JetBlue Airlines 2008 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2008 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

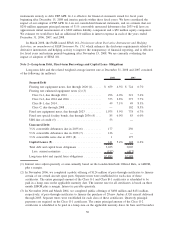

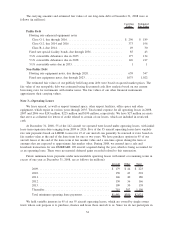

2006

CSPP

Expected term (years) ............................................ 0.5-2.0

Volatility ...................................................... 44.5%

Risk-free interest rate ............................................ 5.0%

Weighted average fair value of purchase rights .......................... $ 3.75

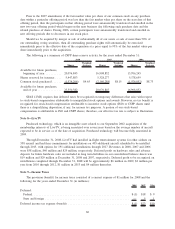

Unrecognized stock-based compensation expense was approximately $24 million as of December 31,

2008, relating to a total of two million unvested restricted stock units and five million unvested stock options

under our 2002 Plan. We expect to recognize this stock-based compensation expense over a weighted average

period of approximately two years. The total fair value of stock options vested during the years ended

December 31, 2008, 2007 and 2006 was approximately $9 million, $6 million and $2 million, respectively.

Stock Incentive Plan: The 2002 Plan, which includes stock options issued during 1999 through 2001

under a previous plan as well as all options issued since, provides for incentive and non-qualified stock

options and restricted stock units to be granted to certain employees and members of our Board of Directors,

as well as deferred stock units to be granted to members of our Board of Directors. The 2002 Plan became

effective following our initial public offering in April 2002.

During 2007, we began issuing restricted stock units under the 2002 Plan. These awards will vest in

annual installments over three years or upon the occurrence of a change in control as defined in the 2002 Plan.

Our policy is to grant restricted stock units based on the market price of the underlying common stock on the

date of grant.

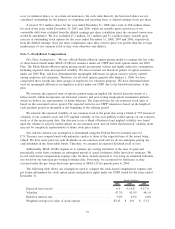

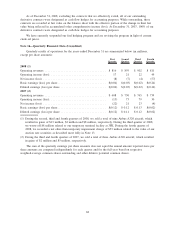

The following is a summary of restricted stock unit activity for the year ended December 31, 2008:

Shares

Weighted

Average

Grant Date

Fair Value

Nonvested at beginning of year ................................. 71,418 $10.42

Granted ................................................... 1,799,849 6.12

Vested .................................................... (23,805) 10.42

Forfeited .................................................. (111,791) 6.35

Nonvested at end of year ...................................... 1,735,671 $ 6.22

During 2008, we also began issuing deferred stock units under the 2002 Plan. These awards will vest

immediately upon being granted to members of the Board of Directors. During the year ended December 31,

2008, we granted 70,000 deferred stock units at a weighted average grant date fair value of $5.00, all of which

remain outstanding at December 31, 2008.

Prior to January 1, 2006, stock options under the 2002 Plan became exercisable when vested, which

occurred in annual installments of three to seven years. For issuances under the 2002 Plan beginning in 2006,

we revised the vesting terms so that all options granted vest in equal installments over a period of three or five

years, or upon the occurrence of a change in control. All options issued under the 2002 Plan expire ten years

from the date of grant. Our policy is to grant options with an exercise price equal to the market price of the

underlying common stock on the date of grant.

58