Mazda 2008 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2008 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

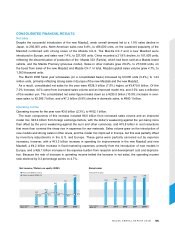

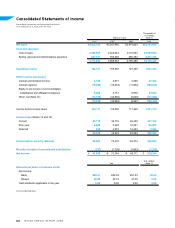

Net income

Net other expenses declined by ¥21.1 billion, to ¥19.0 billion. In addition to a ¥12.4 billion improvement in the

foreign exchange valuation loss, profit from equity-method investments rose ¥2.3 billion. As a result, pretax net

income rose ¥24.7 billion (20.8%), to ¥143.1 billion.

Income taxes rose ¥7.6 billion, to ¥50.6 billion, and minority interests in consolidated subsidiaries declined

¥1.0 billion, to ¥0.7 billion. As a result, consolidated net income grew ¥18.1 billion (24.5%), to ¥91.8 billion. Net

income per share of common stock increased ¥12.62, to ¥65.21, from ¥52.59 in the March 2007 fiscal year.

Record profits were achieved at all levels in the March 2008 fiscal year, which was also the seventh consecutive

year of revenue and profit growth.

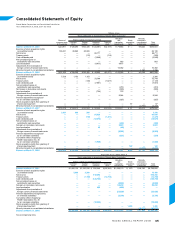

Dividend

A year-end dividend of ¥3.0 per share was approved at the annual general meeting of shareholders held on

June 25, 2008. Combined with the interim dividend of ¥3.0 per share, this brought the full-year dividend to ¥6.0.

Mazda’s policy is to set the dividend by taking into account each year’s earnings and the operating environment,

and to pay a stable dividend while striving to increase the amount.

Capital expenditures

Although production capacity at the company’s two main plants—the Hiroshima plant and the Hofu plant—was

increased and investments for new models continued, capital expenditures for the year declined by ¥4.1 billion,

to ¥75.5 billion. Depreciation and amortization expenses rose ¥19.5 billion, to ¥66.5 billion, reflecting increases

in capital spending over recent years and accounting changes that included moving the treatment of lease

assets on balance sheet.

Production capacity was increased to accommodate the continuation of product-led growth, and during the

year annual domestic capacity surpassed the one million unit level. April 2007 saw the commencement of

engine mass production at Changan Ford Mazda Engine Co., Ltd., a joint venture between Mazda, Ford Motor

Company, and the Changan Automotive Group in Nanjing Province, China. This joint venture’s vehicle assembly plant

also commenced mass production of the Mazda2 in October 2007. In addition, a new Ford joint venture pas-

senger vehicle plant is being built at AutoAlliance (Thailand) Co., Ltd., as planned, with manufacturing of small

passenger vehicles scheduled to start during 2009.

785

1,076 1,104 1,149 1,177 1,240

810 913 983

859

291 294 264 257

290

Domestic (Thousands of units)

Overseas (Thousands of units)

* Excluding the effect of a change in

fiscal years at overseas subsidiaires.

*

(Years ended

March 31)

2.0

7.2 8.0

9.7

11.4

9.2

3.0

6.0 6.0

5.0

Cash dividends applicable to the year (Yen)

Consolidated dividend payout ratio (%)

(Years ended

March 31)