JetBlue Airlines 2008 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2008 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

aircraft fuel prices to provide some short-term protection against a sharp increase in average fuel prices. The

fair values of our derivative instruments are estimated through the use of standard option value models and/or

present value methods with underlying assumptions based on prices observed in commodity futures markets.

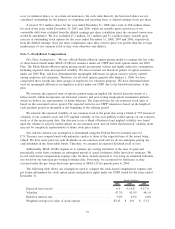

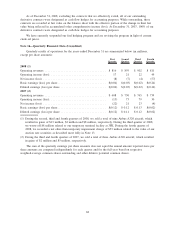

The following is a summary of our derivative contracts (in millions, except as otherwise indicated):

2008 2007

At December 31:

Fair value of fuel derivative instruments at year end ........................... $(128) $ 33

Longest remaining term (months) ........................................ 12 9

Hedged volume (barrels) ............................................... 870 1,506

2008 2007 2006

Year ended December 31:

Hedge effectiveness net gains (losses) recognized in aircraft fuel expense........... $48 $35 $(4)

Hedge ineffectiveness net gains recognized in other income (expense) ............. 4 5 —

Other fuel derivative net losses recognized in other income (expense) ............. — — (5)

Percentage of actual consumption economically hedged ........................ 38% 59% 64%

Ineffectiveness results when the change in the total fair value of the derivative instrument does not

exactly equal the change in the value of our expected future cash outlays for the purchase of aircraft fuel. To

the extent that the periodic changes in the fair value of the hedging instruments are not effective, the

ineffectiveness is recognized in other income (expense) immediately. Likewise, if a hedge ceases to qualify for

hedge accounting, those periodic changes in the fair value of the derivative instruments are recognized in other

income (expense) in the period of the change. When aircraft fuel is consumed and the related derivative

contract settles, any gain or loss previously deferred in other comprehensive income is recognized in aircraft

fuel expense.

Any outstanding derivative instruments expose us to credit loss in the event of nonperformance by the

counterparties to the agreements, but we do not expect that any of our three counterparties will fail to meet

their obligations. The amount of such credit exposure is generally the fair value of our outstanding contracts.

To manage credit risks, we select counterparties based on credit assessments, limit our overall exposure to any

single counterparty and monitor the market position with each counterparty. Some of our agreements require

cash deposits if market risk exposure exceeds a specified threshold amount. We do not use derivative

instruments for trading purposes.

In accordance with our fuel hedging agreements our counterparties may require us to fund all, or a

portion of, our loss position on these contracts. The amount of margin, if any, is periodically adjusted based

on the fair value of the fuel hedge contracts. At December 31, 2008, we had posted cash collateral with our

counterparties totaling $117 million for our 2009 contracts, which was reflected as a reduction of our fuel

hedge liability.

Due to the decline in fuel prices during the fourth quarter, we began selling swap contracts to the same

fuel counterparties covering a majority of our fourth quarter 2008 swap contracts and all of our 2009 swap

contracts, effectively capping our losses related to further oil price declines. As of December 31, 2008, we

have effectively exited all of our open swap contracts by entering into reverse swap sales with the same

counterparties for the same quantity and duration of our existing swap contracts. The forecasted fuel

consumption, for which these transactions were designated as cash flow hedges, is still expected to occur;

therefore, amounts deferred in other comprehensive income related to these contracts will remain deferred

until the forecasted fuel consumption occurs. As of December 31, 2008, we had deferred $93 million of losses

in other comprehensive income associated with these contracts.

67