Kia 2009 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2009 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

REDEFINING

MOBILITY

KIA MOTORS

ANNUAL REPORT

2009

REDEFINING

MOBILITY

KIA MOTORS

ANNUAL REPORT

2009

NOTES TO NONCONSOLIDATED

FINANCIAL STATEMENTS

December 31, 2009 and 2008

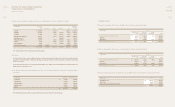

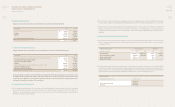

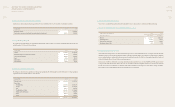

33. NONCASH INVESTING AND FINANCING ACTIVITIES

Signicant non-cash investing and nancing activities for the years ended December 31, 2009 and 2008 are summarized as follows:

36. DATE OF AUTHORIZATION FOR ISSUE

The 2009 non-consolidated nancial statements were authorized for issue on January 29, 2010, at the Board of Directors Meeting.

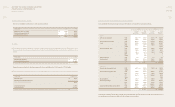

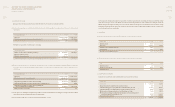

37. RESULTS OF OPERATIONS FOR THE LAST INTERIM PERIOD (Unaudited)

38. PLANNING AND ADOPTION OF KIFRS

The Company subsequently plans to issue nancial statements prepared in accordance with K-IFRS from 2011. In August of 2008, the Company

organized a Task Force Team to perform preliminary analysis of the eects of K-IFRS adoption and establish accounting systems to apply the

new accounting treatments, and trained its relevant personnel internally and externally. The Task Force Team regularly reports the details and

status of the Adoption Plan to its board of directors and management.

The main areas of dierence between the accounting standards generally accepted in Korea currently (K-GAAP) and K-IFRS expected to have

an impact on the financial statements relate to the scope of consolidation, plant and equipment, provision for severance and retirement

benets. These areas are not exhaustive, as in the future other unforeseen dierences may appear as a result of future changes. In addition,

practical eect of some of the signicant dierences listed below may not be obtainable.

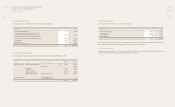

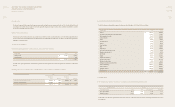

34. VALUE ADDED INFORMATION

The components of manufacturing costs and selling and administrative expenses which are necessary in calculating added value for the years

ended December 31, 2009 and 2008 are as follows:

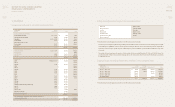

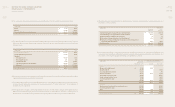

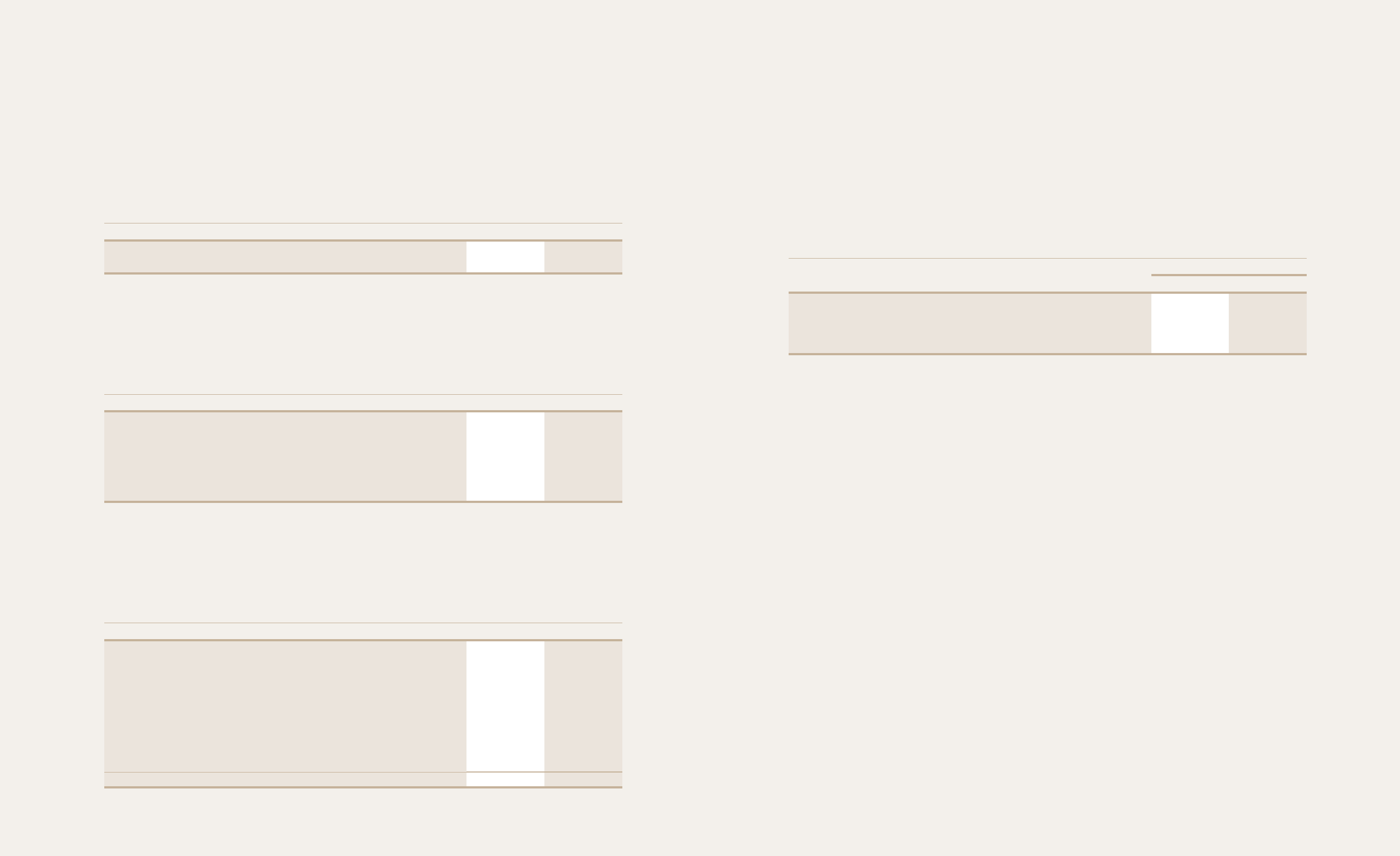

35. GEOGRAPHIC SEGMENT INFORMATION

The Company conducts business globally and is managed geographically. The following table provides information for each geographical

segment for the years ended December 31, 2009 and 2008:

In millions of Won 2009 2008

Revaluation of land ₩ - 1,288,898

Construction-in-progress transferred to property, plant and equipment 388,729 560,422

In millions of Won 2009 2008

Salaries ₩ 2,118,963 2,049,704

Retirement allowance and severance benets 261,166 340,278

Other employee benets 369,839 349,978

Rent 16,348 15,197

Depreciation 429,251 440,109

Taxes and dues 24,754 29,339

In millions of Won 2009 2008

Domestic sales ₩ 6,952,834 5,014,792

Export sales

North America 4,136,258 4,878,179

Europe 2,456,025 2,019,347

Asia 373,010 449,042

The Middle East / Africa 2,624,441 2,159,498

Middle and South America 1,050,154 967,670

China 462,803 171,822

Other 360,214 721,881

₩ 18,415,739 16,382,231

In millions of Won, except earnings per share 2009 2008

Financial instrument 4th Quarter 4th Quarter

Revenue ₩ 5,727,571 5,041,109

Operating income 411,809 35,900

Net income for the period 603,835 74,760

Earnings per share in Won 1,605 216