Kia 2009 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2009 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

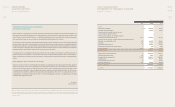

PROVISION FOR WARRANTIES

The Company generally provides warranty to the ultimate consumer for each product sold and accrues warranty expense at the time of sale

based on the history of actual claims. Also, the Company accrues potential expenses, which may occur due to any product liability suits or

voluntary recall campaigns pending as of the end of the reporting period. The dierence between the nominal value and present value of

these is amortized using the eective interest method.

(r) Income Taxes

Income tax on the income or loss for the year comprises current and deferred tax. Income tax is recognized in the statement of income except

to the extent that it relates to items recognized directly in equity, in which case it is recognized in equity.

Current tax is the expected tax payable on the taxable income for the year, using tax rates enacted.

Deferred tax is provided using the asset and liability method, providing for temporary dierences between the carrying amounts of assets

and liabilities for nancial reporting purposes and the amounts used for tax purposes. The amount of deferred tax provided is based on the

expected manner of realization or settlement of the carrying amount of assets and liabilities, using tax rates enacted or substantively enacted

at the end of the reporting period.

A deferred tax asset is recognized only to the extent that it is probable that future taxable income will be available against which the unused

tax losses and credits can be utilized. Deferred tax assets are reduced to the extent that it is no longer probable that the related tax benet will

be realized.

Deferred tax assets and liabilities are classied as current or non-current based on the classication of the related asset or liability for nancial

reporting or the expected reversal date of the temporary dierence for those with no related asset or liability such as loss carryforwards and

tax credit carryforwards. The deferred tax amounts are presented as a net current asset or liability and a net non-current asset or liability.

(s) Earnings (Loss) Per Share

Earnings (loss) per share are calculated by dividing net income attributable to stockholders of the Company by the weighted-average number

of shares outstanding during the period.

Diluted earnings (loss) per share are determined by adjusting net income (loss) attributable to stockholders and the weighted-average

number of shares outstanding for the eects of all dilutive potential shares, which comprise stock options granted to employees.

(t) Use of Estimates

The preparation of non-consolidated financial statements in accordance with accounting principles generally accepted in the Republic

of Korea requires management to make estimates and assumptions that affect the amounts reported in the non-consolidated financial

statements and related notes to non-consolidated nancial statements. Actual results could dier from those estimates.

(u) Reclassication

Certain reclassications have been made to the prior year non-consolidated nancial statements to conform to the 2009 presentation.

NOTES TO NONCONSOLIDATED

FINANCIAL STATEMENTS

December 31, 2009 and 2008

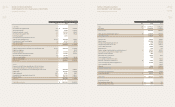

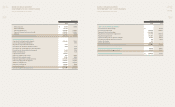

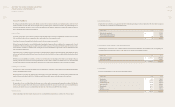

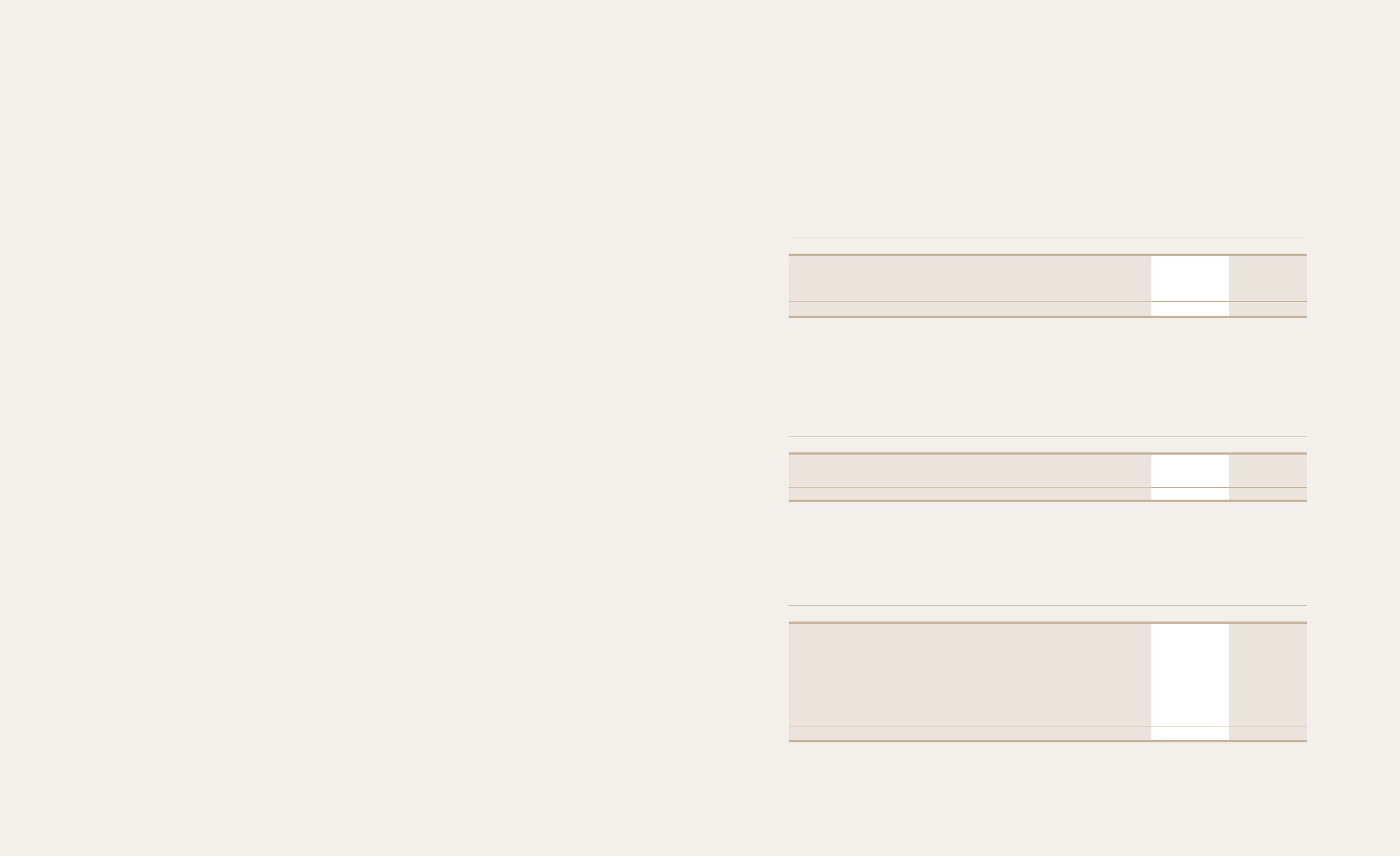

3. RESTRICTED DEPOSITS

Deposits which are restricted in use as guarantee deposits for maintaining checking accounts and expenditures for certain business purposes

as of December 31, 2009 and 2008 are summarized as follows:

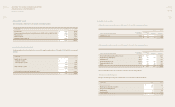

4. TRANSFERS OF TRADE ACCOUNTS AND NOTES RECEIVABLE

Outstanding trade accounts and notes receivable transferred to and discounted with banks, and excluded from the accompanying non-

consolidated statements of nancial position, as of December 31, 2009 and 2008 are summarized as follows:

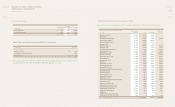

5. INVENTORIES

Inventories as of December 31, 2009 and 2008 are summarized as follows:

In millions of Won 2009 2008

Cash and cash equivalents ₩ - 112,168

Short-term nancial instruments - 15,000

Long-term nancial instruments 32 3,932

₩ 32 131,100

In millions of Won 2009 2008

Trade accounts receivable ₩ 2,594,601 3,591,408

Trade notes receivable - 54,931

₩ 2,594,601 3,646,339

In millions of Won 2009 2008

Merchandise ₩ 3,805 16,890

Finished goods 340,868 475,549

Semi-nished goods 179,783 174,016

Work-in-process 79,186 85,546

Raw materials 94,267 171,792

Supplies 69,252 63,019

Materials-in-transit 31,980 41,024

₩ 799,141 1,027,836

REDEFINING

MOBILITY

KIA MOTORS

ANNUAL REPORT

2009

REDEFINING

MOBILITY

KIA MOTORS

ANNUAL REPORT

2009