Kia 2009 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2009 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

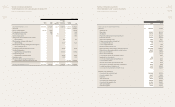

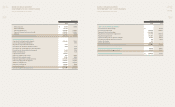

NOTES TO NONCONSOLIDATED

FINANCIAL STATEMENTS

December 31, 2009 and 2008

between the nominal value and the present value of such receivables or payables is amortized using the eective interest method as noted

below. The amount amortized is included in interest expense or interest income.

(n) Foreign Currency Translation

Monetary assets and liabilities denominated in foreign currencies are translated into Korean Won at the rates of exchange on the end of the

reporting period, with the resulting gains or losses recognized in the income statement. Monetary assets and liabilities denominated in foreign

currencies are translated into Korean Won at the rate of exchange on December 31, 2009 as announced by Seoul Money Brokerage Service

Ltd. Non-monetary assets and liabilities denominated in foreign currencies, which are stated at historical cost, are translated into Korean Won

at the foreign exchange rate prevailing on the date of the transaction.

(o) Derivatives and Hedge Accounting

The Company holds derivative nancial instruments to hedge its foreign currency and interest rate risk exposures. Embedded derivatives

are separated from the host contract and accounted for separately if the economic characteristics and risks of the host contract and the

embedded derivative are not closely related, and a separate instrument with the same terms as the embedded derivative would meet the

denition of a derivative.

Derivatives are initially recognized at fair value on the date a derivative contract is entered into and are subsequently remeasured at their fair

value. Attributable transaction costs are recognized in prot or loss when incurred.

HEDGE ACCOUNTING

Where a derivative, which meets certain criteria, is used for hedging the exposure to changes in the fair value of a recognized asset, liability or

rm commitment, it is designated as a fair value hedge. Where a derivative, which meets certain criteria, is used for hedging the exposure to

the variability of the future cash ows of a forecasted transaction it is designated as a cash ow hedge.

The Company documents, at the inception of the transaction, the relationship between hedging instruments and hedged items, as well as its

risk management objective and strategy for undertaking various hedge transactions. The Company also documents its assessment, both at

hedge inception and on an ongoing basis, of whether the derivatives that are used in hedging transactions are highly eective in osetting

the changes in fair values or cash ows of hedged items.

FAIR VALUE HEDGE

Pursuant to the revised SKAS Interpretation 53-70 Accounting for Derivative Instruments, the Company designated non-derivative nancial

instruments as fair value hedging instruments for the year ended December 31, 2008.

Changes in the fair value of derivatives that are designated and qualify as fair value hedges are recorded in the statement of income, together

with any changes in the fair value of the hedged asset or liability that are attributable to the hedged risk.

CASH FLOW HEDGE

Pursuant to the revised SKAS Interpretation 53-70 Accounting for Derivative Instruments, the Company designated non-derivative nancial

instrument as cash ow hedging instruments for the year ended December 31, 2008.

The eective portion of changes in the fair value of derivatives that are designated and qualify as cash ow hedges and changes resulting

from the changes in currency exchange rate are recognized in equity. The gain or loss relating to any ineffective portion is recognized

immediately in the statement of income. Amounts accumulated in equity are recycled to the income statement in the periods in which the

hedged item will aect income or expense. When a hedging instrument expires or is sold, or when a hedge no longer meets the criteria for

hedge accounting, any cumulative gain or loss existing in equity at the time remains in equity and is recognized when the forecast transaction

is ultimately recognized in the statement of income. When a forecast transaction is no longer expected to occur, the cumulative gain or loss

that was reported in equity is immediately transferred to the statement of income.

DERIVATIVES THAT DO NOT QUALIFY FOR HEDGE ACCOUNTING

Changes in the fair value of derivative instruments that are not designated as fair value or cash ow hedges are recognized immediately in the

statement of income.

SEPARABLE EMBEDDED DERIVATIVES

Changes in the fair value of separable embedded derivatives are recognized immediately in the statement of income.

(p) Share-based Payments

The Company has granted shares or share options to its employees and other parties. For equity-settled share-based payment transactions,

the Company measures the goods or services received, and the corresponding increase in equity as a capital adjustment at the fair value of

the goods or services received, unless that fair value cannot be estimated reliably. If the entity cannot estimate reliably the fair value of the

goods or services received, the Company measures their value, and the corresponding increase in equity, indirectly, by reference to the fair

value of the equity instruments granted. If the fair value of the equity instruments cannot be estimated reliably at the measurement date, the

Company measures them at their intrinsic value and recognizes the goods or services received based on the number of equity instruments

that ultimately vest.

For cash-settled share-based payment transactions, the Company measures the goods or services acquired and the liability incurred at the fair

value of the liability. Until the liability is settled, the Company remeasures the fair value of the liability at each reporting date and at the date of

settlement, with changes in fair value recognized in prot or loss for the period.

(q) Provision, Contingent Assets and Contingent Liabilities

Provisions are recognized when all of the following are met: (1) an entity has a present obligation as a result of a past event, (2) it is probable

that an outow of resources embodying economic benets will be required to settle the obligation, and (3) a reliable estimate can be made

of the amount of the obligation. Where the eect of the time value of money is material, a provision is recorded at the present value of the

expenditures expected to be required to settle the obligation.

Where the expenditure required to settle a provision is expected to be reimbursed by another party, the reimbursement is recognized as

a separate asset when, and only when, it is virtually certain that reimbursement will be received if the Company settles the obligation. The

expense relating to a provision is presented net of the amount recognized for a reimbursement.

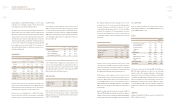

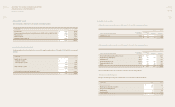

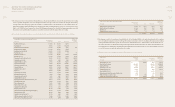

Account Interest rate(%) Period

Long-term accounts receivable – trade* 8.25~8.75 from one to ve years

Long-term accounts receivable - other 4.15 from one to three years

*Current portion of long-term accounts receivable is included in current accounts and notes receivable – trade at present value.

REDEFINING

MOBILITY

KIA MOTORS

ANNUAL REPORT

2009

REDEFINING

MOBILITY

KIA MOTORS

ANNUAL REPORT

2009