JetBlue Airlines 2008 Annual Report Download - page 43

Download and view the complete annual report

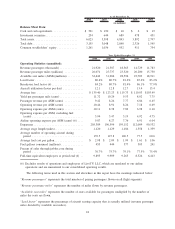

Please find page 43 of the 2008 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(2) During the second, third and fourth quarters, we sold a total of nine aircraft, which resulted in gains of

$13 million, $2 million and $8 million, respectively.

(3) During the third and fourth quarters, we recorded an additional $5 million and $8 million, respectively, in

interest expense related to the early conversion of a portion of our 5.5% convertible debentures due 2038.

Additionally, in the third and fourth quarters, we recognized $12 million and $6 million in interest income

related to the gain on extinguishment of debt, respectively. In the fourth quarter, we recorded a net

other-than-temporary impairment of $53 million related to the write-down in the value of our ARS.

(4) Excludes results of operations and employees of LiveTV, LLC, which are unrelated to our airline

operations and are immaterial to our consolidated operating results.

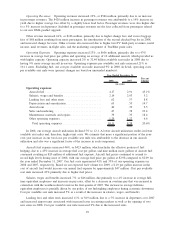

Although we have continued to experience significant revenue growth, this trend may not continue. We

expect our expenses to continue to increase significantly as we acquire additional aircraft, as our fleet ages

and as we expand the frequency of flights in existing markets and enter into new markets. Accordingly, the

comparison of the financial data for the quarterly periods presented may not be meaningful. In addition, we

expect our operating results to fluctuate significantly from quarter to quarter in the future as a result of various

factors, many of which are outside our control. Consequently, we believe that quarter-to-quarter comparisons

of our operating results may not necessarily be meaningful and you should not rely on our results for any one

quarter as an indication of our future performance.

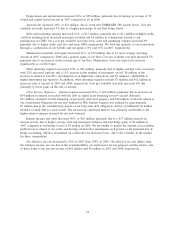

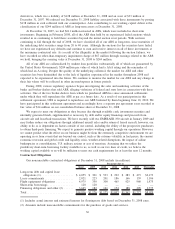

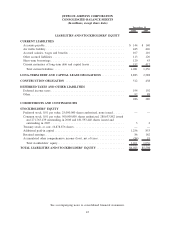

Liquidity and Capital Resources

At December 31, 2008, we had cash and cash equivalents of $561 million, compared to cash and cash

equivalents of $190 million at December 31, 2007. Cash flows used in operating activities totaled $17 million

in 2008 compared to cash flows provided by operating activities of $358 million in 2007 and $274 million in

2006. The $375 million decrease in cash flows from operations in 2008 compared to 2007 was primarily as a

result of a 43% higher price of fuel in 2008 compared to 2007 and the $149 million in collateral we posted for

margin calls related to our outstanding fuel hedge and interest rate swap contracts, offset in part by higher

yields. We also posted $70 million in restricted cash that collateralizes letters of credit issued to certain of our

business partners, including $55 million for our primary credit card processor. Cash flows from operations in

2007 compared to 2006 increased due to the growth of our business. We rely primarily on cash flows from

operations to provide working capital for current and future operations.

At December 31, 2008, we had two lines of credit, totaling $163 million secured by all of our ARS, as

well as one short-term borrowing facility for certain aircraft predelivery deposits. At December 31, 2008, we

had a total of $173 million in borrowings outstanding under these facilities.

Net cash provided by investing and financing activities was $388 million in 2008 compared to net cash

used in investing and financing activities of $178 million in 2007 and $270 million in 2006.

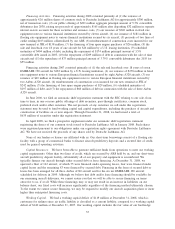

Investing Activities. During 2008, capital expenditures related to our purchase of flight equipment

included expenditures of $587 million for 18 aircraft and four spare engines, $49 million for flight equipment

deposits and $7 million for spare part purchases. Capital expenditures for other property and equipment,

including ground equipment purchases and facilities improvements, were $60 million. Expenditures related to

the construction of our new terminal at JFK totaled $142 million. Net cash provided by the sale of investment

securities was $328 million. Other investing activities included the receipt of $299 million in proceeds from

the sale of nine aircraft.

During 2007, capital expenditures related to our purchase of flight equipment included expenditures of

$531 million for 17 aircraft and four spare engines, $128 million for flight equipment deposits and $12 million

for spare part purchases. Capital expenditures for other property and equipment, including ground equipment

purchases and facilities improvements, were $74 million. Expenditures related to the construction of our new

terminal at JFK totaled $242 million. Net cash provided by the sale of investment securities was $78 million.

Other investing activities included the receipt of $100 million in proceeds from the sale of three Airbus A320

aircraft, the release of $72 million related to restricted cash that collateralized a letter of credit we had posted

in connection with our new terminal lease at JFK and the refund of $12 million in flight equipment deposits

related to aircraft delivery deferrals.

34