Kia 2009 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2009 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

REDEFINING

MOBILITY

KIA MOTORS

ANNUAL REPORT

2009

REDEFINING

MOBILITY

KIA MOTORS

ANNUAL REPORT

2009

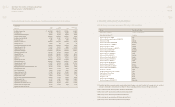

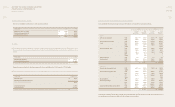

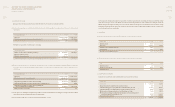

28. SELLING AND ADMINISTRATIVE EXPENSES

Details of selling and administrative expenses for the years ended December 31, 2009 and 2008 are as follows:

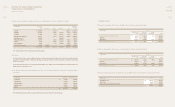

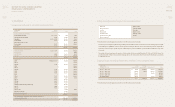

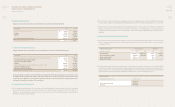

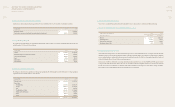

29. INCOME TAXES

(a) The Company was subject to income taxes on taxable income at the following normal tax rates.

(*) All the stock options granted were exercised during current year. The Company does not have any granted stock options as of December

31, 2009.

(b) Changes in treasury stock for the years ended December 31, 2009 and 2008 are summarized as follows:

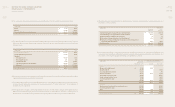

NOTES TO NONCONSOLIDATED

FINANCIAL STATEMENTS

December 31, 2009 and 2008

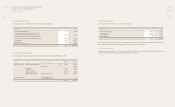

In millions of Won 2009 2008

Treasury stock ₩ (2,249) (2,877)

Stock options(*) - 450

₩ (2,249) (2,427)

In millions of Won 2009 2008

Salaries ₩ 504,253 454,646

Provision for retirement and severance benets 101,820 73,167

Other employee benets 71,502 65,456

Sales promotion 407,220 296,308

Travel 18,454 14,488

Communications 8,276 8,294

Utilities 7,757 7,529

Taxes and dues 7,985 10,208

Rent 16,144 14,965

Depreciation 30,345 36,964

Amortization of intangible assets 1,292 1,315

Repairs and maintenance 5,838 5,418

Advertising 100,393 81,393

Freight 53,597 42,682

Supplies and stationery 2,357 1,920

Commissions and fees 113,611 121,173

Education and training 3,824 3,007

Ordinary research and development 262,623 266,635

Overseas marketing 933,431 558,897

Export expenses 580,936 598,620

Warranty expenses 208,579 388,464

Miscellaneous 6,667 4,095

₩ 3,446,904 3,055,644

In thousands of Won, except number of shares 2009 2008

Number of Number of

shares

Amount

shares

Amount

BALANCE AT BEGINNING OF YEAR 480,764 ₩ 2,877 480,764 ₩ 2,877

Exercise of stock warrants (105,048) (628) - -

BALANCE AT END OF YEAR 375,716 ₩ 2,249 480,764 ₩ 2,877

Taxable income Tax rate

2008 and thereafter 2008 2009 2010 and 2011 Thereafter

Up to ₩200 million 12.1% 12.1% 11.0% 11%

Over ₩200 million 27.5% 24.2% 24.2% 22%

In December 2009, the Korean government postponed the reduction of the corporate income tax rate (including resident tax) from 24.2% to

22% until 2012.

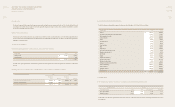

(a) Legal reserve

The Korean Commercial Code requires the Company to appropriate as legal reserve an amount equal to at least 10% of cash dividends for each

accounting period until the reserve equals 50% of stated capital. The legal reserve may be used to reduce a decit or transferred to common

stock in connection with a free issue of shares.

(b) Other reserve under tax law

Under the special Tax Treatment Control Law, investment tax credits have been accumulated as the reserve for Technology Development

and the reserve for Research and Human Resource Development. The appropriated amount for their own purpose and the existing balance are

regarded as a voluntary reserve.

27. CAPITAL ADJUSTMENTS

(a) Details of capital adjustments as of December 31, 2009 and 2008 are as follows: