Kia 2009 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2009 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

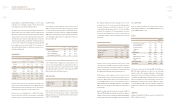

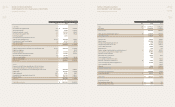

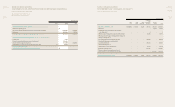

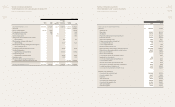

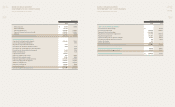

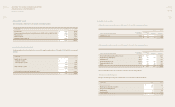

NONCONSOLIDATED

STATEMENTS OF CASH FLOWS

For the years ended December 31, 2009 and 2008

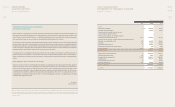

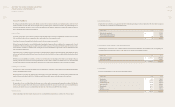

BALANCE AT JANUARY 1, 2009 ₩ 1,848,652 1,704,583 (2,427) 1,086,091 1,104,383 5,741,282

Net income - - - - 1,450,260 1,450,260

Exercise of stock warrants 205,703 52,492 - - - 258,195

Consideration for stock warrants - 3,646 - - - 3,646

Proceeds from treasury stock - 682 628 - - 1,310

Exercise of stock options - - (450) - - (450)

Change in fair value of available-for-sale securities,

net of tax (note 7) - - - (27) - (27)

Eective portion of changes in fair value of

cash ow hedges - - - 11,029 - 11,029

Eective portion of changes resulting from the changes in

currency exchange rate of

non-derivative nancial instrument (note 23(c)) - - - 40,734 - 40,734

Unrealized holding gain on

equity method accounted investments - - - (17,072) - (17,072)

Unrealized holding loss on

equity method accounted investments - - - 77,328 - 77,328

Revaluation surplus - - - (517) - (517)

Decrease in retained earnings from purchase of

equity method accounted investments (note 8(f)) - - - - (189,323) (189,323)

BALANCE AT DECEMBER 31, 2009 ₩ 2,054,355 1,761,403 (2,249) 1,197,566 2,365,320 7,376,395

Accumulated

other

Capital Capital Capital comprehensive Retained

stock surplus adjustments income(loss) earnings Total

NONCONSOLIDATED

STATEMENTS OF CHANGES IN EQUITY

CASH FLOWS FROM OPERATING ACTIVITIES

Net income ₩ 1,450,260 113,784

Adjustments for:

Depreciation 429,251 440,109

Amortization 254,185 275,091

Provision for retirement and severance benets, net 261,166 340,278

Provision for warranties 137,030 333,594

Allowance for doubtful accounts 2,281 8,411

Foreign currency translation loss (gain), net (2,208) 239,028

Loss on repayment of bonds 164 -

Loss on scrapped inventories 5,300 1,768

Reserve for inventory obsolescence 2,465 2,302

Equity in earnings of equity method accounted investees, net (813,703) (547,690)

Dividend income from equity method accounted investees 44,227 40,432

Gain on sale of investments (58,306) (5,538)

Gain on sale of memberships - (1,091)

Loss on valuation of long-term investment securities - 6,320

Impairment loss on investments 689 -

Loss on sale of property, plant and equipment, net 22,065 9,593

Loss on revaluation of land - 2,949

Interest income (reversal of present value discount) (883) (379)

Interest expense (amortization of discount on debentures) 14,320 4,564

Loss (gain) on valuation of derivatives, net 2,973 (36,288)

Loss on sale of accounts and notes receivable – trade 87,540 102,526

Changes in assets and liabilities:

Accounts and notes receivable - trade (246,048) (70,750)

Accounts receivable - other 54,987 22,364

Inventories 220,930 (151,758)

Other current assets 43,700 (31,718)

Accounts and notes payable - trade 598,736 193,663

Accounts and notes payable - other (27,458) 140,692

Other current liabilities 485,772 (9,993)

Income taxes payable 21,511 (11,741)

IN MILLIONS OF WON

IN MILLIONS OF WON

2009 2008

For the years ended December 31, 2009 and 2008

REDEFINING

MOBILITY

KIA MOTORS

ANNUAL REPORT

2009

REDEFINING

MOBILITY

KIA MOTORS

ANNUAL REPORT

2009