Mazda 2008 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2008 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

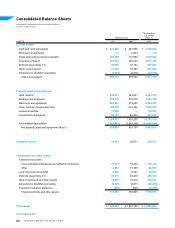

2008 2008/2007 2007 2007/2006

For the year*2:

Net sales ¥3,475,789 7.0 % ¥3,247,485 11.2 %

Domestic 880,132 (0.8)% 887,327 (0.0)%

Overseas 2,595,657 10.0 % 2,360,158 16.1 %

North America 1,015,315 (0.3)% 1,017,874 20.6 %

Europe 888,555 12.6 % 789,135 18.0 %

Other areas 691,787 25.1 % 553,149 6.5 %

Cost of sales 2,485,905 7.0 % 2,322,644 10.0 %

Selling, general and administrative expenses 827,737 8.0 % 766,309 11.8 %

Operating income 162,147 2.3 % 158,532 28.4 %

Income before income taxes 143,117 20.8 % 118,450 0.8 %

Net income 91,835 24.5 % 73,744 10.5 %

Capital expenditures*3 75,518 (5.2)% 79,641 10.5 %

Depreciation and amortization 66,460 41.3 % 47,045 2.7 %

Research and development costs 114,400 6.4 % 107,553 12.4 %

Free cash flows*4 10,209 (51.4)% 20,995 (37.5)%

At the year-end:

Total assets ¥1,985,566 4.1 % ¥1,907,752 6.7 %

Equity*5 554,154 15.5 % 479,882 17.8 %

Financial debt 504,979 6.4 % 474,684 4.2 %

Net financial debt 281,085 21.1 % 232,179 (5.9)%

Average number of shares outstanding (in thousands) 1,408,368 0.4 % 1,402,315 8.3 %

Number of employees 39,364 3.6 % 38,004 3.8 %

Amounts per share of common stock:

Net income*6 ¥ 65.21 24.0 % ¥ 52.59 2.1 %

Cash dividends applicable to the year*7 6.00 0.0 % 6.00 20.0 %

Equity*8 391.82 16.5 % 336.45 18.4 %

Operating income ratio 4.7 % (0.2) points 4.9% 0.7 points

Return on equity (ROE)*9 17.9 % 1.0 points 16.9% (3.1) points

Equity ratio*9 27.8 % 3.0 points 24.8% 2.5 points

Notes: 1. The translation of the Japanese yen amounts into U.S. dollars is presented solely for the convenience of readers, using the prevailing exchange rate at March 31, 2008, of ¥100 to US$1.

2. The consolidated operating results for the year ended March 31, 2004, consist of 15 months of operations for the major overseas subsidiaries that changed their fiscal year-ends.

3. Capital expenditures are calculated on an accrual basis.

4. Free cash flows represent net cash flows from operating activities and from investing activities.

5. Prior-year amounts have been reclassified to conform to March 2007 fiscal year and current fiscal year presentation to include minority interests.

6. The computations of net income per share of common stock are based on the average number of shares outstanding during each fiscal year.

7. Cash dividends per share represent actual amounts applicable to the respective years.

8. The amounts of equity used in the calculation of equity per share, return on equity, and equity ratio exclude minority interests (and, for 2007 and 2008, stock acquisition rights).

9. The amounts of equity exclude minority interests (and, for 2007 and 2008, stock acquisition rights).