting standard,

“Accounting Standard for Presentation of Net Assets in the Balance Sheet” (Statement No. 5 issued by the ASBJ

on December 9, 2005), and the “Implementation Guidance on Accounting Standard for Presentation of Net Assets

in the Balance Sheet” (the Financial Accounting Standard Implementation Guidance No. 8 issued by the ASBJ on

December 9, 2005), (collectively, “the New Accounting Standards”). Also, commencing in the year ended March 31,

2007, Domestic Companies adopted “Accounting Standard for Treasury Shares and Appropriation of Legal Reserve”

(Statement No. 1 issued by the ASBJ on August 11, 2006), and “Guidance on Accounting Standard for Treasury

Shares and Appropriation of Legal Reserve” (Guideline No. 2 issued by the ASBJ on August 11, 2006).

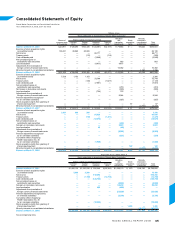

Under the New Accounting Standards, the following items are presented differently at March 31, 2007 compared

to March 31, 2006. The equity section includes net gain/loss on derivative instruments, net of taxes. Under the

previous presentation rules, gain/loss on derivative instruments were included in the assets or liabilities section

without considering the related income tax effects. Stock acquisition rights and minority interests are included in the

equity section at March 31, 2007. Under the previous presentation rules, companies were required to present minority

interests in between the long-term liabilities and the shareholders’ equity sections.

The adoption of the New Accounting Standards had no impacts on the consolidated statement of income for the

year ended March 31, 2007. In the calculation of the equity ratio and the equity per share, the stock acquisition rights

and the minority interests are excluded from equity.

Accounting for leases

Commencing in the year ended March 31, 2008, the Domestic Companies early adopted the ASBJ Statement No.13,

Accounting Standard for Lease Transaction, and ASBJ Guideline No.16, Guidance on Accounting Standard for

Lease Transaction, originally issued by the Business Accounting Deliberation Counsel on June 17, 1993 and by the

Japanese Institute of Certified Public Accountants on January 18, 1994, respectively, and both revised by the ASBJ

on March 30, 2007. Early adoption of ASBJ Statement No. 13 and ASBJ Guideline No. 16 is permitted as of the

beginning of a fiscal year that begins on or after April 1, 2007.

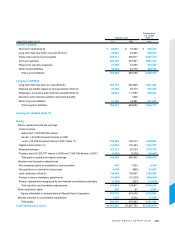

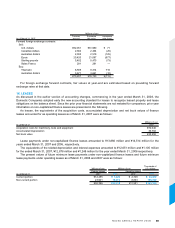

The effects of adopting the new standards on the consolidated balance sheet as of March 31, 2008 were to

increase property, plant and equipment and intangible fixed assets by ¥33,862 million ($338,620 thousand) and ¥15

million ($150 thousand) respectively, and to increase current liabilities and long-term liabilities by ¥12,448 million

($124,480 thousand) and ¥22,505 million ($225,050 thousand) respectively. In addition, the effects of adopting

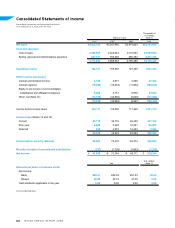

the new standards on the consolidated statement of income for the year ended March 31, 2008, were to increase

operating income by ¥1,199 million ($11,990 thousand), and to decrease income before income taxes by ¥918 million

($9,180 thousand).

Through the year ended March 31, 2007, in the consolidated statement of cash flows, all payments of lease fees

were included in the cash flows from operating activities. Commencing in the year ended March 31, 2008, however,

those portions that constitute payment of lease obligations are included in the cash flows from financing activities.