Kia 2009 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2009 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

REDEFINING

MOBILITY

KIA MOTORS

ANNUAL REPORT

2009

REDEFINING

MOBILITY

KIA MOTORS

ANNUAL REPORT

2009

NOTES TO NONCONSOLIDATED

FINANCIAL STATEMENTS

December 31, 2009 and 2008

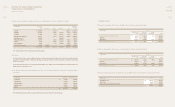

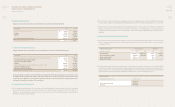

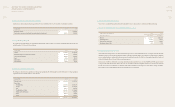

30. EARNINGS PER SHARE

Earnings per share of common stock for the years ended December 31, 2009 and 2008 are calculated as follows:

(a) Basic earnings per share are calculated by dividing net income by the weighted-average number of shares of common stock

outstanding.

For the purpose of calculating the weighted-average number of common equivalent shares outstanding, the Company assumed that ordinary

shares were issued upon exercise of the dilutive stock options at the average market price of the ordinary shares during the period. The

dierence between the number of ordinary shares issued and the number of ordinary shares that would have been issued at the average

market price (₩9,554 and ₩10,231 for the years ended 2009 and 2008, respectively) of ordinary shares during the period is considered as an

issue of ordinary shares for no consideration.

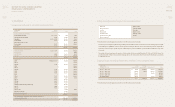

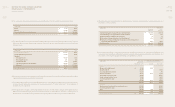

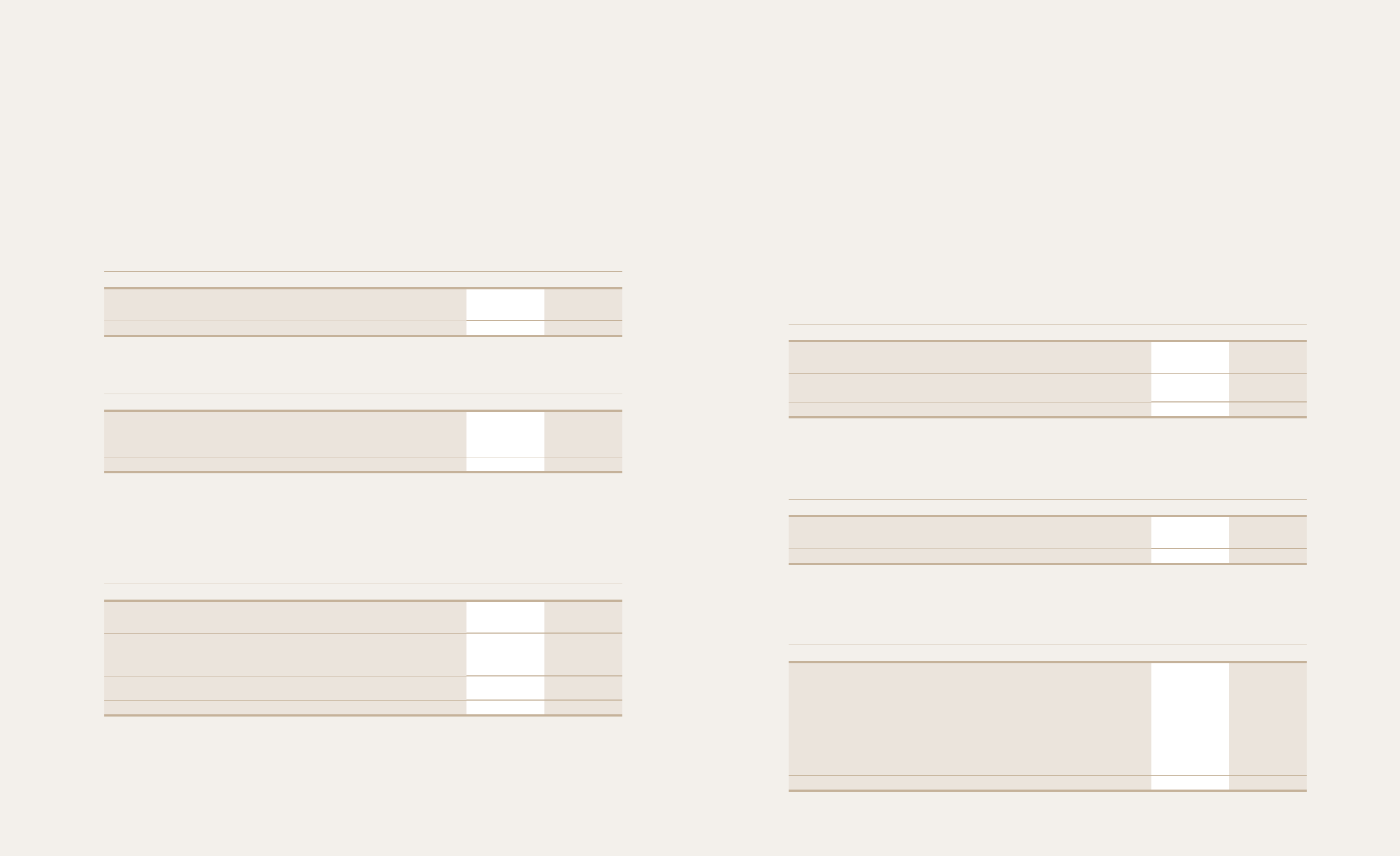

31. DIVIDENDS

(a) Details of dividends for the years ended December 31, 2009 and 2008 are as follows:

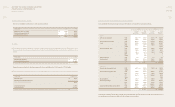

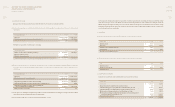

32. COMPREHENSIVE INCOME

Comprehensive income for the years ended December 31, 2009 and 2008 is as follows:

(b) Dividend yield ratios for the years ended December 31, 2009 and 2008 are as follows:

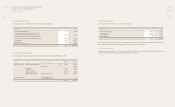

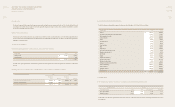

(b) Diluted earnings per share are calculated by dividing net income, as adjusted assuming all potentially dilutive stock options

have been exercised, by the weighted-average number of common shares outstanding and common equivalent shares

outstanding.

In Won, except number of shares 2009 2008

Net income ₩ 1,450,260,139,669 113,784,100,254

Weighted-average number of common shares outstanding(*) 367,279,904 346,749,691

EARNINGS PER SHARE ₩ 3,949 328

In Won, except number of shares 2009 2008

Number of common shares outstanding at January 1 ₩ 346,749,691 346,749,691

Eect of stock options exercise 58,999 -

Eect of stock warrants exercise 20,471,214 -

Weighted-average number of common shares outstanding at December 31, 2009 and 2008 ₩ 367,279,904 346,749,691

In Won, except number of shares 2009 2008

Net income ₩ 1,450,260,139,669 113,784,100,254

BW interest expense x (1 – marginal tax rate) 8,824,881,414 -

1,459,085,021,083 113,784,100,254

Weighted-average number of common shares outstanding 367,279,904 346,749,691

Weighted-average number of common equivalent shares outstanding(*1, *2) 25,405,794 20,854

Weighted-average number of common shares outstanding and

common equivalent shares outstanding 392,685,698 346,770,545

Diluted earnings per share in Won ₩ 3,716 328

(*) Weighted average number of common shares outstanding:

(*1) For the purpose of calculating the weighted-average number of common equivalent shares outstanding, the company assumed that ordinary

shares were issued upon substitute payment of bond with warranty.

(*2) 2009: 105,048-(105,048 ×8,200 ÷ 9,554) / 2008: 105,048-(105,048 ×8,200 ÷ 10,231)

In millions of Won 2009 2008

Dividend amount ₩ 96,999 -

Net income 1,450,260 113,784

Dividends as a percentage of net income 6.69% -

Par value (Won) ₩ 5,000 5,000

Dividends as a percentage of par value 5.00% -

In won 2009 2008

Dividend per share ₩ 250 -

Market price as of year end 20,050 6,550

Dividend yield ratio 1.25% -

In millions of Won 2009 2008

NET INCOME ₩ 1,450,260 113,784

Change in fair value of available-for-sale securities, net of tax (27) 9

Unrealized holding gain on equity method accounted investments, net of tax (17,072) 255,520

Unrealized holding loss on equity method accounted investments, net of tax 77,328 (2,713)

Eective portion of changes in fair value of cash ow hedges, net of tax 11,029 (7,473)

Eective portion of changes resulting from the changes in currency exchange rate of

non-derivative nancial instrument, net of tax 40,734 (99,863)

Revaluation surplus, net of tax (517) 1,005,340

COMPREHENSIVE INCOME ₩ 1,561,735 1,264,604