Mazda 2008 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2008 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

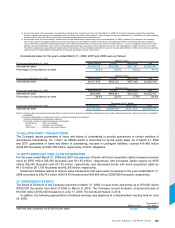

Also, prior year income taxes recorded in the year ended March 31, 2006 are primarily for the taxes expected to

be reassessed on transactions between the Company and an overseas subsidiary. The Company was audited by

the Hiroshima Regional Taxation Bureau, and the Company expects that the tax audit is likely to conclude in the near

future. As a result of the tax audit, it is highly likely that additional income taxes will be reassessed on transactions

between the Company and an overseas subsidiary, and the Company recognized the expected increase in tax with

respect to the transactions as prior year income taxes in the consolidated statement of income for the year ended

March 31, 2006. The Company plans to formally request for bilateral consultations between the two countries under

the applicable tax treaties for transfer pricing in order to obtain relief from double taxation.

15. DERIVATIVE FINANCIAL INSTRUMENTS AND HEDGING TRANSACTIONS

The Company and its consolidated subsidiaries use foreign exchange forward contracts as derivative financial

instruments only for the purpose of mitigating future risks of fluctuations in foreign currency exchange rates. Also, only

for the purpose of mitigating future risks of fluctuations in interest rates with respect to borrowings, the Company and

its consolidated subsidiaries use interest rate swap contracts.

Foreign exchange forward contracts are subject to risks of foreign exchange rate changes.

Interest rate swap contracts are subject to risks of interest rate changes.

The policies for derivative transactions of the Company and its consolidated subsidiaries are determined by

the Company’s president or chief financial officer. Derivative contracts are concluded under the directions of

the Company’s Financial Services Division in accordance with the established rules of the Company. Derivative

transactions are executed and the balances are managed by each individual company; the president of each

company is responsible for the inspection. Also, the Company’s Financial Services Division is responsible for overall

management on a Groupwide basis.

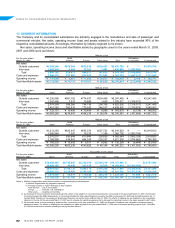

The following summarizes hedging derivative financial instruments used by the Company and its consolidated

subsidiaries and items hedged:

Hedging instruments: Hedged items:

Forward foreign exchange contracts Foreign currency loans receivable and future transactions

Interest rate swap contracts Interest on borrowings

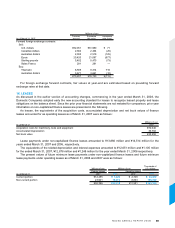

The following tables summarize market value information as of March 31, 2008 and 2007 of derivative transactions

for which hedge accounting has not been applied:

Millions of yen Thousands of U.S. dollars

Contract Estimated Unrealized Contract Estimated Unrealized

As of March 31, 2008 amount fair value gain (loss) amount fair value gain (loss)

Foreign exchange forward contracts:

Sell:

U.S. dollars ¥ 57,972 ¥ 53,148 ¥4,824 $ 579,720 $ 531,480 $48,240

Australian dollars 2,289 2,133 156 22,890 21,330 1,560

Euros 21,431 21,169 262 214,310 211,690 2,620

Sterling pounds 5,529 5,028 501 55,290 50,280 5,010

Buy:

Thai baht 8,486 7,610 (876) 84,860 76,100 (8,760)

Australian dollars 6,489 6,524 35 64,890 65,240 350

Sterling pounds 6,366 6,372 6 63,660 63,720 60

Swiss Francs 788 787 (1) 7,880 7,870 (10)

¥109,350 ¥102,771 ¥4,907 $1,093,500 $1,027,710 $49,070