Mazda 2008 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2008 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

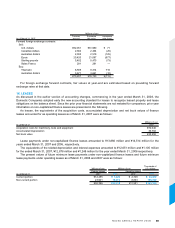

The assets pledged as collateral for short-term debt of ¥39,497million ($394,970 thousand) and long-term debt of

¥39,121 million ($391,210 thousand) at March 31, 2008 were as follows:

Thousands of

Millions of yen U.S. dollars

Property, plant and equipment, at net book value ¥473,554 $4,735,540

Other 36 360

¥473,590 $4,735,900

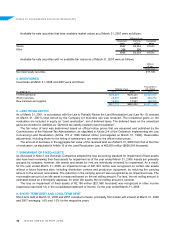

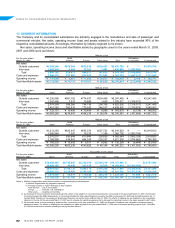

9. EMPLOYEES’ SEVERANCE AND RETIREMENT BENEFITS

The liabilities for severance and retirement benefits included in the liability sections of the consolidated balance

sheets as of March 31, 2008 and 2007 consisted of the following:

Thousands of

Millions of yen U.S. dollars

As of March 31 2008 2007 2008

Projected benefit obligation ¥311,051 ¥322,377 $3,110,510

Unrecognized prior service costs 21,633 23,920 216,330

Unrecognized actuarial differences (66,966) (55,911) (669,660)

Less fair value of pension assets (169,587) (181,514) (1,695,870)

Prepaid pension cost 3,713 2,693 37,130

Liability for severance and retirement benefits ¥ 99,844 ¥111,565 $ 998,440

Severance and retirement benefit expenses included in the consolidated statements of income for the years ended

March 31, 2008, 2007 and 2006 consisted of the following:

Thousands of

Millions of yen U.S. dollars

For the years ended March 31 2008 2007 2006 2008

Service costs—benefits earned during the year ¥11,262 ¥11,048 ¥ 8,630 $112,620

Interest cost on projected benefit obligation 6,623 6,543 10,809 66,230

Expected return on plan assets (5,946) (5,333) (4,365) (59,460)

Amortization of prior service costs (2,095) (2,126) (2,302) (20,950)

Amortization of actuarial differences 6,159 6,456 5,195 61,590

Severance and retirement benefit expenses ¥16,003 ¥16,588 ¥17,967 $160,030

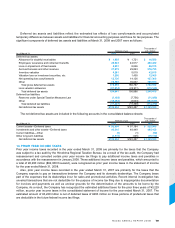

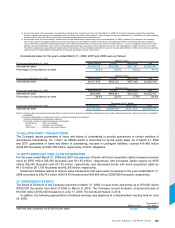

The discount rates and the rates of expected return on plan assets used by the Domestic Companies are primarily

2.0% and 3.0%, respectively, for the year ended March 31, 2008, and 2.0% and 3.0%, respectively, for the year ended

March 31, 2007. The estimated amount of all retirement benefits to be paid at the future retirement dates is allocated

equally to each service year using the estimated number of total service years.

Employees of Japanese companies are compulsorily included in the Welfare Pension Insurance Scheme operated

by the government. Employers are legally required to deduct employees’ welfare pension insurance contributions from

their payroll and to pay them to the government together with employers’ own contributions.

For companies that have established their own Employees’ Pension Fund which meets certain legal requirements,

it is possible to transfer a part of their welfare pension insurance contributions (referred to as the “substitutional

portion“ of the government’s Welfare Pension Insurance Scheme) to their own Employees’ Pension Fund under the

government’s permission and supervision.

The newly enacted Defined Benefit Corporate Pension Law allows a company to transfer the substitutional portion

back to the government. In order to transfer the substitutional portion, a company must obtain approval from the

Minister of Health, Labor and Welfare (MHLW) for the exemption from the payment of the benefits related to future

employee service. In addition, a company must obtain approval from the MHLW to be relieved from the remaining

benefit obligation of the substitutional portion which relates to past employee services. On obtaining that approval,

a company will transfer the remaining benefit obligation of the substitutional portion pertaining to past employee

services and the related plan assets to the government.