JetBlue Airlines 2008 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2008 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

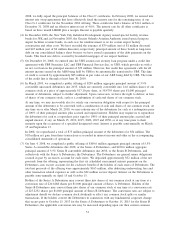

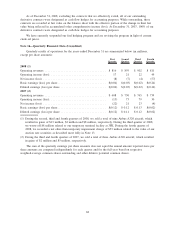

The effective tax rate on income (loss) before income taxes differed from the federal income tax statutory

rate for the years ended December 31 for the following reasons (in millions):

2008 2007 2006

Income tax expense (benefit) at statutory rate . . ............................... $(27) $14 $ 3

Increase (decrease) resulting from:

State income tax, net of federal benefit.................................... (4) 3 —

Stock-based compensation ............................................. 1 3 4

Non-deductible meals ................................................ 2 2 2

Non-deductible costs ................................................. 4 — —

Valuation allowance .................................................. 23 — 1

Other, net ......................................................... 1 1 —

Total income tax expense (benefit) ......................................... $— $23 $10

There were no cash payments for income taxes in 2008, 2007 and 2006.

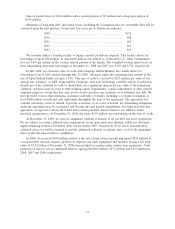

The net deferred taxes below include a current net deferred tax asset of $110 million and a long-term net

deferred tax liability of $194 million at December 31, 2008, and a current net deferred tax asset of

$41 million and a long-term net deferred tax liability of $192 million at December 31, 2007.

The components of our deferred tax assets and liabilities as of December 31 are as follows (in millions):

2008 2007

Deferred tax assets:

Net operating loss carryforwards .................................... $213 $231

Employee benefits ............................................... 23 18

Deferred revenue ................................................ 60 38

Derivative instruments ............................................ 54 —

Investment securities ............................................. 21 —

Other. . ....................................................... 24 41

Valuation allowance .............................................. (26) (3)

Deferred tax assets ............................................. 369 325

Deferred tax liabilities:

Accelerated depreciation .......................................... (453) (463)

Other. . ....................................................... — (13)

Deferred tax liabilities .......................................... (453) (476)

Net deferred tax liability ............................................ $ (84) $(151)

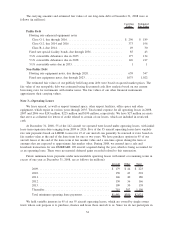

At December 31, 2008, we had U.S. Federal regular and alternative minimum tax net operating loss

(“NOL”) carryforwards of $576 million and $452 million, respectively, which begin to expire in 2022. In

addition, at December 31, 2008, we had deferred tax assets associated with state NOL and credit

carryforwards of $20 million and $4 million, respectively. The state NOLs begin to expire in 2011 through

2022, while the credits carryforward indefinitely. Our NOL carryforwards at December 31, 2008, include an

unrecorded benefit of approximately $9 million related to stock-based compensation that will be recorded in

equity when, and to the extent, realized. Section 382 of the Internal Revenue Code imposes limitations on a

corporation’s ability to use its NOL carryforwards if it experiences an “ownership change”. As of

December 31, 2008, our valuation allowance did not include any amounts attributable to this limitation;

however, if an “ownership change” were to occur in the future, the ability to use our NOLs could be limited.

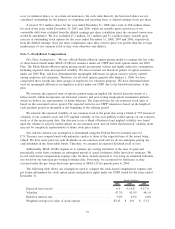

In evaluating the realizability of the deferred tax assets, management assesses whether it is more likely

than not that some portion, or all, of the deferred tax assets, will be realized. Management considers, among

other things, the generation of future taxable income (including reversals of deferred tax liabilities) during the

61