Mazda 2008 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2008 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

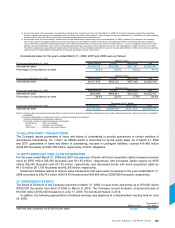

Additional Information

Accounting for residual value of fixed assets

In relation to the changes in the Japanese Income Tax Code, commencing in the year ended March 31, 2008, for the

tangible fixed assets that were acquired on or before March 31, 2007 and for which accumulated depreciation has

reached 95% of the acquisition cost, the Domestic Companies recognize depreciation for the difference between

the 5% residual value and the nominal value (i.e., 1 yen) on a straight-line basis over 5 years, starting in the year

following the year in which accumulated depreciation has reached 95% of the acquisition cost (or the year ended

March 31, 2008, whichever comes later).

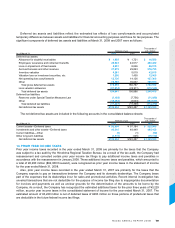

The effects of adopting this accounting for residual value of property, plant and equipment on the consolidated

statement of income for the year ended March 31, 2008 were to decrease operating income by ¥3,951 million

($39,510 thousand) and to decrease income before income taxes by ¥4,113 million ($41,130 thousand).

The effects of adopting this accounting for residual value of fixed assets on the segment information are discussed

in the applicable section of the notes to the consolidated financial statements.

Termination of directors’ and corporate auditors’ retirement benefits

The Company used to recognize, in the liabilities, directors’ and corporate auditors’ retirement benefits that provides

for retirement benefits to directors and corporate auditors; the amount that would be required by the internal

corporate policy if all the directors and corporate auditors retired on the balance sheet date was recognized. As part

of management reform, however, by the resolution of the general meeting of shareholders held on June 26, 2007, the

Company reached a decision to terminate retirement benefits to directors and corporate auditors as of the end of this

general meeting of shareholders as well as to pay the directors and corporate auditors such benefits already earned

by the time of the decision.

In relation to this decision, in the consolidated balance sheet as of March 31, 2008, an amount equivalent to the

retirement benefits earned prior to the resolution, i.e., ¥618 million ($6,180 thousand), was recognized in other long-

term liabilities.

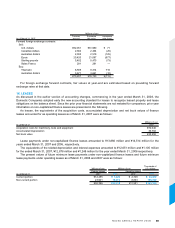

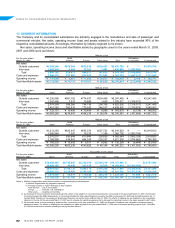

4. SECURITIES

The Company and its consolidated subsidiaries had no trading or held-to-maturity debt securities with available fair

values at March 31, 2008 and 2007.

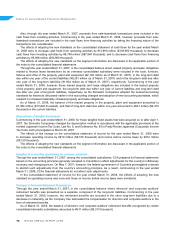

Available-for-sale securities that have available market values as of March 31, 2008 were as follows:

Millions of yen Thousands of U.S. dollars

Acquisition Carrying Unrealized Acquisition Carrying Unrealized

costs values gains costs values gains

Stocks ¥558 ¥1,441 ¥883 $5,580 $14,410 $8,830

Other 362 362 — 3,620 3,620 —

¥920 ¥1,803 ¥883 $9,200 $18,030 $8,830

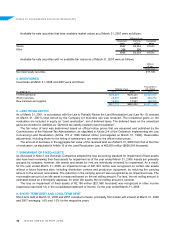

Available-for-sale securities with no available fair values as of March 31, 2008 were as follows:

Millions Thousands of

of yen U.S. dollars

Book value Book value

Non-listed equity securities ¥3,196 $31,960