Mazda 2008 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2008 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

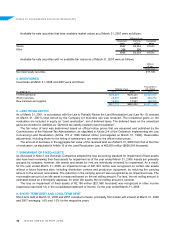

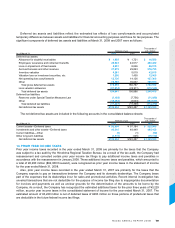

Long-term debt at March 31, 2008 and 2007 consisted of the following:

Thousands of

Millions of yen U.S. dollars

As of March 31 2008 2007 2008

Domestic unsecured bonds due serially 2007 through 2014

at rates of 0.70% to 1.87% per annum ¥105,000 ¥105,200 $1,050,000

Domestic unsecured convertible bonds with stock acquisition rights

due 2007 with no interest — 1,131 —

Loans principally from banks and insurance companies:

Secured loans, maturing through 2020 39,121 44,932 391,210

Unsecured loans, maturing through 2017 255,413 253,081 2,554,130

Lease obligations, maturing through 2017 35,594 — 355,940

435,128 404,344 4,351,280

Amount due within one year (66,024) (63,495) (660,240)

¥369,104 ¥340,849 $3,691,040

The annual interest rates applicable to long-term loans and lease obligations outstanding averaged 2.0% and

3.0% for obligations due within one year and 1.7% and 3.0% for obligations due after one year at March 31, 2008.

And 2.3% for obligations due within one year and 1.7% for obligations due after one year at March 31, 2007.

As is customary in Japan, security must be provided if requested by a lending bank. Such a bank has the right

to offset cash deposited with it against any debt or obligation that becomes due and, in the case of default or certain

other specified events, against all debts payable to the bank. The Company has never received any such requests.

The exercise price of the domestic unsecured convertible bonds with stock acquisition rights is ¥306.

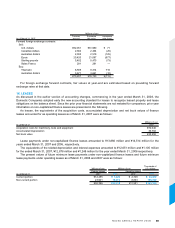

The annual maturities of long-term debt at March 31, 2008 were as follows:

Thousands of

Year ending March 31 Millions of yen U.S. dollars

2009 ¥ 52,935 $ 529,350

2010 19,115 191,150

2011 38,838 388,380

2012 65,785 657,850

2013 54,368 543,680

Thereafter 168,493 1,684,930

¥399,534 $3,995,340

The annual maturities of lease obligations at March 31, 2008 were as follows:

Thousands of

Year ending March 31 Millions of yen U.S. dollars

2009 ¥13,089 $130,890

2010 10,546 105,460

2011 5,683 56,830

2012 3,798 37,980

2013 1,215 12,150

Thereafter 1,263 12,630

¥35,594 $355,940