JetBlue Airlines 2008 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2008 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

Overview

We are an airline that provides award-winning customer service primarily on point-to-point routes at

competitive fares. Our value proposition includes operating a young, fuel efficient fleet with more legroom

than any other domestic airline’s coach product, free in-flight entertainment, pre-assigned seating, unlimited

snacks, and the airline industry’s only Customer Bill of Rights. At December 31, 2008, we served 52

destinations in 19 states, Puerto Rico, and five countries in the Caribbean and Latin America, and operated

over 600 flights a day with a fleet of 107 Airbus A320 aircraft and 35 EMBRAER 190 aircraft.

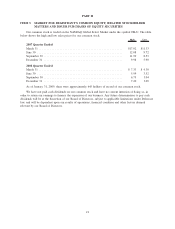

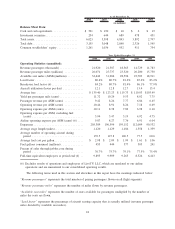

In 2008, we reported a net loss of $76 million and an operating margin of 3.2%, compared to net income

of $18 million and an operating margin of 6.0% in 2007. The year-over-year decline in our financial

performance was primarily a result of a 43% increase in our realized fuel price and a net $53 million

impairment charge related to the write-down of our auction rate securities, or ARS, which was mitigated in

part by continued modifications to our growth plans and increased focus on revenue initiatives. Financial

institutions in the U.S. and around the world were, and continue to be, severely impacted by the ongoing

credit and liquidity crisis. The significant distress experienced by financial institutions has had, and may

continue to have, far reaching adverse consequences across many industries, including the airline industry.

Our disciplined growth strategy begins with managing the growth, size and age of our fleet. In 2008, in

response to continuing high fuel prices and the uncertain economic conditions, we continued to carefully

manage the size of our fleet. We modified our Airbus A320 purchase agreement twice, resulting in the deferral

of 37 aircraft previously scheduled for delivery between 2009 and 2011 to 2012 and 2015. We also modified

our EMBRAER 190 purchase agreement, deferring delivery of ten EMBRAER 190 aircraft previously

scheduled for delivery between 2009 and 2011 to 2016. We increased the size of our A320 operating fleet by

three net aircraft during the year, through the purchase of 12 new aircraft offset by the sale of nine of our

older aircraft. Our EMBRAER 190 operating fleet increased by a total of five net aircraft during the year,

through the acquisition of seven new aircraft offset by our leasing of two aircraft to another airline. We sold

two EMBRAER 190 aircraft in January 2009. We may further slow our fleet growth through additional

aircraft sales, leasing of aircraft, returns of leased aircraft and/or deferral of aircraft deliveries.

Our growth in 2008 was achieved largely through adding more flights to existing routes and new routes

between existing destinations. Additionally, we shifted some of our transcontinental capacity to other routes,

primarily Caribbean routes. We added only two new destinations in 2008, compared to the five that were

added in 2007 and 16 that were added in 2006. In 2008, we closed our operations in Nashville, TN,

Columbus, OH, Tucson, AZ and Ontario, CA, which allowed us to redeploy aircraft to more profitable routes.

In 2009, we plan to continue to focus on adding service between existing destinations and rational growth in

the number of new destinations, including the January 2009 addition of Bogotá, Colombia, the March 2009

addition of San José, Costa Rica, the May 2009 addition of Montego Bay, Jamaica, and the June 2009

addition of Los Angeles, CA.

In January 2008, we issued and sold approximately 42.6 million shares of our common stock to Deutsche

Lufthansa AG for approximately $300 million, net of transaction costs. Following the consummation of this

transaction, Deutsche Lufthansa AG owned approximately 19% of our total outstanding shares of common

stock. In addition to providing us much needed financial flexibility, we believe that this investment by one of

the most highly respected leaders and most recognized brands in the global airline industry to be an

affirmation of the JetBlue brand and business model.

On October 22, 2008, we opened our new 26-gate terminal at JFK’s Terminal 5. Adjacent to this terminal

is a 1,500 space parking structure and access to the AirTrain via a connection bridge. We believe that this new

terminal with its modern amenities, concession offerings and passenger convenience will become as integral to

our customers’ JetBlue Experience as our in-flight entertainment systems.

Airlines operating in the New York metropolitan area airspace faced another difficult year in 2008. As a

result of 2007 being one of the worst years on record for flight delays, the DOT limited the number of flights

in and out of JFK during 2008. Despite this effort to alleviate congestion in the nation’s largest travel market,

26