JetBlue Airlines 2008 Annual Report Download - page 62

Download and view the complete annual report

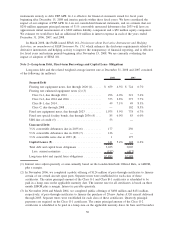

Please find page 62 of the 2008 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.value of capital leases of $141 million with a current portion of $7 million and a long-term portion of

$134 million.

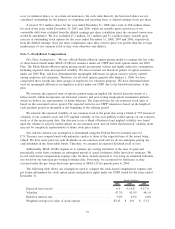

Maturities of long-term debt and capital leases, including the assumption that our convertible debt will be

converted upon the first put date, for the next five years are as follows (in millions):

2009 ............................................. $152

2010 ............................................. 388

2011 ............................................. 160

2012 ............................................. 161

2013 ............................................. 361

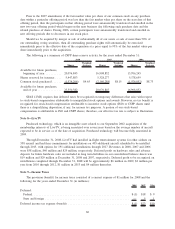

We currently utilize a funding facility to finance aircraft predelivery deposits. This facility allows for

borrowings of up to $30 million, of which $20 million was unused as of December 31, 2008. Commitment

fees are 0.6% per annum on the average unused portion of the facility. The weighted average interest rate on

these outstanding short-term borrowings at December 31, 2008 and 2007 was 5.6% and 6.7%, respectively.

In July 2008, we obtained a line of credit with Citigroup Global Markets, Inc. which allows for

borrowings of up to $110 million through July 20, 2009. Advances under this agreement bear interest at the

rate of Open Federal Funds rate plus 2.30%. This line of credit is secured by $227 million par value of our

auction rate securities, or ARS, being held by Citigroup, with total borrowings available subject to reduction

should any of the collateral be sold, or should there be a significant drop in the fair value of the underlying

collateral. Advances may be used to fund working capital requirements, capital expenditures or other general

corporate purposes, except that they may not be used to purchase any securities or to refinance any debt. We

have provided various representations, warranties and other covenants, including a covenant to maintain at

least $300 million in cash and cash equivalents throughout the term of the agreement. The agreement also

contains customary events of default. Upon the occurrence of an event of default, the outstanding obligations

under the agreement may be accelerated and become due and payable immediately. In connection with this

agreement, we agreed to release the lender from certain potential claims related to our ARS in certain

specified circumstances. At December 31, 2008, the entire $110 million was outstanding on this line of credit.

At December 31, 2008, we were in compliance with the covenants of all our debt and lease agreements.

We are subject to certain collateral ratio requirements in our spare parts pass-through certificates and spare

engine financing issued in November 2006 and December 2007, respectively. If we fail to maintain these

collateral ratios, we will be required to provide additional collateral or redeem some or all of the equipment

notes so that the ratios return to compliance.

In 2008, we received $299 million related to the sale of nine owned aircraft and repaid $210 million in

associated debt. Aircraft, engines, predelivery deposits and other equipment and facilities having a net book

value of $3.32 billion at December 31, 2008 were pledged as security under various loan agreements. Cash

payments of interest, net of capitalized interest, aggregated $166 million, $175 million and $133 million in

2008, 2007 and 2006, respectively.

53