Kia 2009 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2009 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

REDEFINING

MOBILITY

KIA MOTORS

ANNUAL REPORT

2009

REDEFINING

MOBILITY

KIA MOTORS

ANNUAL REPORT

2009

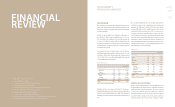

Salary expense accruals increased temporarily as ongoing

negotiations caused a portion of wages to be deferred to 2010.

Borrowings, meanwhile, declined by KRW 1.073 trillion to KRW

4.56 trillion. This was due mainly to a reduced need for short-term

borrowings, including commercial paper and short-term loans.

The proportion of short-term borrowings among total borrowings

therefore posted a sharp decline from 23% in 2008 to 2% in 2009.

In total, year-on-year fourth-quarter net borrowings dropped from

KRW 2.648 trillion to approximately KRW 2 trillion in 2009.

Kia Motors’ strong sales performance in 2009 led to an

improvement in the company’s nancial structure, particularly in

terms of borrowings. The overall debt ratio and net borrowings

ratio both improved to 129.7% and 35.9%, respectively. Going

forward, Kia’s management intends to continue to improve the

company’s nancial structure by steadily reducing borrowings.

EQUITY

Kia Motors’ capital stock amounted to KRW 7.376 trillion, up KRW

1.635 trillion from the fourth quarter of the previous year. The

increase is attributable to a higher net income of KRW 1.45 trillion

and issuance of new stock worth KRW 249 billion.

CAPEX

Total CAPEX investment amounted to KRW 1.541 trillion on a

consolidated basis in 2009, posting a slight increase over the

previous year. The portion of R&D investment comprises 4.3%

of total revenue. Approximately 86% of R&D spending was

expensed in Korea, among which new vehicle-related R&D costs

were recorded as intangible assets and new vehicle facility costs

as tangible assets. Both are amortized according to predefined

schedules (3 years for intangible assets, starting from the time that

mass-production of new vehicles commences, and 15 years on

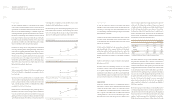

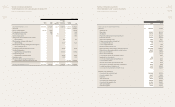

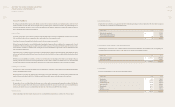

(KRW Billion)

2008 2009 Dierence

R&D 882 796 -86

(% of Revenue) 5.4% 4.3%

Maintenance 183 199 15

Korea 1,065 995 -70

Overseas 456 547 91

CAPEX Total 1,521 1,541 21

* CAPEX totals include R&D costs recognized in the current period, and therefore

are not identical to the gures contained in the consolidated statement of cash

ows.

* The above contents may dierent from nancial reporting standards.

* In case of Overseas CAPEX, F/X evaluation is not considered.

MANAGEMENT’S

DISCUSSION & ANALYSIS

average for the depreciation period of tangible assets).

CAPEX investments recognized overseas rose by KRW 91 billion

year-on-year, as plants in China, Slovakia and the US were outtted

for new vehicle production.

Construction on major facilities abroad was completed in 2009,

but continuing investments will be made as new vehicles and

facilities are introduced. Following the relatively large CAPEX

investments in 2009, new vehicle development spending will

continue in 2010, but to a smaller degree than in the past.

CREDIT RATINGS

Despite the deterioration in global economic conditions, Kia Motors’

business fundamentals strengthened due to the company’s solid

financial performance. Kia’s short- and long-term credit ratings

remained high at A1 for short-term credit as of 2009 and AA- for

long-term credit. The long-term rating was revised upward to AA in

March of 2010.

The company’s overseas credit ratings and outlook were revised

downward, as credit evaluation agencies lowered their projections

for the auto industry amid generally poor performances by the

majority of the world’s major automakers. In January 2009, Moody’s

lowered Kia’s credit outlook, followed by a downgrade from S&P in

April.

However, overseas ratings on Kia Motors were later revised upward,

following the company’s strong sales performance in comparison

with its competitors. Moody’s upgraded the company’s outlook in

November 2009, and S&P followed suit in January of 2010.

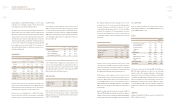

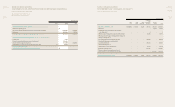

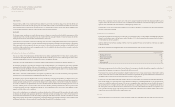

(KRW Billion)

2008 2009 Dierence

Account Payable 1,807 2,405 597

Short-term debt 1,287 79 -1,208

Current portion of long-term debt 890 1,735 846

Provision for warranties 291 228 -63

Others 919 1,398 479

Current Liabilities 5,194 5,846 651

Long-term debt 3,457 2,746 -711

Provision for warranties 446 372 -75

Accural for retirement 492 328 -164

Others 122 114 -8

Non-current Liabilities 4,517 3,720 -797

Total Liabilities 9,711 9,565 -146

Total Debt 5,633 4,560 -1,073

Cash & Deposits 1,017 1,912 895

Total Net Debt 4,616 2,648 -1,968

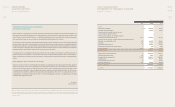

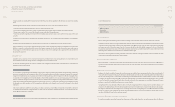

(KRW Billion)

2008 2009 Dierence

Capital Stock 1,849 2,054 206

Capital surplus 1,705 1,761 57

Capital adjustment -2 -2 0

Retained earnings 1,104 2,365 1,261

Accumulated other

comprehensive gain (losses) 1,086 1,198 111

Equity 5,741 7,376 1,635

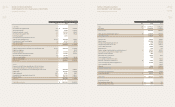

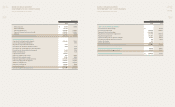

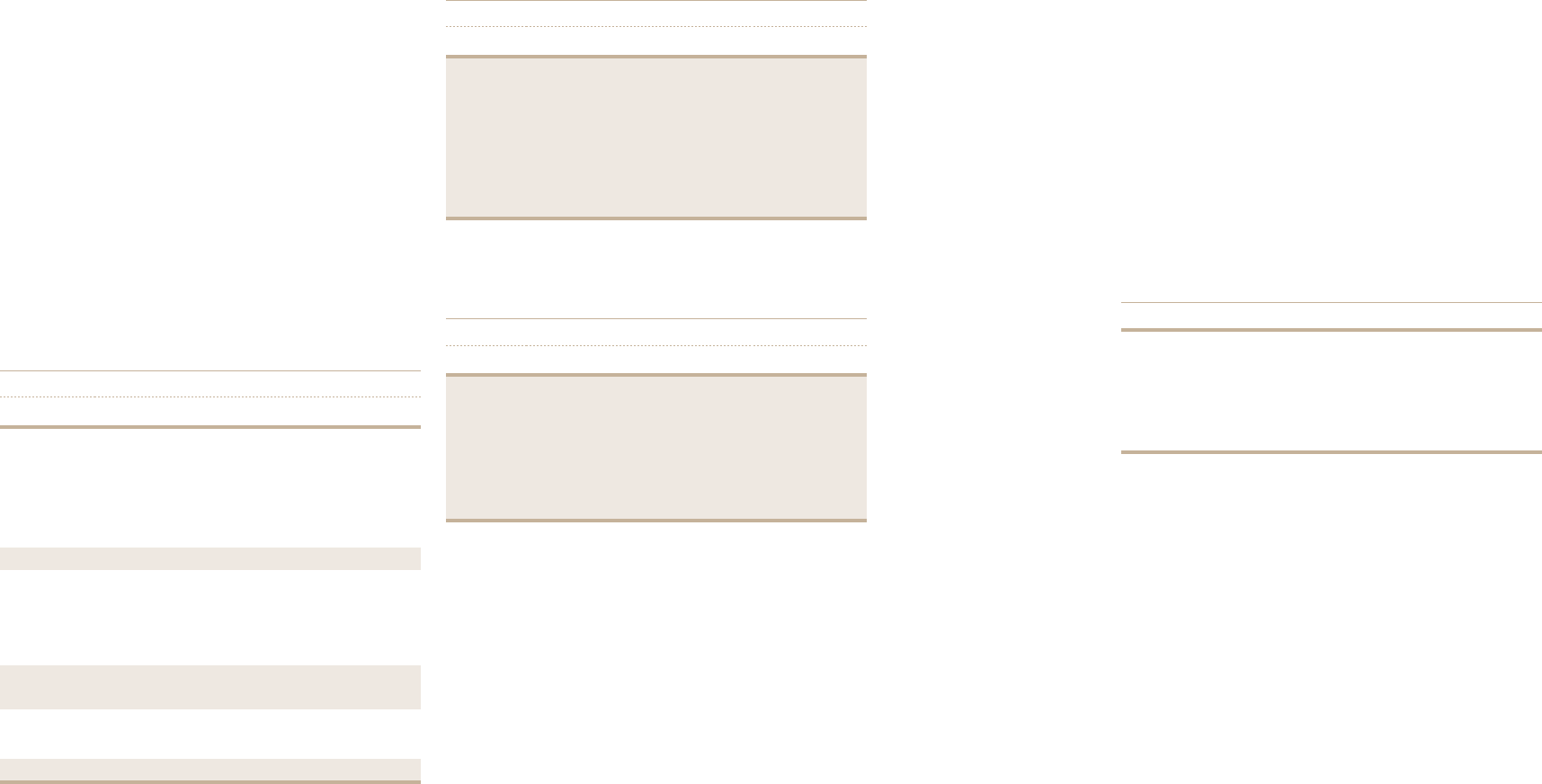

End of 2008 As of March 2010

Domestic Korea Ratings AA- (Stable) AA (Stable)

Korea Investors Service AA- (Stable) AA (Stable)

NICE Investors Service AA- (Stable) AA (Stable)

Overseas Moody’s Baa3 (Stable) Ba1 (Stable)

Standard & Poor’s BBB- (Stable) BBB- (Stable)