JetBlue Airlines 2008 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2008 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Colombia in January 2009 and is scheduled to begin service to San Jose, Costa Rica in March 2009 and

Montego Bay, Jamaica in May 2009. To the extent we seek to provide air transportation to additional

international markets in the future, we will be required to obtain necessary authority from the DOT and the

applicable foreign government.

Foreign Ownership. Under federal law and the DOT regulations, we must be controlled by

United States citizens. In this regard, our president and at least two-thirds of our board of directors must be

United States citizens and not more than 24.99% of our outstanding common stock may be voted by

non-U.S. citizens. We believe that we are currently in compliance with these ownership provisions.

Other Regulations. All air carriers are also subject to certain provisions of the Communications Act of

1934 because of their extensive use of radio and other communication facilities, and are required to obtain an

aeronautical radio license from the FCC. To the extent we are subject to FCC requirements, we will take all

necessary steps to comply with those requirements. Our labor relations are covered under Title II of the

Railway Labor Act of 1926 and are subject to the jurisdiction of the National Mediation Board. In addition,

during periods of fuel scarcity, access to aircraft fuel may be subject to federal allocation regulations. We are

also subject to state and local laws and regulations at locations where we operate and the regulations of

various local authorities that operate the airports we serve.

Civil Reserve Air Fleet. We are a participant in the Civil Reserve Air Fleet Program which permits the

United States Department of Defense to utilize our aircraft during national emergencies when the need for

military airlift exceeds the capability of military aircraft. By participating in this program, we are eligible to

bid on and be awarded peacetime airlift contracts with the military.

ITEM 1A. RISK FACTORS

Risks Related to JetBlue

We operate in an extremely competitive industry.

The domestic airline industry is characterized by low profit margins, high fixed costs and significant price

competition. We currently compete with other airlines on all of our routes. Many of our competitors are larger

and have greater financial resources and name recognition than we do. Following our entry into new markets

or expansion of existing markets, some of our competitors have chosen to add service or engage in extensive

price competition. Unanticipated shortfalls in expected revenues as a result of price competition or in the

number of passengers carried would negatively impact our financial results and harm our business. The

extremely competitive nature of the airline industry could prevent us from attaining the level of passenger

traffic or maintaining the level of fares required to maintain profitable operations in new and existing markets

and could impede our growth strategy, which would harm our business. Additionally, if a traditional network

airline were to fully develop a low cost structure, or if we were to experience increased competition from low

cost carriers, our business could be materially adversely affected.

Our business is highly dependent on the price and availability of fuel.

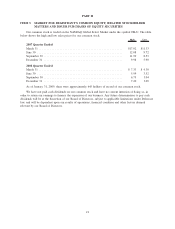

Our results of operations are heavily impacted by the price and availability of fuel. Fuel costs, which

increased significantly in 2007 and 2008, comprise a substantial portion of our total operating expenses and

fuel has been our single largest operating expense since 2005. Our 2008 average fuel price, including the

impact of fuel hedging, has nearly doubled since 2005, which has adversely affected our operating results.

Moreover, crude oil and fuel prices have become quite volatile, with the spot price of crude oil dropping over

75% at the end of the fourth quarter from the historic high observed in the early part of the third quarter of

2008. Historically, fuel costs have been subject to wide price fluctuations based on geopolitical factors and

supply and demand. The availability of fuel is not only dependent on crude oil, but also refining capacity.

When even a small amount of the domestic or global oil refining capacity becomes unavailable, supply

shortages can result for extended periods of time. The availability of fuel is also affected by demand for home

heating oil, gasoline and other petroleum products, as well as crude oil reserves, dependence on foreign

imports of crude oil and potential hostilities in oil producing areas of the world. Because of the effects of

these factors on the price and availability of fuel, the cost and future availability of fuel cannot be predicted

with any degree of certainty.

11