JetBlue Airlines 2008 Annual Report Download - page 75

Download and view the complete annual report

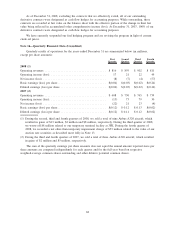

Please find page 75 of the 2008 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.securities are either expected to have a successful auction or otherwise return to par value and expected

interest income to be received over this period. Because of the inherent subjectivity in valuing these securities,

we also considered independent valuations obtained for each of our ARS as of December 31, 2008 in

estimating their fair values.

All of our ARS are collateralized by student loan portfolios (substantially all of which are guaranteed by

the United States Government), $284 million par value of which had a AAA rating and the remainder had an

A rating. Despite the quality of the underlying collateral, the market for ARS and other securities has been

diminished due to the lack of liquidity experienced in the market throughout 2008 and expected to be

experienced into the future. Through September 30, 2008, we had experienced a $13 million decline in fair

value, which we had classified as temporary and reflected as an unrealized loss in other comprehensive

income. Through the fourth quarter, however, the lack of liquidity in the capital markets not only continued,

but deteriorated further, resulting in the decline in fair value totaling $67 million at December 31, 2008. This

decline in fair value was also deemed to be other than temporary due to the continued auction failures and

expected lack of liquidity in the capital markets continuing into the foreseeable future, which resulted in an

impairment charge being recorded in other income/expense. In February 2009, we sold certain ARS for

$29 million, an amount which approximated their fair value as of December 31, 2008. The proceeds from

these sales were used to reduce our $110 million line of credit. We continue to monitor the market for our

ARS and any change in their fair values will be reflected in other income/expense in future periods.

During 2008, various regulatory agencies began investigating the sales and marketing activities of the

banks and broker-dealers that sold ARS, alleging violations of federal and state laws in connection with these

activities. UBS, one of the two broker-dealers from which we purchased ARS, subsequently announced

settlements under which they will repurchase the ARS at par at a future date. As a result of our participation

in this settlement agreement, UBS is required to repurchase from us, ARS brokered by them, which had a par

value of $85 million at December 31, 2008, beginning in June 2010. Refer to Note 2 for further details on our

participation in UBS’s auction rate security program.

Put option related to ARS: We have elected to apply the fair value option under SFAS 159, The Fair

Value Option for Financial Assets and Financial Liabilities, to UBS’s agreement to repurchase, at par, ARS

brokered by them as described above. The $14 million fair value of this put option is included in other long

term assets in our consolidated balance sheets with the resultant gain offsetting $15 million of related ARS

impairment included in other income/expense. The fair value of the put is determined by comparing the fair

value of the related ARS, as described above, to their par values and also considers the credit risk associated

with UBS. This put option will be adjusted on each balance sheet date based on its then fair value. The fair

value of the put option is based on unobservable inputs and is therefore classified as level 3 in the hierarchy.

Interest rate swaps: In February 2008, we entered into interest rate swaps, which qualify as cash flow

hedges in accordance with Statement of Financial Accounting Standards No. 133, Accounting for Derivative

Instruments and Hedging Activities, or SFAS 133. The fair values of our interest rate swaps were initially

based on inputs received from the counterparty. These values were corroborated by adjusting the active swap

indications in quoted markets for similar terms (6-8 years) for the specific terms within our swap agreements.

There was no ineffectiveness relating to these interest rate swaps for the three or twelve months ended

December 31, 2008, with all of the unrealized losses being deferred in accumulated other comprehensive

income. At December 31, 2008, we had posted cash collateral with our counterparties totaling $11 million for

our interest rate swap contracts, which was reflected as a reduction of our hedge liability.

Aircraft fuel derivatives: Our heating oil swaps and heating oil collars are not traded on public

exchanges. Their fair values are determined based on inputs that are readily available from public markets;

therefore, they are classified as level 2 inputs. The effective portion of realized aircraft fuel hedging derivative

gains/(losses) is recognized in fuel expense, while ineffective gains/(losses) are recognized in interest income

and other. All cash flows related to our fuel hedging derivative instruments classified as cash flow hedges are

included in operating cash flows.

We are exposed to the effect of changes in the price and availability of aircraft fuel. To manage this risk,

we periodically purchase crude or heating oil option contracts or swap agreements. Prices for these

commodities are normally highly correlated to aircraft fuel, making derivatives of them effective at offsetting

66