JetBlue Airlines 2008 Annual Report Download - page 58

Download and view the complete annual report

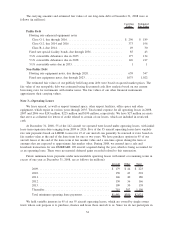

Please find page 58 of the 2008 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.each aircraft was operated during each month or the number of flight hours each engine was operated during

each month, subject to annual escalations. These payments are expensed as the related flight hours or cycles

are incurred.

Advertising Costs: Advertising costs, which are included in sales and marketing, are expensed as

incurred. Advertising expense in 2008, 2007 and 2006 was $52 million, $41 million and $40 million,

respectively.

Loyalty Program: We account for our customer loyalty program, TrueBlue Flight Gratitude, by

recording a liability for the estimated incremental cost for points outstanding and awards we expect to be

redeemed. We adjust this liability, which is included in air traffic liability, based on points earned and

redeemed as well as changes in the estimated incremental costs associated with providing travel.

We also sell points in TrueBlue to third parties. A portion of these point sales is deferred and recognized

as passenger revenue when transportation is provided. The remaining portion, which is the excess of the total

sales proceeds over the estimated fair value of the transportation to be provided, is recognized in other revenue

at the time of sale. Deferred revenue for points not redeemed is recorded upon expiration.

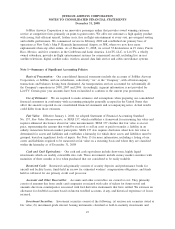

Income Taxes: We account for income taxes utilizing the liability method. Deferred income taxes are

recognized for the tax consequences of temporary differences between the tax and financial statement

reporting bases of assets and liabilities. A valuation allowance for net deferred tax assets is provided unless

realizability is judged by us to be more likely than not. We adopted the provisions of FASB Interpretation

No. 48, Accounting for Uncertainty in Income Taxes-an Interpretation of FASB Statement No. 109, or FIN 48,

on January 1, 2007. Our policy is to recognize interest and penalties accrued on any unrecognized tax benefits

as a component of income tax expense.

Stock-Based Compensation: Effective January 1, 2006, we adopted the provisions of Statement of

Financial Accounting Standards 123(R), Share-Based Payment, and related interpretations, or SFAS 123(R), to

account for stock-based compensation using the modified prospective transition method and therefore did not

restate our prior period results. SFAS 123(R) supersedes Accounting Principles Board Opinion 25, Accounting

for Stock Issued to Employees, or APB 25, and revises guidance in Statement of Financial Accounting

Standards 123, Accounting for Stock-Based Compensation, or SFAS 123. Among other things, SFAS 123(R)

requires that compensation expense be recognized in the financial statements for share-based awards based on

the grant date fair value of those awards. The modified prospective transition method applies to (a) unvested

stock options under our amended and restated 2002 Stock Incentive Plan, or the 2002 Plan, and issuances

under our Crewmember Stock Purchase Plan, as amended, or CSPP, outstanding as of December 31, 2005

based on the grant date fair value estimated in accordance with the pro forma provisions of SFAS 123, and

(b) any new share-based awards granted subsequent to December 31, 2005, based on the grant-date fair value

estimated in accordance with the provisions of SFAS 123(R). Additionally, stock-based compensation expense

includes an estimate for pre-vesting forfeitures and is recognized over the requisite service periods of the

awards on a straight-line basis, which is generally commensurate with the vesting term.

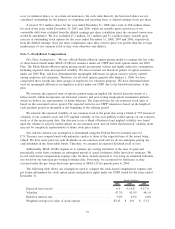

SFAS 123(R) requires the benefits associated with tax deductions in excess of recognized compensation

cost to be reported as a financing cash flow rather than as an operating cash flow as previously required. In

2008, we recorded $1 million in excess tax benefits generated from option exercises and RSU vestings. We

did not record any excess tax benefit generated from option exercises in 2007 or 2006.

Our policy is to issue new shares for purchases under our CSPP and issuances under our 2002 Plan.

New Accounting Standards:

In May 2008, the Financial Accounting Standards Board, or FASB, issued FSP APB 14-1, Accounting for

Convertible Debt Instruments That May Be Settled In Cash upon Conversion (Including Partial Cash

Settlement), which applies to all convertible debt instruments that have a “net settlement feature”, which

means instruments that by their terms may be settled either wholly or partially in cash upon conversion. Under

FSP APB 14-1, the liability and equity components of convertible debt instruments that may be settled wholly

or partially in cash upon conversion must be accounted for separately in a manner reflective of their issuer’s

nonconvertible debt borrowing rate. Previous guidance provided for accounting of this type of convertible debt

49