JetBlue Airlines 2008 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2008 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Financing Activities. Financing activities during 2008 consisted primarily of (1) the issuance of

approximately 42.6 million shares of common stock to Deutsche Lufthansa AG for approximately $300 million,

net of transaction costs, (2) our public offering of $201 million aggregate principal amount of 5.5% convertible

debentures due 2038, raising net proceeds of approximately $165 million after depositing $32 million in separate

interest escrow accounts for these securities and issuance costs, (3) our issuance of $340 million in fixed rate

equipment notes to various financial institutions secured by eleven aircraft, (4) our issuance of $181 million in

floating rate equipment notes to various financial institutions secured by six aircraft, (5) proceeds of two lines of

credit totaling $163 million collateralized by our ARS, (6) reimbursement of construction costs incurred for our

new terminal at JFK of $138 million, (7) the financing of four spare engine purchases of $26 million, (8) the

sale and leaseback over 18 years of one aircraft for $26 million by a U.S. leasing institution, (9) scheduled

maturities of $404 million of debt, including the repayment of $174 million principal amount of 3.5%

convertible debt issued in 2003, (10) the repayment of $209 million of debt in connection with the sale of nine

aircraft and (11) the repurchase of $73 million principal amount of 3.75% convertible debentures due 2035 for

$55 million.

Financing activities during 2007 consisted primarily of (1) the sale and leaseback over 18 years of seven

EMBRAER 190 aircraft for $183 million by a U.S. leasing institution, (2) our issuance of $278 million in fixed

rate equipment notes to various European financial institutions secured by eight Airbus A320 aircraft, (3) our

issuance of $69 million in floating rate equipment notes to various European financial institutions secured by

two Airbus A320 aircraft, (4) reimbursement of construction costs incurred for our new terminal at JFK of

$242 million, (5) the financing of four spare engine purchases of $29 million, (6) scheduled maturities of

$197 million of debt, and (7) the repayment of $68 million of debt in connection with the sale of three Airbus

A320 aircraft.

In June 2006, we filed an automatic shelf registration statement with the SEC relating to our sale, from

time to time, in one or more public offerings of debt securities, pass-through certificates, common stock,

preferred stock and/or other securities. The net proceeds of any securities we sell under this registration

statement may be used to fund working capital and capital expenditures, including the purchase of aircraft and

construction of facilities on or near airports. Through December 31, 2008, we had issued a total of

$635 million of securities under this registration statement.

In April 2008, we filed a prospectus supplement under our automatic shelf registration statement

registering the shares of our common stock issued to Deutsche Lufthansa AG in January 2008. Such shares

were registered pursuant to our obligations under our registration rights agreement with Deutsche Lufthansa

AG. We have not received the proceeds of any shares sold by Deutsche Lufthansa AG.

None of our lenders or lessors are affiliated with us. Our short-term borrowings consist of a floating rate

facility with a group of commercial banks to finance aircraft predelivery deposits and a secured line of credit,

used for general operating activities.

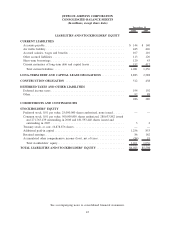

Capital Resources. We have been able to generate sufficient funds from operations to meet our working

capital requirements. Other than two lines of credit, which are secured by ARS held by us, and our short-term

aircraft predelivery deposit facility, substanitally all of our property and equipment is encumbered. We

typically finance our aircraft through either secured debt or lease financing. At December 31, 2008, we

operated a fleet of 142 aircraft, of which 55 were financed under operating leases, four were financed under

capital leases and the remaining 83 were financed by secured debt. Financing in the form of secured debt or

leases has been arranged for all three Airbus A320 aircraft and for the six net EMBRAER 190 aircraft

scheduled for delivery in 2009. Although we believe that debt and/or lease financing should be available for

our remaining aircraft deliveries, we cannot assure you that we will be able to secure financing on terms

attractive to us, if at all. While these financings may or may not result in an increase in liabilities on our

balance sheet, our fixed costs will increase significantly regardless of the financing method ultimately chosen.

To the extent we cannot secure financing, we may be required to modify our aircraft acquisition plans or incur

higher than anticipated financing costs.

Working Capital. We had a working capital deficit of $119 million at December 31, 2008, which is

customary for airlines since air traffic liability is classified as a current liability, compared to a working capital

deficit of $140 million at December 31, 2007. Our working capital includes the fair value of our fuel hedge

35