JetBlue Airlines 2008 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2008 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

As of December 31, 2008, excluding the contracts that we effectively exited, all of our outstanding

derivative contracts were designated as cash flow hedges for accounting purposes. While outstanding, these

contracts are recorded at fair value on the balance sheet with the effective portion of the change in their fair

value being reflected in accumulated other comprehensive income (loss). At December 31, 2007, 100% of our

derivative contracts were designated as cash flow hedges for accounting purposes.

We have currently suspended our fuel hedging program and are revising the program in light of current

crude oil prices.

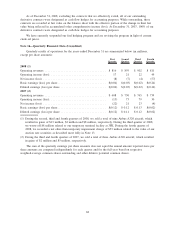

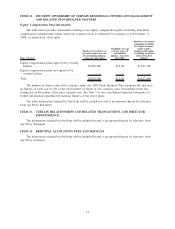

Note 14—Quarterly Financial Data (Unaudited)

Quarterly results of operations for the years ended December 31 are summarized below (in millions,

except per share amounts):

First

Quarter

Second

Quarter

Third

Quarter

Fourth

Quarter

2008 (1)

Operating revenues ...................................... $ 816 $ 859 $ 902 $ 811

Operating income (loss)................................... 17 21 22 49

Net income (loss) ....................................... (8) (7) (4) (57)

Basic earnings (loss) per share .............................. $(0.04) $(0.03) $(0.02) $(0.24)

Diluted earnings (loss) per share ............................ $(0.04) $(0.03) $(0.02) $(0.24)

2007 (2)

Operating revenues ...................................... $ 608 $ 730 $ 765 $ 739

Operating income (loss)................................... (13) 73 79 30

Net income (loss) ....................................... (22) 21 23 (4)

Basic earnings (loss) per share .............................. $(0.12) $ 0.12 $ 0.13 $(0.02)

Diluted earnings (loss) per share ............................ $(0.12) $ 0.11 $ 0.12 $(0.02)

(1) During the second, third and fourth quarters of 2008, we sold a total of nine Airbus A320 aircraft, which

resulted in gains of $13 million, $2 million and $8 million, respectively. During the third quarter of 2008,

we wrote-off $8 million related to our temporary terminal facility at JFK. During the fourth quarter of

2008, we recorded a net other-than-temporary impairment charge of $53 million related to the value of our

auction rate securities as described more fully in Note 13.

(2) During the third and fourth quarters of 2007, we sold a total of three Airbus A320 aircraft, which resulted

in gains of $2 million and $5 million, respectively.

The sum of the quarterly earnings per share amounts does not equal the annual amount reported since per

share amounts are computed independently for each quarter and for the full year based on respective

weighted-average common shares outstanding and other dilutive potential common shares.

68