JCPenney 2002 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2002 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

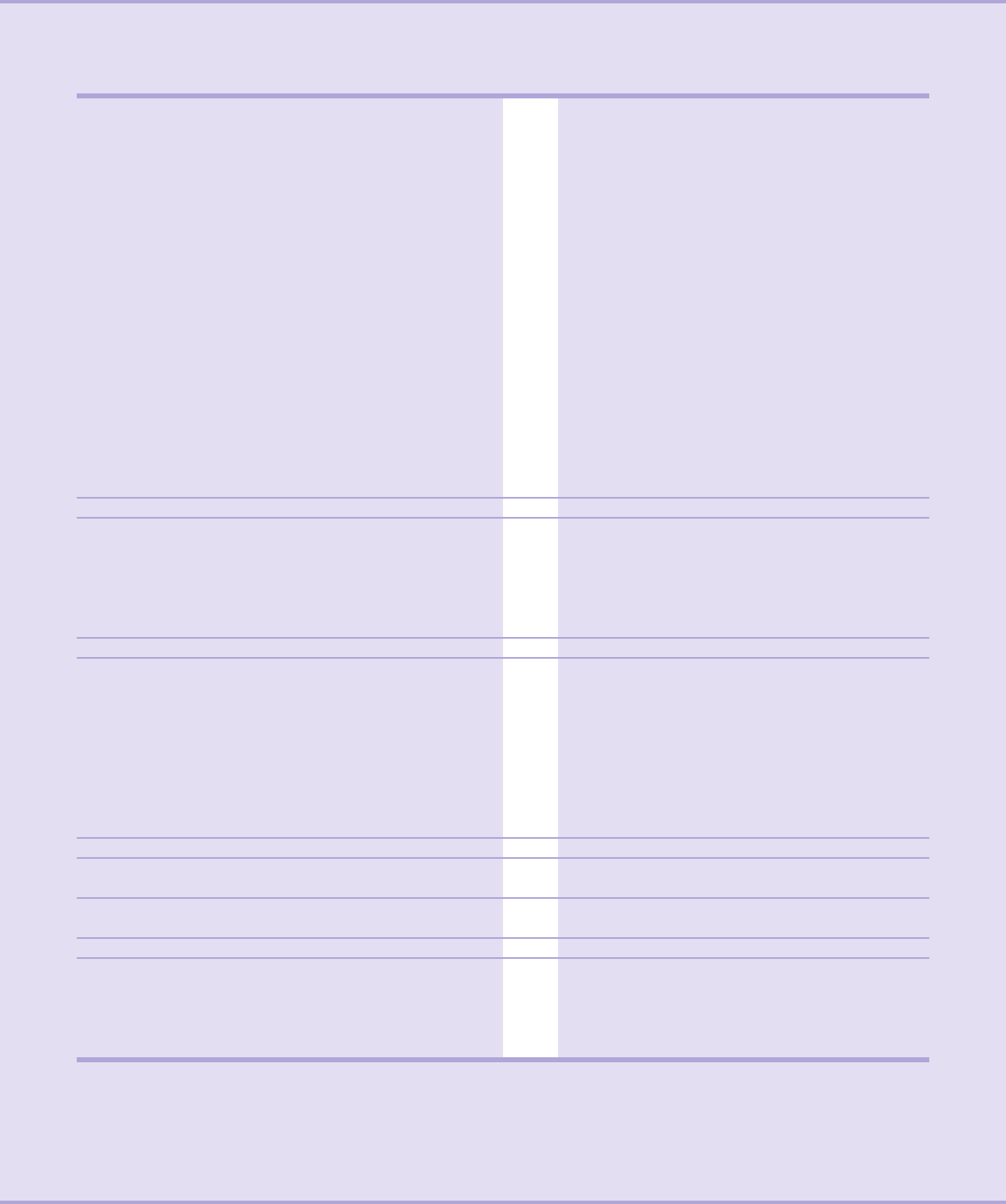

2002 annual report J. C. Penney Company, Inc. 21

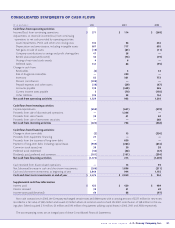

CONSOLIDATED STATEMENTS OF CASH FLOWS

($ in millions) 2002 2001 2000

Cash flows from operating activities:

Income/(loss) from continuing operations $ 371 $ 114 $ (568)

Adjustments to reconcile income/(loss) from continuing

operations to net cash provided by operating activities

Asset impairments, PVOL and other unit closing costs 104 56 454

Depreciation and amortization, including intangible assets 667 717 695

Net gains on sale of assets (18) (81) (11)

Company contributions to savings and profit sharing plans 47 58 —

Benefit plans expense/(income) 30 (73) (79)

Vesting of restricted stock awards 46—

Deferred taxes 141 86 (95)

Change in cash from:

Receivables (6) 333

Sale of drugstore receivables —200 —

Inventory 82 381 772

Pension contribution (300) ——

Prepaid expenses and other assets (36) (29) (67)

Accounts payable 138 (458) 365

Current income taxes payable 3(70) (150)

Other liabilities 102 22 154

Net cash from operating activities 1,329 932 1,503

Cash flows from investing activities:

Capital expenditures (658) (631) (678)

Proceeds from sale of discontinued operations —1,306 —

Proceeds from sale of assets 38 61 62

Proceeds from sale of investment securities —— 268

Net cash from investing activities (620) 736 (348)

Cash flows from financing activities:

Change in short-term debt (2) 15 (330)

Proceeds from equipment financing 27 ——

Proceeds from the issuance of long-term debt —630 —

Payment of long-term debt, including capital leases (939) (263) (816)

Common stock issued, net 30 30 28

Preferred stock redeemed (30) (36) (47)

Dividends paid, preferred and common (161) (161) (294)

Net cash from financing activities (1,075) 215 (1,459)

Cash received from discontinued operations —13 93

Net (decrease)/increase in cash and short-term investments (366) 1,896 (211)

Cash and short-term investments at beginning of year 2,840 944 1,155

Cash and short-term investments at end of year $ 2,474 $ 2,840 $ 944

Supplemental cash flow information

Interest paid $ 422 $ 420 $ 489

Interest received 39 51 49

Income taxes paid/(received) 60 68 (97)

Non-cash transactions: In 2002, the Company exchanged certain notes and debentures with a carrying amount of $227 million for new notes

recorded at a fair value of $225 million and issued 2.9 million shares of common stock to fund the 2001 contribution of $58 million to the sav-

ings plan. Eckerd acquired $15 million, $6 million and $40 million of equipment utilizing capital leases in 2002, 2001 and 2000, respectively.

The accompanying notes are an integral part of these Consolidated Financial Statements.