Kia 2009 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2009 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

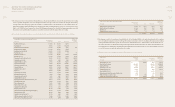

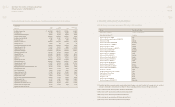

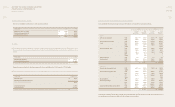

The Company accounted for its all investment by using equity method of accounting based on the unaudited nancial statements as it was

unable to obtain the audited nancial statements and performed procedures to verify the unaudited nancial statements.

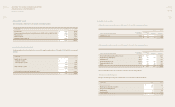

(*1) The cumulative income (losses) and unrealized gains not recognized by the Company due to the suspension of the valuation of equity

securities using the equity method as of December 31, 2008 consist of the following

(*2) Investments in associates are recorded at cost, except where the eect of applying the equity method of accounting for investments on the

non-consolidated nancial statements is material.

(*3) The Company made additional investment in Kia Motors America Inc, Kia Motors Deutschland GmbH and Kia Motors Europe GmbH during

the year. However, as noted above, the equity method was discontinued as the Company’s share of losses exceeded the carrying amount of

the investment. In accordance with the equity method of accounting, the Company’s additional investment is recognized as a decrease of

retained earnings, as the cumulative losses are greater than the Company’s additional investment.

(*4) The Company reclassied equity interest in HMC Investment Securities Co., Ltd. from available-for- sale securities to equity method securities

as the Company and its holding company, Hyundai Motor Company, together own more than 20%.

(*5) Other decrease consists of dividends from associates companies except for Kia Motors Deutschland GmbH, Kia Motors Europe GmbH (as

noted in *3 above) and HMC Investment Securities Co., Ltd. (as noted in *4 above)

(*6) The Company made an adjustment to conform the associates’ accounting policies to those of the Company for like transactions and events in

similar circumstances. Relating to this adjustment, equity in earnings of aliates has been reduced by ₩ 21,103 million and unrealized holding

gain on equity method accounted investments has been increased by ₩ 84,164 million for the year ended December 31, 2008, respectively.

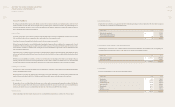

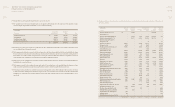

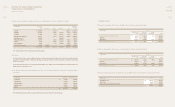

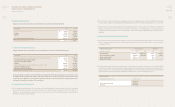

(h) The market price of equity investments in listed associates companies as of December 31, 2009 and 2008 are as follows:

NOTES TO NONCONSOLIDATED

FINANCIAL STATEMENTS

December 31, 2009 and 2008

In millions of Won

Cumulative Unrealized

Company income(losses) gains

Kia Motors America, Inc. ₩ 144,117 (281,009)

Kia Canada Inc. (103,224) (12,604)

Kia Motors Europe GmbH 57,326 (75,895)

Kia Motors Australia Pty Ltd. (63,789) (12,853)

₩ 34,430 (382,361)

In millions of Won

Company

2009 2008

Hyundai Mobis Co., Ltd. ₩ 2,660,439 981,717

Hyundai Hysco Co., Ltd. 188,514 83,102

Hyundai Steel Company 1,570,798 682,798

Hyundai Autonet Co., Ltd. - 51,940

Hyundai Investment Securites Co., Ltd 23,411 7,723

₩ 4,443,162 1,807,280

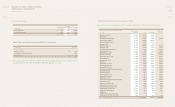

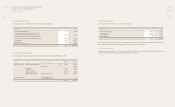

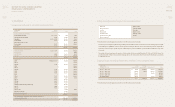

(i) Summarized nancial information of the investees as of and for the year ended December 31, 2009 is as follows:

In millions of Won

Total Total Net income

Company assets liabilities Sales (loss)

Kia Motors America, Inc. ₩ 4,260,207 4,112,141 5,953,234 (139,731)

Kia Canada Inc. 165,035 234,174 1,176,573 41,354

Kia Motors Deutschland GmbH 703,110 618,880 1,302,757 47,035

Kia Motors Europe GmbH 3,078,993 3,502,571 5,701,474 (563,426)

Kia Motors Australia Pty Ltd. 142,702 180,127 433,681 (7,067)

Kia Tigers Co., Ltd. 3,956 4,560 25,492 (33)

Kia Motors Slovakia s.r.o. 2,839,718 2,068,891 2,989,067 46,018

Kia Japan Co., Ltd. 29,252 147 1,376 (22)

Dongfeng Yueda Kia Motors Co., Ltd. 1,941,749 1,334,429 3,800,855 136,279

Haevichi Resort Co., Ltd. 352,379 322,293 49,115 992

Hyundai Mobis Co., Ltd. 11,106,365 3,339,531 10,633,020 1,615,220

Hyundai Steel Company 15,401,749 8,973,935 7,966,444 11,519,970

Hyundai Powertech Co., Ltd. 1,382,198 918,240 1,304,903 39,649

Hyundai WIA Corp. 2,277,700 1,457,510 3,118,249 72,218

Hyundai Card Co., Ltd. 7,352,490 5,857,366 1,840,842 222,391

Dymos Inc. 865,598 561,574 905,926 15,387

Hyundai Hysco Co., Ltd. 2,926,589 1,773,368 4,423,311 54,395

EUKOR Car Carriers, Inc. 2,192,606 1,604,475 2,058,808 68,648

Hyundai AMCO Co.,Ltd. 813,195 405,258 1,081,273 45,428

Beijing Hyundai Mobis Automotive Parts Co., Ltd. 303,319 104,860 375,185 29,335

China Millennium Corp. 117,079 63,311 24,008 4,092

Partecs Company, Ltd. 102,431 56,275 33,569 5,497

Autoever Systems Co., Ltd. 253,567 146,480 537,040 27,217

Hyundai-Motor Group Ltd. 401,462 262,722 1,550,027 71,302

Donghee Auto Co., Ltd. 126,521 95,742 129,513 3,581

WIA Automotive Engine (Shandong) Company 474,755 227,341 231,359 8,968

TRW Steering Co., Ltd. 91,050 68,529 155,218 (279)

Haevichi Country Club., Ltd. 281,392 262,314 11,307 (4,957)

HMC Investment Securities Co., Ltd. 1,922,907 1,349,438 271,440 28,368

The Korea Economic Daily Co., Ltd. 188,058 65,402 118,778 8,578

HMC Win-Win Cooperation Fund 31,011 - 1,335 946

EUKOR Shipowning Singapore Pte. Ltd. 112,251 94,763 33,234 33,177

REDEFINING

MOBILITY

KIA MOTORS

ANNUAL REPORT

2009

REDEFINING

MOBILITY

KIA MOTORS

ANNUAL REPORT

2009