JCPenney 2002 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2002 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

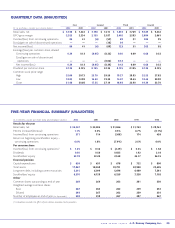

2002 annual report J. C. Penney Company, Inc. 41

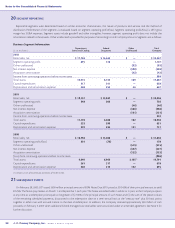

SUPPLEMENTAL DATA (UNAUDITED)

The following information is provided as a supplement to the

Company’s audited financial statements.

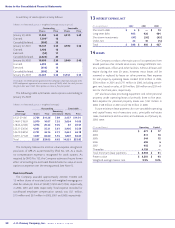

EBITDA

Earnings before interest, taxes, depreciation and amortization is

a key measure of cash flow generated and is provided as an alter-

native assessment of operating performance. It is not intended to

be a substitute for generally accepted accounting principles

(GAAP) measurements and may vary for other companies. EBIT-

DA includes the effects of certain charges and credits not reflective

of normal operating performance. For a discussion of these trans-

actions, see pages 8-11 in Management’s Discussion and Analysis.

The following calculation of segment EBITDA includes seg-

ment operating profit before depreciation and amortization.

($ in millions) 2002 2001 2000

Department Stores

and Catalog

Segment operating profit(1) $ 695 $ 548 $ 254

Depreciation and

amortization 368 370 360

Department Stores and

Catalog segment EBITDA $ 1,063 $ 918 $ 614

Eckerd Drugstores

Segment operating profit/(loss)(1) $ 412 $ 208 $ (76)

Depreciation and

amortization 253 226 213

Eckerd Drugstores

segment EBITDA $ 665 $ 434 $ 137

Total Segments

Segment operating profit(1) $ 1,107 $ 756 $ 178

Depreciation and

amortization 621 596 573

Total segments EBITDA $ 1,728 $ 1,352 $ 751

(1) Segment operating profit/(loss) excludes net interest expense and income taxes.

The table below reconciles income/(loss) from continuing

operations to total segment EBITDA:

($ in millions) 2002 2001 2000

Income/(loss) from

continuing operations $ 371 $ 114 $ (568)

Add back:

Income taxes 213 89 (318)

Acquisition amortization 42 121 122

Net interest expense 388 386 427

Other unallocated 93 46 515

Segment depreciation

and amortization 621 596 573

Total segments EBITDA $ 1,728 $ 1,352 $ 751

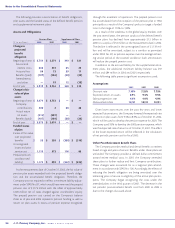

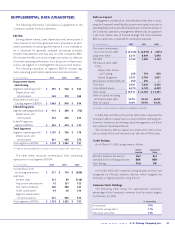

Debt-to-Capital

Management considers all on- and off-balance sheet debt in evalu-

ating the Company’s overall liquidity position and capital structure. As

operating leases and securitized receivables are a fundamental part of

the Company’s operations, management believes that this approach

is the most realistic view of financial leverage. The more traditional

debt-to-capital ratio is presented for comparison purposes.

($ in millions) 2002 2001 2000

Short-term investments,

net of short-term debt $ (2,455) $ (2,819) $ (935)

Long-term debt(1) 5,215 6,099 5,698

Net debt 2,760 3,280 4,763

Off-balance sheet debt:

PVOL:

Department Stores

and Catalog 659 794 838

Eckerd Drugstores 2,922 2,764 2,631

Securitization of receivables, net 200 200 —

Tot al debt 6,541 7,038 8,232

Consolidated equity 6,370 6,129 6,259

Total capital $ 12,911 $ 13,167 $ 14,491

Debt-to-capital, including

off-balance sheet debt 50.7% 53.5% 56.8%

Debt-to-capital 30.2% 34.9% 43.2%

(1) Includes current maturities, capital lease obligations and other.

In 2002, free cash flow of more than $500 million improved the

Company’s debt-to-capital ratio as a result of better operating per-

formance, inventory and working capital management, and lower

than planned capital expenditures.

The Company’s debt-to-capital ratio improved in 2001 prima-

rily as a result of the cash received from the sale of DMS assets.

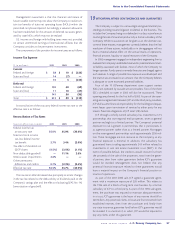

Credit Ratings

As of March 21, 2003, ratings were as follows:

Senior Long-term

Implied Debt

Moody’s Investors Service, Inc. Ba2 Ba3

Standard & Poor’s Ratings Services BBB- BBB-

Fitch Ratings N/A BB

In October 2002, the Company’s strong liquidity position was

recognized by Moody’s Investors Service, which assigned the

Company its highest liquidity rating (SGL-1).

Common Stock Holdings

The following table shows the approximate ownership

percentage of the Company’s common stock by major category

as of January 25, 2003:

% Ownership

Institutional 70%

Company savings plans 17%

Individual and other 13%