Mazda 2008 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2008 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

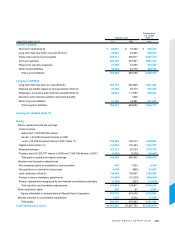

Leased properties

Through the year ended March 31, 2007, finance leases, which do not transfer ownership and do not have bargain

purchase provisions, are accounted for in the same manner as operating leases in accordance with generally

accepted accounting principles in Japan. Commencing in the year ended March 31, 2008, finance leases are

recognized on balance sheet. Depreciation or amortization expense is recognized on a straight-line basis over the

lease period. For leases with a guaranteed minimum residual value, the contracted residual value is considered to be

the residual value for financial accounting purposes. For other leases, the residual value is zero.

Allowance for doubtful receivables

The Companies provide for doubtful accounts principally at an amount computed based on past experience plus

estimated uncollectible amounts based on the analysis of certain individual doubtful accounts.

Investment valuation allowance

Investment valuation allowance provides for losses from investments. The amount is estimated in light of the financial

standings of the investee companies.

Reserve for warranty expenses

In order to match the recognition of after-sales expenses to product (vehicle) sales revenues, an amount estimated

based on product warranty provisions and actual costs incurred in the past, taking future prospects into consideration,

is recognized.

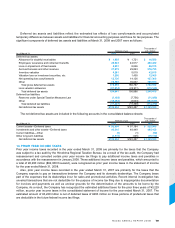

Employees’ severance and retirement benefits

The Domestic Companies provide various types of post-employment benefit plans, including lump-sum plans, defined

benefit pension plans, and defined contribution pension plans, under which all eligible employees are entitled to

benefits based on the level of wages and salaries at the time of retirement or termination, length of service and certain

other factors. For the Company, the pension plans cover 50% of total retirement benefits. Also, consolidated overseas

subsidiaries provide defined benefit and/or contribution plans.

For the Domestic Companies, the liabilities and expenses for severance and retirement benefits are determined

based on the amounts actuarially calculated using certain assumptions.

The Domestic Companies provide for employees’ severance and retirement benefits based on the estimated

amounts of projected benefit obligation and the fair value of the plan assets. Prior service costs are recognized in

expenses in equal amounts mainly over 12 years, which is within the average of the estimated remaining service

periods of employees, and actuarial gains and losses are recognized in expenses using the straight-line basis mainly

over 13 years, which is within the average of the estimated remaining service periods, commencing with the following

period. For executive officers, the liability is provided for the amount that would be required if all the executive officers

retired at the balance sheet date.

As discussed in Note 9, in connection with the enactment of the Defined Benefit Corporate Pension Law, as of

July 31, 2005, the Mazda Social Welfare Pension Fund, which the Company and certain Domestic Companies were

members of, obtained approval from the Minister of Health, Labor and Welfare to be relieved of the retirement benefit

obligation of the substitutional portion, which relates to past employee services, and for transfer of the retirement

benefit obligation of the substitutional portion and the related plan assets to the government. On March 28, 2006, the

transfer of the plan assets attributable to the substitutional portion to the government was completed.

Directors’ and corporate auditors’ retirement benefits

Through the year ended March 31, 2007, the Companies accrued liabilities for directors’ and corporate auditors’

retirement benefits in an amount calculated based on the internal corporate policy. Commencing the year ended

March 31, 2008, the Company reached a decision to terminate retirement benefits to directors and corporate auditors.

Refer to the following section “3. Adoption of new accounting standards” for more details.