JetBlue Airlines 2008 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2008 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

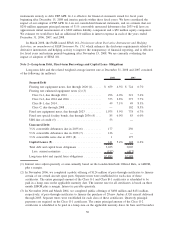

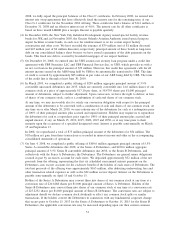

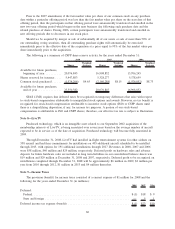

The carrying amounts and estimated fair values of our long-term debt at December 31, 2008 were as

follows (in millions):

Carrying

Value

Estimated

Fair Value

Public Debt

Floating rate enhanced equipment notes

Class G-1, due through 2016.................................. $ 296 $ 189

Class G-2, due 2014 and 2016 ................................ 373 196

Class B-1, due 2014 . . . ..................................... 49 30

Fixed rate special facility bonds, due through 2036 ................... 85 43

33⁄4% convertible debentures due in 2035 .......................... 177 134

51⁄2% convertible debentures due in 2038 .......................... 126 217

31⁄2% convertible notes due in 2033............................... 1 1

Non-Public Debt

Floating rate equipment notes, due through 2020 ..................... 659 547

Fixed rate equipment notes, due through 2023....................... 1,075 1,022

The estimated fair values of our publicly held long-term debt were based on quoted market prices. The

fair value of our non-public debt was estimated using discounted cash flow analysis based on our current

borrowing rates for instruments with similar terms. The fair values of our other financial instruments

approximate their carrying values.

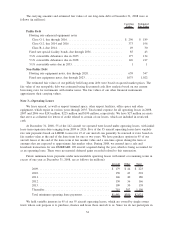

Note 3—Operating Leases

We lease aircraft, as well as airport terminal space, other airport facilities, office space and other

equipment, which expire in various years through 2035. Total rental expense for all operating leases in 2008,

2007 and 2006 was $243 million, $225 million and $190 million, respectively. We have $27 million in assets

that serve as collateral for letters of credit related to certain of our leases, which are included in restricted

cash.

At December 31, 2008, 55 of the 142 aircraft we operated were leased under operating leases, with initial

lease term expiration dates ranging from 2009 to 2026. Five of the 55 aircraft operating leases have variable

rate rent payments based on LIBOR. Leases for 47 of our aircraft can generally be renewed at rates based on

fair market value at the end of the lease term for one or two years. We have purchase options in 45 of our

aircraft leases at the end of the lease term at fair market value and a one-time option during the term at

amounts that are expected to approximate fair market value. During 2008, we entered into a sale and

leaseback transaction for one EMBRAER 190 aircraft acquired during the year, which is being accounted for

as an operating lease. There were no material deferred gains recorded related to this transaction.

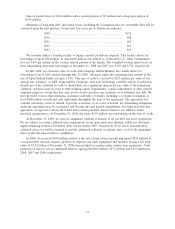

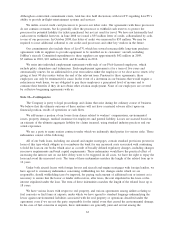

Future minimum lease payments under noncancelable operating leases with initial or remaining terms in

excess of one year at December 31, 2008, are as follows (in millions):

Aircraft Other Total

2009............................................ $ 179 $ 44 $ 223

2010............................................ 158 43 201

2011............................................ 146 40 186

2012............................................ 130 36 166

2013............................................ 109 30 139

Thereafter ........................................ 719 387 1,106

Total minimum operating lease payments................. $1,441 $580 $2,021

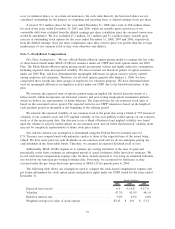

We hold variable interests in 45 of our 55 aircraft operating leases, which are owned by single owner

trusts whose sole purpose is to purchase, finance and lease these aircraft to us. Since we do not participate in

54