Kia 2009 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2009 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

REDEFINING

MOBILITY

KIA MOTORS

ANNUAL REPORT

2009

REDEFINING

MOBILITY

KIA MOTORS

ANNUAL REPORT

2009

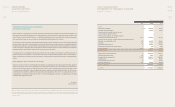

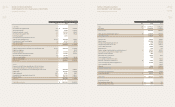

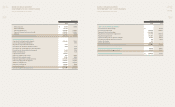

51 Management’s Discussion & Analysis

60 Independent Auditors’ Report

61 Non-Consolidated Statements of Financial Position

63 Non-Consolidated Statements of Income

64 Non-Consolidated Statements of Appropriation of Retained Earnings

65 Non-Consolidated Statements of Changes in Equity

67 Non-Consolidated Statements of Cash Flows

70 Notes to Non-Consolidated Financial Statements

120 Independent Accountants’ Review Report on Internal Accounting Control System

121 Report on the Operations of Internal Accounting Control System

MANAGEMENT’S

DISCUSSION & ANALYSIS

OPERATING REVIEW

The contraction in worldwide auto demand that followed the

onset of the global financial crisis continued throughout 2009.

Vehicle sales remained weak in all major markets, including the

US, Europe and China.

Kia Motors’ export volume for 2009 therefore shrank year-on-

year, due also in part to inventory adjustments at our overseas

lots. Nevertheless, the company’s total ex-factory sales were up

9.6% over 2008, thanks to surging domestic demand. Driven by

favorable tax incentives and a strong response to the launch of

our latest models, sales in Korea recorded 1.142 million units, an

8.1% increase year-on-year.

Our overseas factories sold 392,000 units, up 14.2%. The top-

performing foreign market was China, which recorded a 70.0% rise

in volume to 241,000 units. The European plants, however, posted

a 25.2% fall to 150,000 units, attributable mainly to the extended

economic diculties in Eastern Europe.

Globally, ex-factory sales were up 9.6% in 2009. This rise was

dwarfed by the large increase in retail sales, however, which grew

by 20.1%, and is particularly impressive in light of the widespread

hardships faced by the majority of the world’s automakers last

year.

The economic downturn has been an excellent opportunity for

Kia Motors to improve the company’s brand recognition and

emphasize the high value-for-money oered by our automotive

products. Although our price competitiveness has been eroded

somewhat by the increasing value of the Korean won, we

nonetheless expect the rising sales trend to continue. We have

used the past year to leverage our marketing advantages with

a stronger dealer network and well-prepared launches of new

automobiles. On the operations side, Kia has streamlined its

inventory management while expanding its product line, and is

therefore well-positioned to continue building market share in

this challenging economic environment.

DOMESTIC SALES AND STRATEGIES

Despite serious financial difficulties faced by GM Daewoo and

SsangYong Motor, Kia’s major domestic competitors, the Korean

market posted its strongest annual sales since 2002, recording

a 17.6% rise to 1,465,697 units in 2009. This increase followed

determined measures by the Korean government to support

automakers with consumption tax breaks and favorable tax

treatment for trade-ins of older vehicles. All major domestic

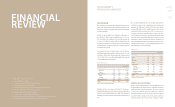

FINANCIAL

REVIEW

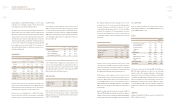

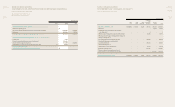

(thousand units)

Ex-factory Sales 2008 2009 Chg (%)

Domestic 315 411 30.5%

Export 741 731 -1.4%

Korean factories 1,056 1,142 8.1%

China 142 241 70.0%

Slovakia 201 150 -25.2%

Overseas factories 343 392 14.2%

Total 1,399 1,534 9.6%

* Figures based on shipment and revenue

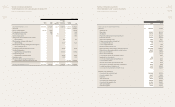

(thousand units)

Retail Sales 2008 2009 Chg (%)

Korea 315 411 30.5%

US 273 300 9.8%

W. Europe 225 242 7.7%

China 142 241 70.0%

Rest of World 419 455 8.7%

Canada 38 46 22.9%

Latin America 77 78 0.6%

E. Europe 110 89 -18.8%

Middle East/ Africa 141 188 33.5%

Asia Pacic 53 54 1.9%

Total 1,375 1,651 20.1%

* W. Europe: EU+EFTA countries

EXFACTORY SALES

RETAIL SALES