Kia 2009 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2009 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

REDEFINING

MOBILITY

KIA MOTORS

ANNUAL REPORT

2009

REDEFINING

MOBILITY

KIA MOTORS

ANNUAL REPORT

2009

NOTES TO NONCONSOLIDATED

FINANCIAL STATEMENTS

December 31, 2009 and 2008

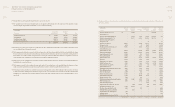

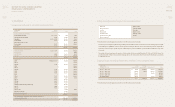

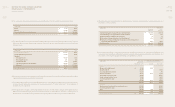

20. PROVISION FOR WARRANTIES

Changes in provision for warranties for the years ended December 31, 2009 and 2008 are summarized as follows:

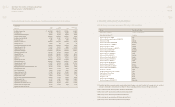

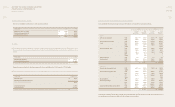

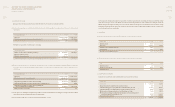

21. RETIREMENT AND SEVERANCE BENEFITS

Changes in retirement and severance benets for the years ended December 31, 2009 and 2008 are summarized as follows:

The Company maintains an employees’ severance benet insurance arrangement with the Samsung Life Insurance Co., Ltd. and others. Under

this arrangement, the Company has made a deposit in the amount equal to 68.90% and 55.97% of the reserve balances of retirement and

severance benets as of December 31, 2009 and 2008, respectively. This deposit is to be used to guarantee the required payments to prior

employees and accounted for as a reduction of the reserve balance.

22. COMMITMENTS AND CONTINGENCIES

(a) The Company provides guarantees for certain customers’ nancing relating to long-term installment sales. The oustanding

amount for which the Company has provided guarantees to the respective financial institutions is ₩17,748 million as of

December 31, 2009. However, these guarantees are covered by insurance contracts in which the Company is the beneciary of

the claim amount if the customer defaults.

(b) As of December 31, 2009, 32 blank checks, 95 blank promissory notes and three promissory notes totaling ₩2,020 million have

been provided as collateral to Standard Chartered First Bank Korea Ltd. and others for the Company’s debts (see notes 15 and 16).

(c) The Company is involved in 24 lawsuits. Claims for alleged damages, which arose in the ordinary course of business, total ₩15,275

million as of December 31, 2009. No provision is recorded as of December 31, 2009. Management is of the opinion that the

foregoing lawsuits and claims will not have a material adverse eect on the Company’s nancial position, operating results or

cash ows.

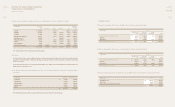

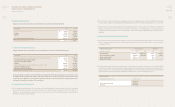

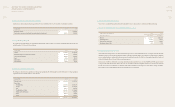

23. DERIVATIVE INSTRUMENTS AND HEDGE ACCOUNTING

(a) The Company has entered into derivative instrument contracts including swaps, forwards, and options to hedge its foreign

currency and interest rate risk exposures. Detail of derivative instrument contracts as of December 31, 2009 and 2008 are

summarized as follows:

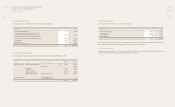

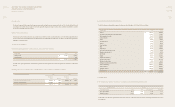

(b) The Company designated foreign currency borrowings and debentures to hedge the cash flow risk associated with a highly

probable forecast transaction. The Company retroactively designated the foreign currency as a hedging instrument pursuant to

the transitional provision as specied in the revised SKAS Interpretation 53-70 (Accounting for Derivatives Instruments). Detail of

designated foreign currency borrowings and debentures as of December 31, 2009 are summarized as follows:

In millions of Won 2009 2008

NET BALANCE AT BEGINNING OF YEAR ₩ 737,063 650,710

Provision 137,030 333,594

Payment (274,963) (247,241)

599,130 737,063

Less current portion of provision warranties (227,515) (290,892)

NET BALANCE AT END OF YEAR ₩ 371,615 446,171

In millions of Won 2009 2008

ESTIMATED RETIREMENT AND SEVERANCE BENEFITS AT BEGINNING OF YEAR ₩ 1,141,712 1,177,013

Accrual for retirement and severance benets 261,166 340,278

Transfer-in from associate companies 452 (629)

Payments (324,878) (374,950)

ESTIMATED RETIREMENT AND SEVERANCE BENEFITS AT END OF YEAR 1,078,452 1,141,712

Transfer to National Pension Fund (7,553) (11,090)

Deposit for severance benet insurance (743,018) (639,012)

NET BALANCE AT DECEMBER 31, 2009 ₩ 327,881 491,610

In thousands of USD, EUR

Designated nancial instrument Contract amount

USD 79,200

Foreign currency borrowings EUR 225,000

Debentures EUR 190,000

In millions of Won, thousands of USD Contract amounts Fair value

Derivative instrument

2009

2008

2009

2008

Interest rate swap KRW 350,000 KRW 350,000 (6,805) (15,797)

Interest rate and currency swaps USD 55,000 USD 115,000 11,829 34,343

foreign currency forward USD 110,000 - 4,205 -

foreign currency option USD 210,000 - 1,757 -