Kia 2009 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2009 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

REDEFINING

MOBILITY

KIA MOTORS

ANNUAL REPORT

2009

REDEFINING

MOBILITY

KIA MOTORS

ANNUAL REPORT

2009

MANAGEMENT’S

DISCUSSION & ANALYSIS

players used this opportunity to promote brand-specic launches

of value-added new vehicles.

Overall sales of passenger cars rose by 18.8% (+152,834 units),

as new models of popular domestic brands (EQUUS, SM3, SM5,

Matiz, Forte Koup) were launched. In the RV segment, demand

rose by 23.0% (+52,610 units), buoyed mostly by new launches of

the Sorento R (Sorento) and Tucson IX. Commercial vehicle sales

rose more modestly, gaining 6.7%.

Looking at Korean demand for import cars, total sales posted

a slight increase for the year, but market share slipped by 0.6

percentage points to 5.3%. Japanese vehicles showed the

strongest gains in terms of unit sales, but unfavorable exchange

rates during the rst half of the year led to a contraction in their

total market share.

Overall, Kia Motors reported annual unit sales growth of 29.0%

(+92,691 units), capturing an additional 2.5% market share to

command a total domestic share of 28.2%.

Our top-performing models were the New Morning (Picanto),

Forte (Cerato) and K7 (Cadenza), which led the 7.4% growth

(+51,664 units) in Kia’s passenger vehicle sales. In the RV segment,

the continuing popularity of Soul and Sportage, along with the

launch of the Sorento R (Sorento), pushed annual sales up by

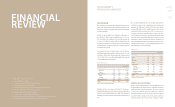

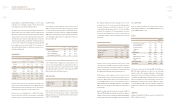

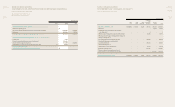

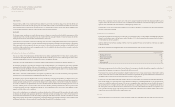

2008 2009 Change (thousand units, %)

Segment

Domestic Domestic Domestic

Market KIA M/S Market KIA M/S Market change(%) KIA change(%) M/S

PCs 814 189 23.2 967 241 24.9 153 18.8 52 27.4 1.7

RVs 229 92 40.2 282 129 45.8 53 23.0 37 40.0 5.6

Commercial 204 39 19.2 217 43 19.9 13 6.7 4 10.7 0.7

Total 1,247 320 25.7 1,466 413 28.2 219 17.6 93 29.0 2.5

* Based on KAMA new registrations data; there may be slight dierences with the company’s data

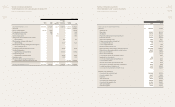

2007 2008 2009

(thousand units, %)

Particulars

Sales M/S Sales M/S Sales M/S

Kia 263 20.9 320 25.7 413 28.2

Hyundai 619 49.0 569 45.6 700 47.7

GM-Daewoo 139 11.0 127 10.2 105 7.2

Ssangyong 59 4.7 41 3.3 22 1.5

Renault-Samsung 117 9.3 103 8.3 137 9.3

Others 65 5.1 86 6.9 88 6.0 Imports, etc.

Total 1,262 100 1,246 100 1,465 100

* Based on KAMA new registrations data; there may be slight dierences with the company’s data

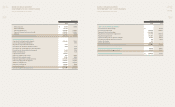

MARKET SHARE BY DOMESTIC MANUFACTURES DOMESTIC, 2009

40.0% (+36,827 units), placing Kia Motors at the top of market

share for this segment. Sales of Kia’s commercial vehicles,

meanwhile, outpaced the market with 10.7% growth (+4,200

units), mostly attributable to purchases by self-employed

individuals.

In 2009, Kia maintained up a steady pace of new product launches

to improve vehicle quality, particularly focusing on design

esthetics and fuel eciency. We were therefore able to compete

eectively with similar new launches by our competitors, and take

advantage of the government’s measures to stimulate auto sales.

The Sorento R, Forte Koup and K7 were especially instrumental

in expanding Kia’s market share and strengthening our overall

lineup.

2010 is expected to see a decline in domestic sales as the

government’s stimulus measures are withdrawn. This, however,

should be offset somewhat by organic sales growth in line with

the nascent economic recovery that is now underway.

Kia Motors’ strategy for this year is to press forward with new

product launches that will raise our market profile even higher,

and intensify our marketing activities. These will include strategic

alliances with other top-tier companies, acting as an official

sponsor of the 2010 FIFA World Cup, and co-promoting our

vehicles along with the Kia Tigers pro baseball team.

OVERSEAS SALES AND STRATEGIES

In 2009, Kia Motors fought to protect its market share amid a

global decline in demand for automobiles. We adopted a mixed

production system to increase flexibility, reduce inventory and

increase our responsiveness to changing market conditions.

At the same time, we took advantage of foreign governments’

stimulus measures to boost auto sales, and conducted aggressive

marketing campaigns to raise brand awareness of our products.

The result was a rise in Kia’s overseas retail sales to 1,650,500 units,

with Forte (Cerato) and Soul leading the way in growth.

We are looking forward to a gradual turnaround in demand next

year, although we expect erce competition in the US market, as

major rivals step up their eorts to re-establish themselves in the

world’s most important auto market. In Europe, meanwhile, the

withdrawal of government scrappage support for older models is

expected to lead to a decline in demand. Kia’s response will be to

strengthen its oversight and management of foreign plants, while

timing new product launches carefully so as to achieve maximum

impact. New versions of the Lotze (Optima) and Sportage are

now being prepared for market, and our overseas dealer network

is being strengthened with a focus on major cities and dealer

incentive programs. We also expect to receive a boost from our

high-profile sponsorship of the 2010 FIFA World Cup in South

Africa.

US market

Kia Motors recorded a very successful year in the US in 2009. While

total demand shrank by over 20%, Kia was able to raise sales by

9.8% (+300,000 units), while also expanding market share to the

3% range. We launched an intensive TV advertising blitz in the

summer months to take advantage of the US car disposal program

incentives, backing the campaign with special promotions

on selected models. Our dealer network was also overhauled,

bringing on board more high-performing dealers in major cities to

support the new supply of Sorento vehicles manufactured at the

newly-completed Georgia production plant.

US demand is forecast to grow in 2010 as the economy improves

and carmakers offer generous incentives to boost sales.

Accordingly, Kia Motors will focus on promoting proven models

like the Soul and Forte, as well as ensuring a successful launch

of the all-new Sorento, which will be Kia’s first locally-produced

vehicle. Financial and sales support will be expanded, and

intensive marketing campaigns will be conducted to increase

trac at our top dealerships in the US.