JetBlue Airlines 2008 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2008 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

derivatives, which was a liability of $128 million at December 31, 2008 and an asset of $33 million at

December 31, 2007. We reduced our December 31, 2008 liability associated with these instruments by posting

$138 million in cash collateral with our counterparties. Also contributing to our working capital deficit is the

classification of our $244 million of ARS as long-term assets at December 31, 2008.

At December 31, 2007, we had $611 million invested in ARS, which were included in short-term

investments. Beginning in February 2008, all of the ARS then held by us experienced failed auctions which

resulted in us continuing to hold these securities beyond the initial auction reset periods. With auctions

continuing to fail through the end of 2008, we have classified all of our ARS as long-term, since maturities of

the underlying debt securities range from 20 to 40 years. Although the auctions for the securities have failed,

we have not experienced any defaults and continue to earn and receive interest on all of these investments at

the maximum contractual rate. As a result of the illiquidity in the market following the auction failures, we

have recorded an other-than-temporary impairment charge of $67 million through earnings related to the ARS

we hold, bringing the carrying value at December 31, 2008 to $244 million.

All of our ARS are collateralized by student loan portfolios (substantially all of which are guaranteed by

the United States Government), $284 million par value of which had a AAA rating and the remainder of

which had an A rating. Despite the quality of the underlying collateral, the market for ARS and other

securities has been diminished due to the lack of liquidity experienced in the market throughout 2008 and

expected to be experienced into the future. We continue to monitor the market for our ARS and any change in

their fair values will be reflected in other income/expense in future periods.

During 2008, various regulatory agencies began investigating the sales and marketing activities of the

banks and broker-dealers that sold ARS, alleging violations of federal and state laws in connection with these

activities. One of the two broker-dealers from which we purchased ARS has since announced settlements

under which they will repurchase the ARS at par at a future date. As a result of our participation in this

settlement agreement, UBS is required to repurchase our ARS brokered by them beginning June 10, 2010. We

have participated in this settlement agreement and accordingly have a separate put agreement asset recorded at

fair value of $14 million on our consolidated balance sheet at December 31, 2008.

We expect to meet our obligations as they become due through available cash, investment securities and

internally generated funds, supplemented as necessary by debt and/or equity financings and proceeds from

aircraft sale and leaseback transactions. We have recently sold two EMBRAER 190 aircraft in January 2009 and

may further reduce our obligations through additional aircraft sales and/or return of leased aircraft; however, our

ability to do so is dependent on factors outside of our control, including the ability of the prospective purchasers

to obtain third-party financing. We expect to generate positive working capital through our operations. However,

we cannot predict what the effect on our business might be from the extremely competitive environment we are

operating in or from events that are beyond our control, such as the extreme volatility in fuel prices, the current

economic recession and global credit and liquidity crisis, weather-related disruptions, the impact of airline

bankruptcies or consolidations, U.S. military actions or acts of terrorism. Assuming that we utilize the

predelivery short-term borrowing facility available to us, as well as our two lines of credit, we believe the

working capital available to us will be sufficient to meet our cash requirements for at least the next 12 months.

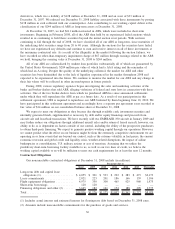

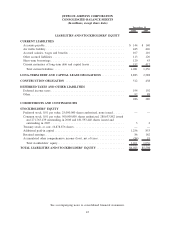

Contractual Obligations

Our noncancelable contractual obligations at December 31, 2008 include (in millions):

Total 2009 2010 2011 2012 2013 Thereafter

Payments due in

Long-term debt and capital lease

obligations (1) .................... $ 4,055 $ 301 $ 533 $ 292 $ 283 $ 473 $2,173

Lease commitments .................. 2,021 223 201 186 166 139 1,106

Flight equipment obligations ........... 4,975 350 300 465 925 960 1,975

Short-term borrowings ................ 120 120 — — — — —

Financing obligations and other (2) ...... 3,645 182 141 154 188 205 2,775

Total ............................. $14,816 $1,176 $1,175 $1,097 $1,562 $1,777 $8,029

(1) Includes actual interest and estimated interest for floating-rate debt based on December 31, 2008 rates.

(2) Amounts include noncancelable commitments for the purchase of goods and services.

36