Mazda 2008 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2008 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

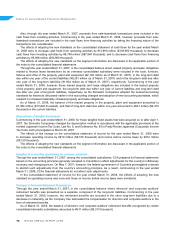

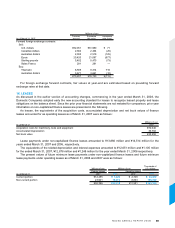

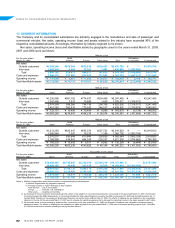

Millions of yen

Contract Estimated Unrealized

As of March 31, 2007 amount fair value gain (loss)

Forward foreign exchange contracts:

Sell:

U.S. dollars ¥32,051 ¥31,980 ¥ 71

Canadian dollars 2,384 2,404 (20)

Australian dollars 2,393 2,518 (125)

Euros 20,420 21,097 (677)

Sterling pounds 5,402 5,475 (73)

Swiss Francs 291 291 —

Buy:

Thai baht 8,595 9,314 719

Australian dollars 3,671 3,661 (10)

¥75,207 ¥76,740 ¥(115)

For foreign exchange forward contracts, fair values at year-end are estimated based on prevailing forward

exchange rates at that date.

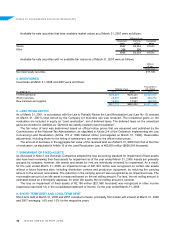

16. LEASES

As discussed in the earlier section of accounting changes, commencing in the year ended March 31, 2008, the

Domestic Companies adopted early the new accounting standard for leases to recognize leased property and lease

obligations on the balance sheet. Since the prior year financial statements are not restated for comparison, prior year

information on non-capitalized finance leases are presented in the following.

As lessee, the equivalents of the acquisition costs, accumulated depreciation and net book values of finance

leases accounted for as operating leases as of March 31, 2007 were as follows:

Millions of yen

As of March 31 2007

Acquisition costs for machinery, tools and equipment ¥72,040

Accumulated depreciation 36,782

Net book value ¥35,258

Lease payments under non-capitalized finance leases amounted to ¥13,866 million and ¥14,514 million for the

years ended March 31, 2007 and 2006, respectively.

The equivalents of the related depreciation and interest expenses amounted to ¥12,651 million and ¥1,105 million

for the ended March 31, 2007, ¥12,878 million and ¥1,248 million for the year ended March 31, 2006 respectively.

The present values of future minimum lease payments under non-capitalized finance leases and future minimum

lease payments under operating leases as of March 31, 2008 and 2007 were as follows:

Thousands of

Millions of yen Millions of yen U.S. dollars

Finance leases Operating leases

As of March 31 2007 2008 2007 2008

Current portion ¥12,455 ¥ 3,443 ¥ 2,748 $ 34,430

Non-current portion 23,941 16,072 8,833 160,720

¥36,396 ¥19,515 ¥11,581 $195,150