JetBlue Airlines 2008 Annual Report Download - page 73

Download and view the complete annual report

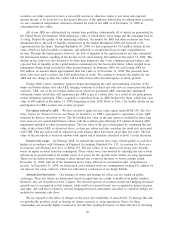

Please find page 73 of the 2008 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.participating airlines. We have purchased a stand alone environmental liability insurance policy to help

mitigate this exposure. Our existing aviation hull and liability policy includes some limited environmental

coverage when a clean up is part of an associated single identifiable covered loss.

Under certain contracts, we indemnify specified parties against legal liability arising out of actions by

other parties. The terms of these contracts range up to 30 years. Generally, we have liability insurance

protecting ourselves for the obligations we have undertaken relative to these indemnities.

On October 10, 2008, the DOT issued its final Congestion Management Rule for JFK and Newark

International Airport. The rule continues caps on the number of scheduled operations that may be conducted

during specific hours and prohibits airlines from conducting operations during those hours without obtaining a

slot (authority to conduct a scheduled arrival or departure). In addition, the rule provides for the confiscation

of 10% of the slots over a five year period currently held by carriers and reallocates them through an auction

process over a five year period. On December 8, 2008, the United States Court of Appeals for the District of

Columbia issued an order temporarily enjoining the auctions from taking place until such time as the court

could rule on the merits of the case challenging the proposed auctions. We are participating in the litigation

challenging the rule, which if ultimately unsuccessful and the auctions are permitted to proceed, would likely

result in our losing a portion of our operating capacity at JFK, which would negatively impact our ability to

fully utilize our new Terminal 5 and may result in increased competition.

LiveTV provides product warranties to third party airlines to which it sells its products and services. We

do not accrue a liability for product warranties upon sale of the hardware since revenue is recognized over the

term of the related service agreements of up to 12 years. Expenses for warranty repairs are recognized as they

occur. In addition, LiveTV has provided indemnities against any claims which may be brought against its

customers related to allegations of patent, trademark, copyright or license infringement as a result of the use

of the LiveTV system. LiveTV customers include other airlines, which may be susceptible to the inherent risks

of operating in the airline industry and/or economic downturns, which may in turn have a negative impact on

our business.

We are unable to estimate the potential amount of future payments under the foregoing indemnities and

agreements.

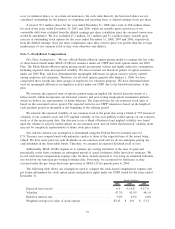

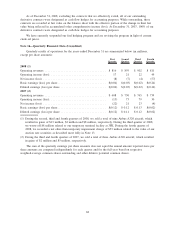

Note 13—Fair Value, Financial Instruments and Risk Management

SFAS 157 requires disclosure about how fair value is determined for assets and liabilities and establishes

a hierarchy for which these assets and liabilities must be grouped, based on significant levels of inputs as

follows:

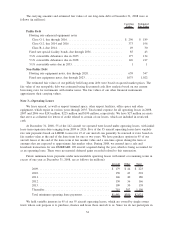

Level 1 quoted prices in active markets for identical assets or liabilities;

Level 2 quoted prices in active markets for similar assets and liabilities and inputs that are

observable for the asset or liability; or

Level 3 unobservable inputs for the asset or liability, such as discounted cash flow models

or valuations.

The determination of where assets and liabilities fall within this hierarchy is based upon the lowest level

of input that is significant to the fair value measurement.

64