JetBlue Airlines 2008 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2008 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.these trusts and we are not at risk for losses, we are not required to include these trusts in our consolidated

financial statements. Our maximum exposure is the remaining lease payments, which are reflected in the

future minimum lease payments in the table above.

Note 4—JFK Terminal 5

In October 2008, we began operating out of our new Terminal 5 at JFK, or Terminal 5, which we had

been constructing since November 2005. The construction and operation of this facility is governed by a lease

agreement that we executed with the Port Authority of New York and New Jersey, or PANYNJ, in 2005.

Under the terms of this lease agreement, we were responsible for the construction of a 635,000 square foot

26-gate terminal, a parking garage, roadways and an AirTrain Connector, all of which are owned by the

PANYNJ and which are collectively referred to as the Project. The lease term ends in 2038 and we have a

one-time early termination option in 2033.

We are responsible for various payments under the lease, including ground rents for the new terminal site

which began on lease execution in 2005, and facility rents that commenced in 2008 when we took beneficial

occupancy of Terminal 5. The facility rents are based on the number of passengers enplaned out of the new

terminal, subject to annual minimums. The PANYNJ has reimbursed us for the costs of constructing the

Project in accordance with the lease, except for approximately $76 million in leasehold improvements that

have been provided by us and which are classified as leasehold improvements and included in ground property

and equipment on our consolidated balance sheets.

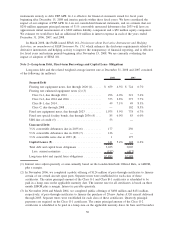

We are considered the owner of the Project for financial reporting purposes only and are required to

reflect an asset and liability for the Project on our balance sheets. Through December 31, 2008, exclusive of

ground property, we had paid $589 million in Project costs and have capitalized $68 million of interest, which

are reflected as Assets Constructed for Others in the accompanying consolidated balance sheets.

Reimbursements from the PANYNJ and financing charges totaled $589 million through December 31, 2008

and are reflected as Construction Obligation in our consolidated balance sheets, net of $17 million in

scheduled facility payments to the PANYNJ made in 2007 and 2008.

Certain elements of the Project, including the parking garage and Airtrain Connector, are not subject to

the underlying ground lease and, following their delivery to and acceptance by the PANYNJ in October 2008,

we no longer have any continuing involvement in these elements as defined in Statement of Financial

Accounting Standards No. 98, Accounting for Leases. As a result, Assets Constructed for Others and

Construction Obligation were both reduced by $125 million in a non-cash transaction. Our continuing

involvement in the remainder of the Project precludes us from sale and leaseback accounting; therefore the

cost of these elements of the Project and the related liability will remain on our balance sheets and accounted

for as a financing.

Assets Constructed for Others are being amortized over the shorter of the 25 year non-cancellable lease

term or their economic life. Facility rents will be recorded as debt service on the Construction Obligation,

with the portion not relating to interest reducing the principal balance. Ground rents are being recognized on a

straight-line basis over the lease term and are reflected in the future minimum lease payments table included

in Note 3. Minimum estimated facility payments, including escalations, associated with this lease are

approximated to be $30 million in 2009, $34 million in 2010, $38 million in 2011, $39 million in 2012,

$40 million in 2013 and $817 million thereafter. Payments could exceed these amounts depending on future

enplanement levels at JFK. Included in the future minimum lease payments is $512 million representing

interest.

We have subleased a portion of Terminal 5, primarily space for concessionaires. Minimum lease

payments due to us are subject to various escalation amounts over a ten year period and also include a

percentage of gross receipts, which may vary from month to month. Future minimum lease payments due to

us are approximated to be $8 million in 2009, $7 million in 2010 and $8 million in each of 2011 through

2013.

55