Mazda 2008 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2008 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Pension adjustments recognized by an overseas consolidated subsidiary

Commencing in the year ended March 31, 2007, a consolidated subsidiary in the United States adopted the

Statement of Financial Accounting Standards No. 158, Employers’ Accounting for Defined Benefit Pension and Other

Postretirement Plans. The amount (net of tax) that the consolidated subsidiary recognized, in the balance sheet, as a

component of the other accumulated comprehensive income in the equity is recognized, in the consolidated balance

sheet, as “pension adjustments recognized by an overseas consolidated subsidiary” as a separate component of the

valuation and translation adjustments of the equity.

Accounting for uncertainty in income taxes

Commencing in the year ended March 31, 2008, the consolidated subsidiary in the United States adopted the FASB

Interpretation No.48 (“FIN 48”), Accounting for Uncertainty in Income Taxes—an Interpretation of FASB Statement

No. 109, and made a cumulative effect adjustment to the opening balance of retained earnings. In the consolidated

financial statements, the cumulative effect was recognized as a reduction in retained earnings in the consolidated

statement of equity for the year ended March 31, 2008.

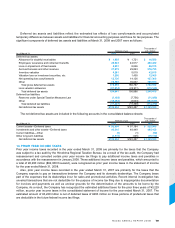

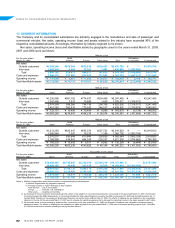

12. OTHER INCOME (EXPENSES)

The components of “Other, net” in Other income (expenses) in the statements of income for the years ended March

31, 2008, 2007 and 2006 were comprised as follows:

Thousands of

Millions of yen U.S. dollars

For the years ended March 31 2008 2007 2006 2008

Gain/(loss) on sale of investment securities, net ¥ 27 ¥ (16) ¥ 1,407 $ 270

Loss on sale of property, plant and equipment, net (3,030) (3,380) (6,433) (30,300)

Rental income 1,989 1,764 1,926 19,890

Gain on the transfer to the government of the substitutional

portion of employee pension fund liabilities — — 59,611 —

Loss on impairment of fixed assets (2,196) (3,356) (36,650) (21,960)

Foreign exchange loss (7,544) (19,914) (19,088) (75,440)

Compensation received for the exercise of eminent domain 122 — 472 1,220

Gain on retroactive correction of fixed assets 1,330 — — 13,300

Insurance claim income — — 996 —

Adoption of revised accounting standard for leases (1,144) — — (11,440)

Inventory valuation loss related to car-carrying vessel accident — (1,979) — —

Other (2,713) (5,975) (7,881) (27,130)

¥(13,159) ¥(32,856) ¥(5,640) $(131,590)

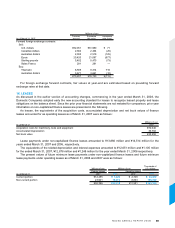

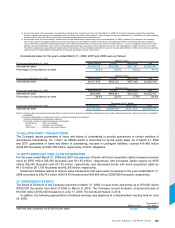

13. INCOME TAXES

The effective tax rates reflected in the consolidated statements of income differ from the statutory tax rate for the

following reasons.

For the years ended March 31 2008 2007 2006

Statutory tax rate 40.4% 40.4% 40.4%

Equity in net income of unconsolidated subsidiaries and affiliated companies (2.4) (2.1) (3.1)

Valuation allowances (1.7) (2.1) 1.0

Unrealized profits from intercompany transactions — — (6.6)

Prior year income taxes 2.1 2.8 8.7

Tax credit (3.3) (3.8) —

Other 0.2 1.1 1.4

Effective tax rate 35.3% 36.3% 41.8%