Mazda 2008 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2008 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

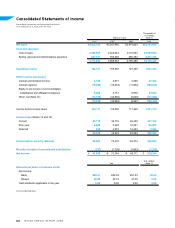

• Global retail sales: 1.48 million units (an 8.6% increase from the March 2008 fiscal year)

• Net sales: ¥3,000.0 billion (a 13.7% decrease from the March 2008 fiscal year*)

• Operating income: ¥115.0 billion (a 29.1% decrease from the March 2008 fiscal year)

• Net income: ¥70.0 billion (a 23.8% decrease from the March 2008 fiscal year)

* Changes in accounting policies are planned for next year in accordance with the application of the Practical Solution on Unification of Accounting

Policies Applied to Foreign Subsidiaries for Consolidated Financial Statements (ASBJ PITF No. 18).

Despite the adverse external environment, Mazda will continue to work toward achieving the targets set in

the Mazda Advancement Plan by accelerating innovations to reduce costs and promoting brand value, while

maintaining a path of product-led growth.

BUSINESS RISKS

Significant risks that could affect the Company’s business results and financial position include those listed

below. This, however, does not represent a comprehensive list of all the risks faced by the Mazda Group at the

current time.

1. Economic Conditions Impacting the Mazda Group

The Mazda Group sells products in Japan and around the world, including in North America, Europe and Asia.

An economic downturn or declining demand in these markets could adversely affect Mazda’s business results

and financial position.

2. Exchange Rates

The Mazda Group exports products from Japan to the rest of the world and consequently its business results

and financial position are exposed to the effects of fluctuations in exchange rates. An appreciation of the yen,

particularly against the U.S. dollar and euro, could lower the Mazda Group’s profitability and ability to compete

on price.

Mazda uses forward-exchange contracts and other instruments in some of its transactions to minimize the

impact of short-term exchange rate risk. However, a weakening of the yen could result in a loss of contingent

gains.

12.4

15.1

24.8

27.8

22.3

(Years ended

March 31)

(%)

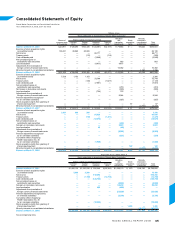

* The amounts of equity used in the calculation of equity ratio exclude minority interests

(and, for 2007 and 2008, stock acquisition rights).

*

(Years ended

March 31)

49.1

35.9 33.6

21.0

10.2

924

133.7

114.6 1.164

103.0

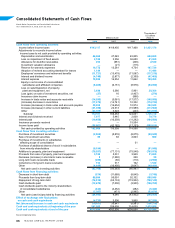

Cash flow from operating activities (Billions of yen)

Free cash flow (Billions of yen)