JetBlue Airlines 2008 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2008 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

periods in which the related temporary differences will become deductible. At December 31, 2008, we

provided a $26 million valuation allowance, $21 million of which relates to an unrealized tax capital loss on

investment securities, to reduce the deferred tax assets to an amount that we consider is more likely than not

to be realized.

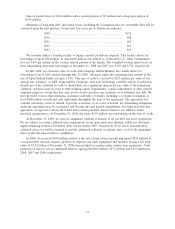

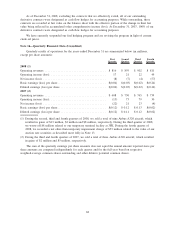

A reconciliation of the beginning and ending amount of unrecognized tax benefits is as follow

(in millions):

Unrecognized tax benefits December 31, 2007 .............................. $2

Increases for tax positions taken during the current period...................... 6

Unrecognized tax benefits December 31, 2008 .............................. $8

Interest and penalties accrued on unrecognized tax benefits were not significant. If recognized, $7 million

of the unrecognized tax benefits at December 31, 2008 would impact the effective tax rate. We do not expect

any significant change in the amount of these unrecognized tax benefits within the next twelve months. As a

result of NOLs and statute of limitations in our major tax jurisdictions, years 2000 through 2008 remain

subject to examination by the relevant tax authorities.

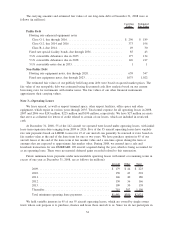

Note 10—Employee Retirement Plan

We sponsor a retirement savings 401(k) defined contribution plan, or the Plan, covering all of our

employees. In 2008, we matched 100% of our employee contributions up to 5% of their compensation in cash,

which vests over five years of service measured from an employees hire date. Prior to 2007, the Company

match was up to 3% of employee contributions. Participants are immediately vested in their voluntary

contributions.

A component of the Plan is a profit sharing retirement plan. In 2007, we amended the profit sharing

retirement plan to provide for Company contributions, subject to Board of Director approval, to be 5% of

eligible non-management employee compensation or 15% of pre-tax earnings, whichever is greater. Prior to

the 2007 amendment, we contributed 15% of our pre-tax earnings, adjusted for stock option compensation

expense, which was distributed on a pro rata basis based on employee compensation. These contributions vest

immediately. Our contributions expensed for the Plan in 2008, 2007 and 2006 were $43 million, $39 million

and $13 million, respectively.

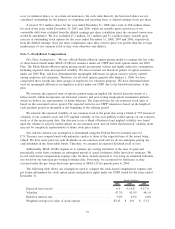

Note 11—Commitments

As of December 31, 2008, our firm aircraft orders consisted of 58 Airbus A320 aircraft, 70 EMBRAER

190 aircraft and 21 spare engines scheduled for delivery through 2016. Committed expenditures for these

aircraft and related flight equipment, including estimated amounts for contractual price escalations and

predelivery deposits, will be approximately $350 million in 2009, $300 million in 2010, $465 million in 2011,

$925 million in 2012, $960 million in 2013 and $1.98 billion thereafter. We have options to purchase 22

Airbus A320 aircraft scheduled for delivery from 2011 through 2015 and 86 EMBRAER 190 aircraft

scheduled for delivery from 2010 through 2015. Debt or lease financing has been arranged for all of our three

Airbus A320 and for all of our six net EMBRAER 190 aircraft scheduled for delivery in 2009. However, there

is no associated recourse with the committed financing in the event the financial institution providing this

financing fails to perform as anticipated.

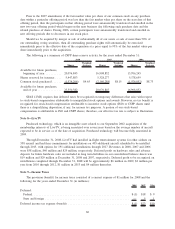

In September 2008, we announced the long-term lease of two of our owned EMBRAER 190 aircraft that

have since been delivered to Azul Linhas Ae’reas Brasileiras, SA, or Azul, a new airline founded by David

Neeleman, our former CEO and Chairman of the Board. One aircraft was leased in September and the other

leased in October, each with a lease term of 12 years. Under the terms of these leases, we recorded

approximately $2 million in rental income during 2008. Future lease payments due to us over the next five

years are approximately $6 million per year. Additionally, in September 2008, we executed, and subsequently

amended, a purchase agreement relating to the sale of two new EMBRAER 190 aircraft scheduled for initial

delivery to us in the first quarter of 2009. The subsequent sales of these aircraft to a third party occurred

immediately after such aircraft were received by us in January 2009. We understand that these two

EMBRAER 190 aircraft are being operated by Azul, in addition to the two leased aircraft described above.

62