Kia 2009 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2009 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

REDEFINING

MOBILITY

KIA MOTORS

ANNUAL REPORT

2009

REDEFINING

MOBILITY

KIA MOTORS

ANNUAL REPORT

2009

NOTES TO NONCONSOLIDATED

FINANCIAL STATEMENTS

December 31, 2009 and 2008

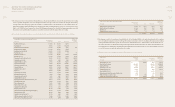

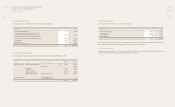

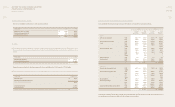

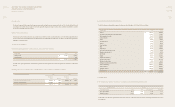

16. LONGTERM DEBT

(a) Long-term debt as of December 31, 2009 and 2008 are summarized as follows:

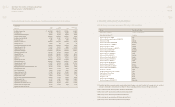

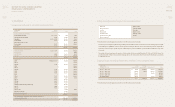

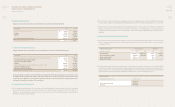

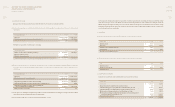

(b) Details of bond with warrant as of December 31, 2009 are summarized as follows:

In millions of Won Annual

Lender interest rate 2009 2008

LOCAL CURRENCY BORROWINGS

Kookmin Bank and Others 3.00 ~ 5.00% ₩ 7,998 8,852

The Korea Development Bank 4.34% 45,833 50,000

Hana Bank 3.81% ~ 6.52% 220,000 70,000

Kookmin Bank 4.30% 350,000 350,000

Kyobo Life Insurance Co., Ltd. - - 30,000

Kookmin Bank 6.97% 350,000 350,000

Hana Bank 6.21% 150,000 -

1,123,831 858,852

FOREIGN CURRENCY BORROWINGS

KOREA EXIMBANK 1.32% ~ 1.97% 326,873 430,380

BNP PARIBAS - - 75,450

SC FIRST BANK 5.45% 64,218 69,163

CALYON 2.12% 376,713 399,649

767,804 974,642

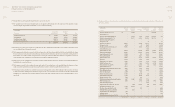

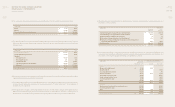

DEBENTURES

264th 6M Euribor+0.95 502,284 532,866

266-1st - - 100,000

266-2nd 5.19% 200,000 200,000

267th - - 100,000

268-1st - - 150,000

268-2nd 5.01% 150,000 150,000

269th 5.33% 300,000 300,000

270th 5.73% 190,000 200,000

271st - - 350,000

272nd 7.00% 200,000 200,000

273rd 8.90% 70,000 70,000

274-1st 8.30% 180,000 -

274-2nd 8.40% 160,000 -

274-3rd 8.60% 60,000 -

275th (Bond with warrant(see (b) below)) 1.00% 280,042 -

276-1st 5.85% 90,000 -

276-2nd 6.80% 110,000 -

Less discount (8,236) (4,092)

Redemption premium 40,800 -

Stock warrants adjustment (15,711) -

2,509,179 2,348,774

Less current portion of long-term debt, net of discount of ₩ 510

in 2009 and ₩ 474 in 2008 (1,655,222) (805,830)

₩ 2,745,592 3,376,438

Date issued March 19, 2009

Amount of issue(*) ₩ 400,000 million

Issued at Face value

Maturity date March 19, 2012

Convertible until February 19, 2012

Conversion price in Won ₩ 6,880

Amount converted -

(*) The amount represents principal portion only and does not reect discount on present value.

The exercise prices are adjusted by the following conditions, when the additional stocks are issued due to new stock issuing for paid-in capital,

stock dividends, and capitalization of reserves at lower price than market price before the exercise of stock warrants, when the adjustment of

exercise price is necessary due to merger, reduction of capital, split of stock and consolidation of stock, and when the market price of the stock

is decreased.

The number of shares issued upon the exercise of stock warrants for the year ended December 31, 2009 are 41,140,593 shares. The

accumulated number of shares exercised and the remaining shares to be exercised are 41,140,593 shares and 16,993,873 shares, respectively,

as of December 31, 2009

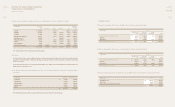

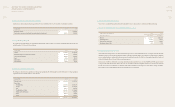

(c) Aggregate maturities of the Company’s long-term debt as of December 31, 2009 are summarized as follows:

(*) The amount represents principal portion only and does not reect discount on present value.

In millions of Won Local Foreign

December 31, 2009 currency debt(*) currency debt(*) Debentures(*) Total

2010.1.1 ~ 2010.12.31 ₩ 87,568 695,880 872,284 1,655,732

2011.1.1 ~ 2011.12.31 367,523 71,924 780,000 1,219,447

2012.1.1 ~ 2012.12.31 163,247 - 730,042 893,289

2013.1.1 ~ 2013.12.31 350,741 - - 350,741

2014 and thereafter 154,752 - 110,000 264,752

₩ 1,123,831 767,804 2,492,326 4,383,961