Kia 2009 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2009 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

REDEFINING

MOBILITY

KIA MOTORS

ANNUAL REPORT

2009

REDEFINING

MOBILITY

KIA MOTORS

ANNUAL REPORT

2009

Europe market

The most significant influences on the European auto market

in 2009 were government support measures for the disposal of

aged vehicles, most notably in Germany and the UK. These eorts

kept year-on-year demand shrinkage to a minimum, despite the

continuing hardships experienced by many European economies.

Kia Motors took advantage of the stimulus measures by actively

promoting its small-sized passenger vehicle line-up, touting the

fuel efficiency and environmental benefits of these models. We

also worked to streamline our dealer network and add more high-

volume dealerships to drive our market share upward.

Kia’s European strategy in 2010 will prioritize the replacement

of poorly-performing dealers with high-yielding dealerships in

major markets, upgrading dealership facilities, improving service

delivery and intensifying our marketing and promotion activities.

We will increase the supply of small-sized vehicles and launch

products that cater to emerging consumer demands. These

include the B-segment MPV Venga and the eco-friendly Sportage,

which offers reduced CO2 emissions, smaller displacement and

higher fuel eciency than its predecessor.

China market

Total passenger vehicle demand in the Chinese market was up

53.6% in 2009 thanks to comprehensive government policies to

boost auto sales.

Kia Motors posted 70% growth in China as a result, with vehicles

of 1.6L or smaller comprising the greatest share of sales. Pride (Rio),

previous generation Cerato and the new Forte all recorded solid

gains, as did the Sportage SUV. Kia’s overall market share in China

rose from 2.6% in 2008 to 2.9% last year.

With the Chinese economy showing positive growth signs in 2010,

the market is expected to record a steady increase in demand for

new cars. Consumer demand for personal vehicles is strong and

growing, and it has been announced that tax incentives for small-

sized vehicles will continue. Nonetheless, we must be prepared for

increasingly erce competition as rival carmakers release newly-

designed models targeting Chinese consumers.

Kia Motors will respond to this challenge by pushing sales of our

tax-incentivized Forte and Cerato, and introducing new vehicles

such as the Sportage. We are also proceeding steadily with the

expansion of a well-supported nationwide dealer network.

MANAGEMENT’S

DISCUSSION & ANALYSIS

Rest of the world

In 2009, Kia continued to tap into new markets and expand

globally in regions such as Eastern Europe and Latin America by

increasing our sales support for new models likethe Forte and

Soul, and oering competitive nancing packages in partnership

with local nance companies.

Total sales for the rest-of-the-world amounted to 455,000 units, up

8.7% year-on-year. The majority of sales came from regions such

as the Middle East, Africa and Canada, where Kia has had a strong

presence for several years.

In Africa and the Middle East, sales momentum continued to

gain strength thanks to the company’s attention to fostering its

relationship with the Gulf Cooperation Council, as well as the

emerging markets of North Africa. We also benefited from the

Brazilian government’s tax reductions on the import of industrial

goods.

Kia Motors will continue to explore new markets and expand its

global presence in 2010.

We will be active in local biddings and strive to secure orders

in all major countries. In Africa and the Middle East, we expect

to see growth in high value-added mid- to large-sized vehicles,

particularly in Saudi Arabia. In Latin America, particularly Brazil,

demand will likely swing toward stylish new models of the Forte

and Soul as local economies recover from the economic slump.

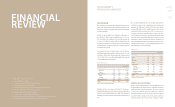

PRODUCTION

Kia Motors currently operates four assembly plants in Korea

that produce complete vehicles, including OEM manufacturing

centers that produce light vehicles. Our output in 2009 was

1.137 million units of assembled vehicles from a production base

with a capacity of 1.28 million units (1.5 million units standard

capacity), which was a 7.8% increase in production year-on-year.

The production increase came in response to a dramatic rise in

domestic demand, spurred by strong policy measures to promote

vehicle sales. The demand was unbalanced, however, as demand

of small-sized vehicles actually increased, while domestic demand

for RVs and large-sized vehicles was restrained. To meet this

challenge, Kia adapted its RV production lines to enable them to

produce small-sized vehicles. These lines were up and running by

the end of 2008, and enabled the company to satisfactorily meet

the demand for small vehicles throughout 2009.

Kia’s Chinese plants were set up as joint partnerships with Dong

Feng and Yueda, and will be able to produce a total of 430,000

units when both plants reach full production capability. 2009

production totaled 244,000 units, up 75.8% year-on-year, driven by

surging demand for the under-1.6L models Cerato and Rio, which

received the greatest tax incentives from the Chinese government.

Sales of the Forte C-segment passenger car, launched in China in

June, were also strong. We anticipate high demand for the Soul

B-segment CUV while was introduced to the Chinese market at

the end of 2009 based on the model’s success in every market

where it has been launched so far. The Soul is also expected to

make a significant contribution to increasing the profitability of

Kia’s Chinese operations.

Due to the ongoing recession in Europe, our Slovakia Plant - where

cee’d and Sportage are produced - recorded an output of 150,000

units in 2009, down 25.6% from the previous year. The majority of

European production is sold in the European market, with a small

number of units being exported to the Middle East and Africa.

While demand recovery in Europe is still uncertain, the Slovakia

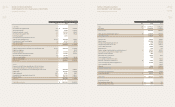

(thousand units)

2007 2008 2009

Korea Plants 1,119 1,055 1,137

China 107 139 244

Slovakia 145 201 150

Overseas Plants 252 340 394

Total 1,371 1,395 1,531

* Including OEM Production (Picanto - Donghee Automotive in Korea)

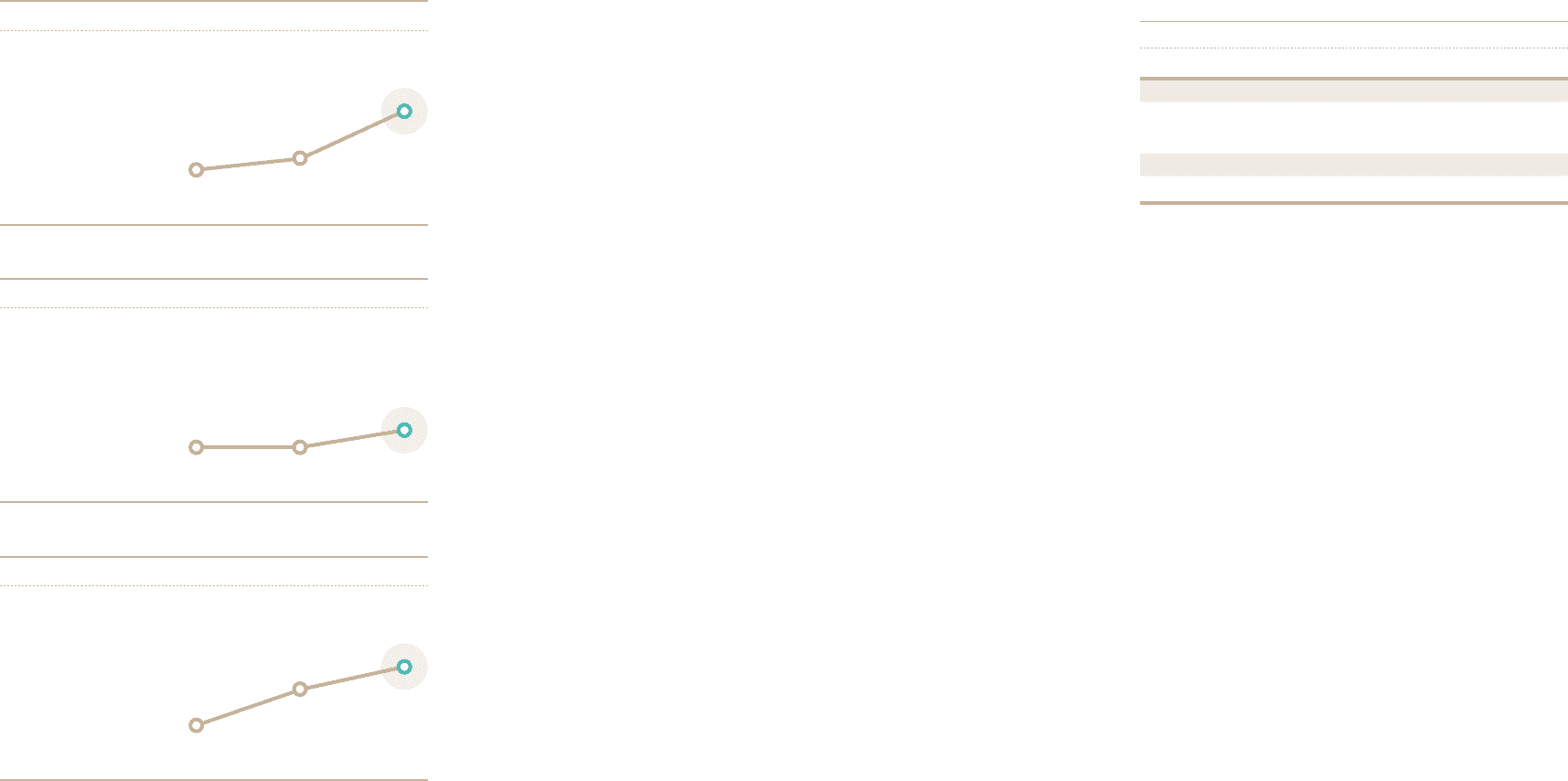

CHINA MARKET SHARE

2007

2.0

2.6

2.9

2008 2009

(%)

* Source: China Passenger Vehicle Group

US MARKET SHARE

2007

1.9 2.1

2.9

2008 2009

(%)

* Source: Autodata

WESTERN EUROPE MARKET SHARE

2007

1.6 1.6

1.7

2008 2009

(%)

* W.Europe: EU+EFTA countries / ** Source: ACEA, Company data