Kia 2009 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2009 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

REDEFINING

MOBILITY

KIA MOTORS

ANNUAL REPORT

2009

REDEFINING

MOBILITY

KIA MOTORS

ANNUAL REPORT

2009

NOTES TO NONCONSOLIDATED

FINANCIAL STATEMENTS

December 31, 2009 and 2008

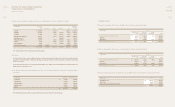

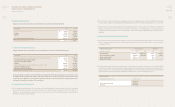

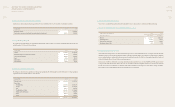

(b) The components of income tax expense for the years ended December 31, 2009 and 2008 are summarized as follows: (g) The deferred tax assets and liabilities that are directly charged or credited to accumulated other comprehensive income as of

December 31, 2009 are as follows:

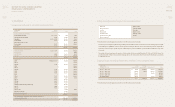

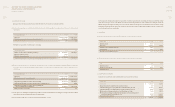

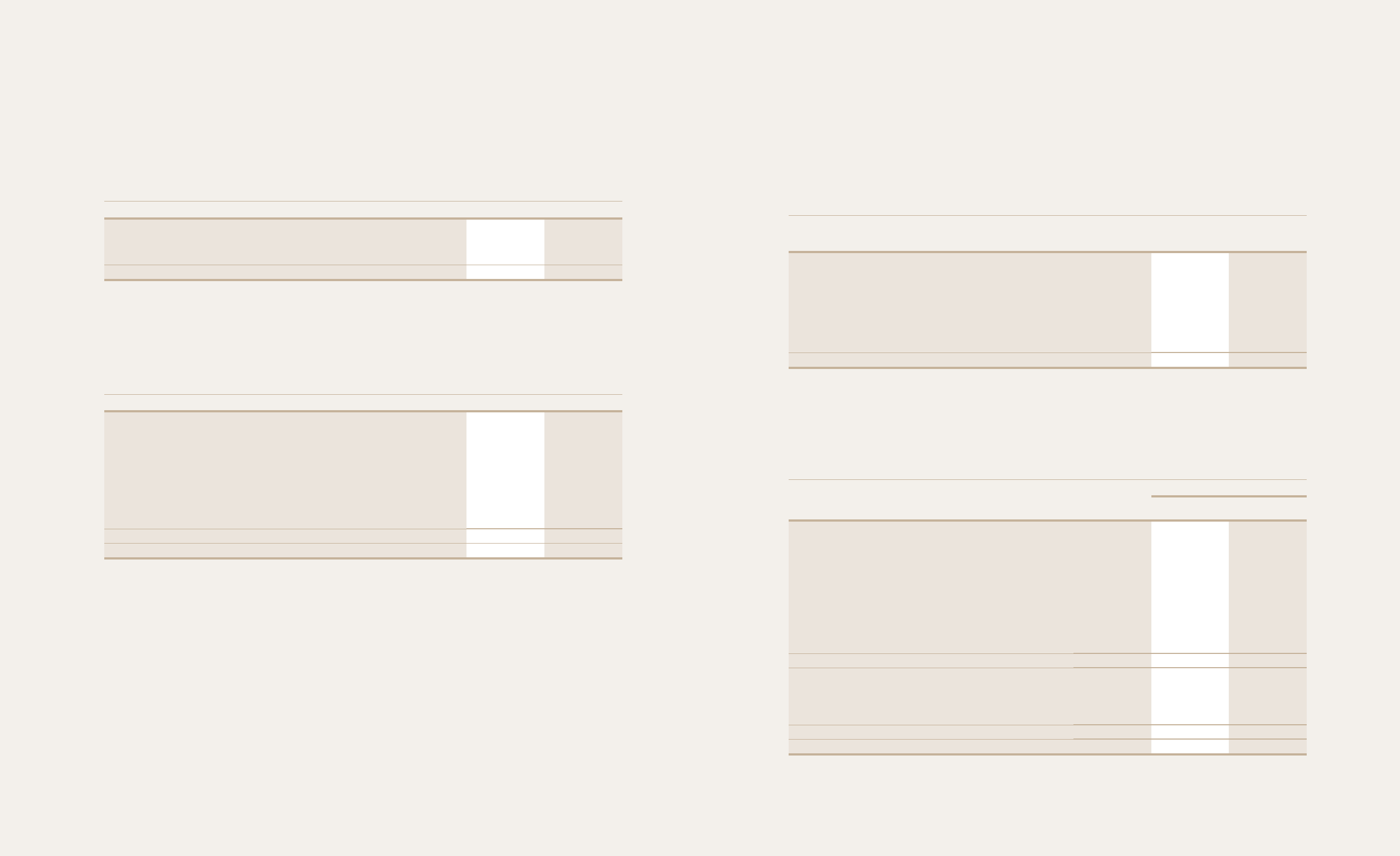

(h) In accordance with SKAS No. 16, the deferred tax amounts should be presented as a net current asset or liability and a net

non-current asset or liability. In addition, the Company is required to disclose aggregate deferred tax assets (liabilities). As of

December 31, 2009, details of aggregate deferred tax assets (liabilities) are as follows:

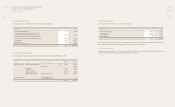

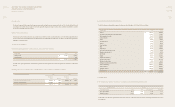

(c) The charge (benet) for income taxes calculated by applying statutory tax rates to the Company’s taxable income for the year

diers from the actual charge (benet) in the statement of income for the years ended December 31, 2009 and 2008 for the

following reasons:

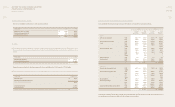

(d) Deferred tax assets have been recognized as the Company has determined it is probable that future prots will be available

against which the Company can utilize the related benet.

(e) The taxable temporary dierence associated with impairment loss on investments and equity method accounted investments

in respect of which deferred tax assets have not recognized amounted to ₩ 129,980 million and ₩ 181,009 million as of

December 31, 2009, respectively.

(f) The Company did not recognize a deferred tax liability in the amount of ₩164,610 million arising from the taxable temporary

differences associated with equity method accounted investments as of December 31, 2009, since a certain portion of

dividend income is not taxable and it is probable that the temporary dierences will not reverse in the foreseeable future.

In millions of Won 2009 2008

Current ₩ 41,185 55,082

Deferred 242,447 180,805

Charge directly to other comprehensive income (34,315) (281,899)

INCOME TAX CHARGE ₩ 249,317 (46,012)

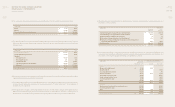

In millions of Won Deferred tax

Temporary assets

dierences (liabilities)

Unrealized holding gain on equity method accounted investments ₩ (388,696) (80,713)

Unrealized holding loss on equity method accounted investments 54,061 1,087

Change in fair value of available-for-sale securities, net (9) (2)

Eective portion of changes in fair value of cash ow hedges, net 4,030 887

Eective portion of changes resulting from the changes in currency exchange rate of

non-derivative nancial instrument 75,807 16,677

Revaluation surplus (1,288,235) (283,412)

₩ (1,543,042) (345,476)

INCOME BEFORE INCOME TAX ₩ 1,699,577 67,772

Tax at the applicable statutory tax rate 411,298 18,638

Adjustment

Non-taxable income (55,432) (611)

Non-deductible expense 8,790 882

Investment tax credit 39,781 (64,419)

Unrecognized deferred income tax liabilities (94,395) 116,731

Others, net (60,725) (117,233)

ACTUAL INCOME TAXES ₩ 249,317 (46,012)

EFFECTIVE TAX RATE 14.67% -

In millions of Won 2009 2008

In millions of Won Temporary Deferred tax assets (liabilities)

dierences at

December 31, 2009

Current Non-current

ASSETS

Allowance for doubtful accounts ₩ 115,185 27,874 -

Bad debts write-o 256,405 - 56,409

Loss on impairment of investments 310,877 - 787

Provision for warranties 599,131 55,059 81,754

Carryforwards of unused tax credits 284,346 - 372,251

Foreign exchange translation loss, net 177,050 - 38,950

Tax reserve applicable to equity 133,898 - 18,651

Others 1,315,206 82,790 213,297

3,192,098 165,723 782,099

LIABILITIES

Equity in income of equity method accounted investees, net 1,603,939 - 395,385

Tax reserve applicable to equity 1,676,940 - 364,127

Other 866,959 7,884 182,776

4,147,838 7,884 942,288

NET DEFERRED TAX ASSET ₩ (955,740) 157,839 (160,189)